Financial Statement - Short Form (Standard)

ADVERTISEMENT

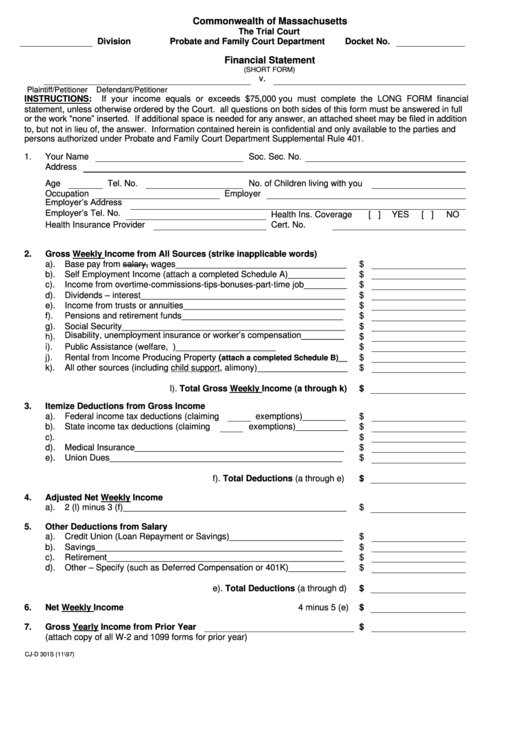

Commonwealth of Massachusetts

The Trial Court

Division

Probate and Family Court Department

Docket No.

Financial Statement

(SHORT FORM)

v.

Plaintiff/Petitioner

Defendant/Petitioner

INSTRUCTIONS:

If your income equals or exceeds $75,000 you must complete the LONG FORM financial

statement, unless otherwise ordered by the Court. all questions on both sides of this form must be answered in full

or the work “none” inserted. If additional space is needed for any answer, an attached sheet may be filed in addition

to, but not in lieu of, the answer. Information contained herein is confidential and only available to the parties and

persons authorized under Probate and Family Court Department Supplemental Rule 401.

1.

Your Name

Soc. Sec. No.

Address

Age

Tel. No.

No. of Children living with you

Occupation

Employer

Employer’s Address

Employer’s Tel. No.

Health Ins. Coverage

[ ]

YES

[ ]

NO

Health Insurance Provider

Cert. No.

2.

Gross Weekly Income from All Sources (strike inapplicable words)

a).

Base pay from salary, wages____________________________________

$

b).

Self Employment Income (attach a completed Schedule A)____________

$

c).

Income from overtime-commissions-tips-bonuses-part-time job_________

$

Dividends – interest___________________________________________

d).

$

e).

Income from trusts or annuities__________________________________

$

f).

Pensions and retirement funds__________________________________

$

g).

Social Security_______________________________________________

$

Disability, unemployment insurance or worker’s compensation_________

h).

$

i).

Public Assistance (welfare, A.F.D.C. payments)_____________________

$

j).

Rental from Income Producing Property (

$

attach a completed Schedule B)__

k).

All other sources (including child support, alimony)___________________

$

l). Total Gross Weekly Income (a through k)

$

3.

Itemize Deductions from Gross Income

a).

Federal income tax deductions (claiming

exemptions)_________

$

b).

State income tax deductions (claiming

exemptions)___________

$

c).

F.I.C.A./Medicare_____________________________________________

$

d).

Medical Insurance____________________________________________

$

e).

Union Dues_________________________________________________

$

f). Total Deductions (a through e)

$

4.

Adjusted Net Weekly Income

a).

2 (l) minus 3 (f)_______________________________________________

$

5.

Other Deductions from Salary

a).

Credit Union (Loan Repayment or Savings)________________________

$

b).

Savings____________________________________________________

$

c).

Retirement__________________________________________________

$

Other – Specify (such as Deferred Compensation or 401K)____________

d).

$

e). Total Deductions (a through d)

$

6.

Net Weekly Income

4 minus 5 (e)

$

7.

Gross Yearly Income from Prior Year

$

(attach copy of all W-2 and 1099 forms for prior year)

CJ-D 301S (11\97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2