Form Llc-4/7 - Certificate Of Cancellation

ADVERTISEMENT

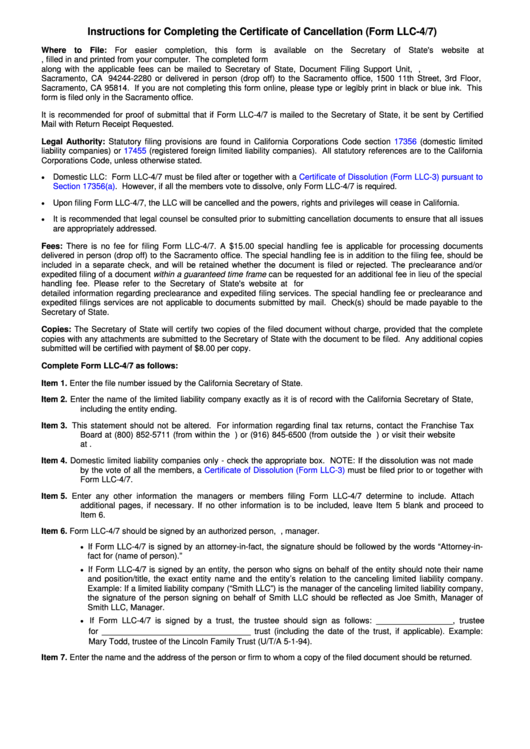

Instructions for Completing the Certificate of Cancellation (Form LLC-4/7)

Where to File: For easier completion, this form is available on the Secretary of State's website at

and can be viewed, filled in and printed from your computer. The completed form

along with the applicable fees can be mailed to Secretary of State, Document Filing Support Unit, P.O. Box 944228,

Sacramento, CA 94244-2280 or delivered in person (drop off) to the Sacramento office, 1500 11th Street, 3rd Floor,

Sacramento, CA 95814. If you are not completing this form online, please type or legibly print in black or blue ink. This

form is filed only in the Sacramento office.

It is recommended for proof of submittal that if Form LLC-4/7 is mailed to the Secretary of State, it be sent by Certified

Mail with Return Receipt Requested.

Legal Authority: Statutory filing provisions are found in California Corporations Code section

17356

(domestic limited

liability companies) or

17455

(registered foreign limited liability companies). All statutory references are to the California

Corporations Code, unless otherwise stated.

Domestic LLC: Form LLC-4/7 must be filed after or together with a

Certificate of Dissolution (Form LLC-3) pursuant to

Section

17356(a). However, if all the members vote to dissolve, only Form LLC-4/7 is required.

Upon filing Form LLC-4/7, the LLC will be cancelled and the powers, rights and privileges will cease in California.

It is recommended that legal counsel be consulted prior to submitting cancellation documents to ensure that all issues

are appropriately addressed.

Fees: There is no fee for filing Form LLC-4/7. A $15.00 special handling fee is applicable for processing documents

delivered in person (drop off) to the Sacramento office. The special handling fee is in addition to the filing fee, should be

included in a separate check, and will be retained whether the document is filed or rejected. The preclearance and/or

expedited filing of a document within a guaranteed time frame can be requested for an additional fee in lieu of the special

handling fee. Please refer to the Secretary of State's website at

for

detailed information regarding preclearance and expedited filing services. The special handling fee or preclearance and

expedited filings services are not applicable to documents submitted by mail. Check(s) should be made payable to the

Secretary of State.

Copies: The Secretary of State will certify two copies of the filed document without charge, provided that the complete

copies with any attachments are submitted to the Secretary of State with the document to be filed. Any additional copies

submitted will be certified with payment of $8.00 per copy.

Complete Form LLC-4/7 as follows:

Item 1.

Enter the file number issued by the California Secretary of State.

Item 2.

Enter the name of the limited liability company exactly as it is of record with the California Secretary of State,

including the entity ending.

Item 3.

This statement should not be altered. For information regarding final tax returns, contact the Franchise Tax

Board at (800) 852-5711 (from within the U.S.) or (916) 845-6500 (from outside the U.S.) or visit their website

at

Item 4.

Domestic limited liability companies only - check the appropriate box. NOTE: If the dissolution was not made

by the vote of all the members, a

Certificate of Dissolution (Form LLC-3)

must be filed prior to or together with

Form LLC-4/7.

Item 5.

Enter any other information the managers or members filing Form LLC-4/7 determine to include. Attach

additional pages, if necessary. If no other information is to be included, leave Item 5 blank and proceed to

Item 6.

Item 6.

Form LLC-4/7 should be signed by an authorized person, i.e., manager.

If Form LLC-4/7 is signed by an attorney-in-fact, the signature should be followed by the words “Attorney-in-

fact for (name of person).”

If Form LLC-4/7 is signed by an entity, the person who signs on behalf of the entity should note their name

and position/title, the exact entity name and the entity’s relation to the canceling limited liability company.

Example: If a limited liability company (“Smith LLC”) is the manager of the canceling limited liability company,

the signature of the person signing on behalf of Smith LLC should be reflected as Joe Smith, Manager of

Smith LLC, Manager.

If Form LLC-4/7 is signed by a trust, the trustee should sign as follows: _________________, trustee

for _________________________________ trust (including the date of the trust, if applicable). Example:

Mary Todd, trustee of the Lincoln Family Trust (U/T/A 5-1-94).

Item 7.

Enter the name and the address of the person or firm to whom a copy of the filed document should be returned.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2