Form St-9 Virginia Retail Sales And Use Tax Return

ADVERTISEMENT

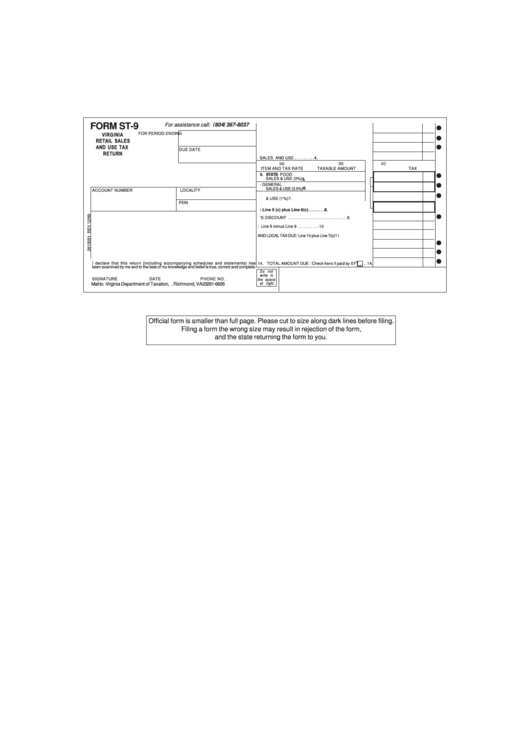

FORM ST-9

(

)

For assistance call:

804

367-8037

1. GROSS SALES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

FOR PERIOD ENDING

2. PERSONAL USE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2.

3. EXEMPT STATE SALES AND OTHER DEDUCTIONS 3.

DUE DATE

4. TOTAL TAXABLE STATE SALES AND USE . . . . . . . . . 4.

(a)

(b)

(c)

ITEM AND TAX RATE

TAXABLE AMOUNT

TAX

5. STATE- FOOD

SALES & USE (3%)

5.

6. STATE - GENERAL

6.

SALES & USE (3.5%)

ACCOUNT NUMBER

LOCALITY

7. LOCAL - SALES

& USE (1%)

7.

FEIN

8. TOTAL STATE TAX: Line 5 (c) plus Line 6(c) . . . . . . . 8.

9. DEALER’S DISCOUNT . . . . . . . . . . . . . . . . . . . . . . . . . .9.

10. NET STATE TAX DUE: Line 8 minus Line 9 . . . . . . . . . . 10

11. TOTAL STATE AND LOCAL TAX DUE:Line 10 plus Line 7(c) 11.

12. PENALTY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. INTEREST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13.

I declare that this return (including accompanying schedules and statements) has

14. TOTAL AMOUNT DUE : Check here if paid by EFT . . . . 14.

been examined by me and to the best of my knowledge and belief is true, correct and complete.

SIGNATURE

DATE

PHONE NO.

Mail to: Virginia Department of Taxation, P.O. Box 26626 , Richmond, VA 23261-6626

Official form is smaller than full page. Please cut to size along dark lines before filing.

Filing a form the wrong size may result in rejection of the form,

and the state returning the form to you.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2