Form St-9 - Sales Tax

ADVERTISEMENT

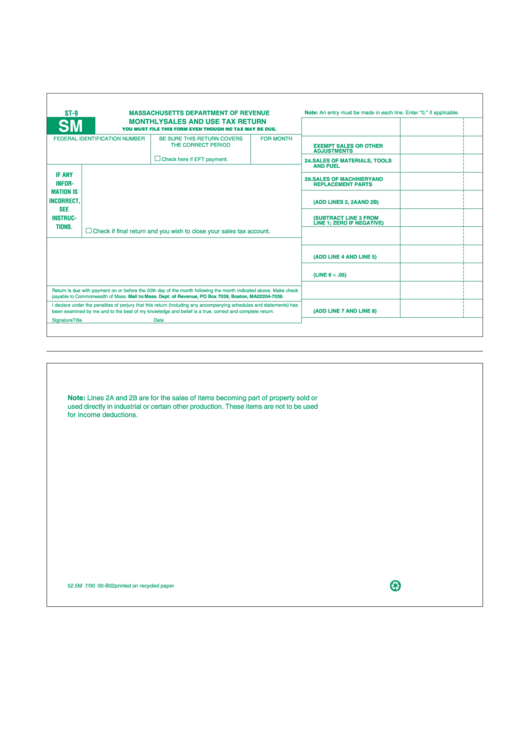

ST-9

MASSACHUSETTS DEPARTMENT OF REVENUE

Note: An entry must be made in each line. Enter “0,” if applicable.

MONTHLY SALES AND USE TAX RETURN

SM

1. GROSS SALES

YOU MUST FILE THIS FORM EVEN THOUGH NO TAX MAY BE DUE.

FEDERAL IDENTIFICATION NUMBER

BE SURE THIS RETURN COVERS

FOR MONTH

2. SALES FOR RESALE/

THE CORRECT PERIOD

EXEMPT SALES OR OTHER

ADJUSTMENTS

Check here if EFT payment.

2

. SALES OF MATERIALS, TOOLS

A

AND FUEL

IF ANY

2

. SALES OF MACHINERY AND

B

INFOR-

REPLACEMENT PARTS

MATION IS

3. TOTAL NONTAXABLE SALES

INCORRECT,

(ADD LINES 2, 2A AND 2B)

SEE

4. TAXABLE SALES

INSTRUC-

(SUBTRACT LINE 3 FROM

LINE 1; ZERO IF NEGATIVE)

TIONS.

Check if final return and you wish to close your sales tax account.

5. USE TAX PURCHASES

6. TOTAL TAXABLE AMOUNT

(ADD LINE 4 AND LINE 5)

7. TOTAL TAXES

(LINE 6 × .05)

8. PENALTIES AND INTEREST

Return is due with payment on or before the 20th day of the month following the month indicated above. Make check

payable to Commonwealth of Mass. Mail to: Mass. Dept. of Revenue, PO Box 7039, Boston, MA 02204-7039.

I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has

9. TOTAL AMOUNT DUE

(ADD LINE 7 AND LINE 8)

been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Signature

Title

Date

Note: Lines 2

and 2

are for the sales of items becoming part of property sold or

A

B

used directly in industrial or certain other production. These items are not to be used

for income deductions.

52.5M 7/00 00-B02

printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1