Mutual Fund Transfer - T. Rowe Price

ADVERTISEMENT

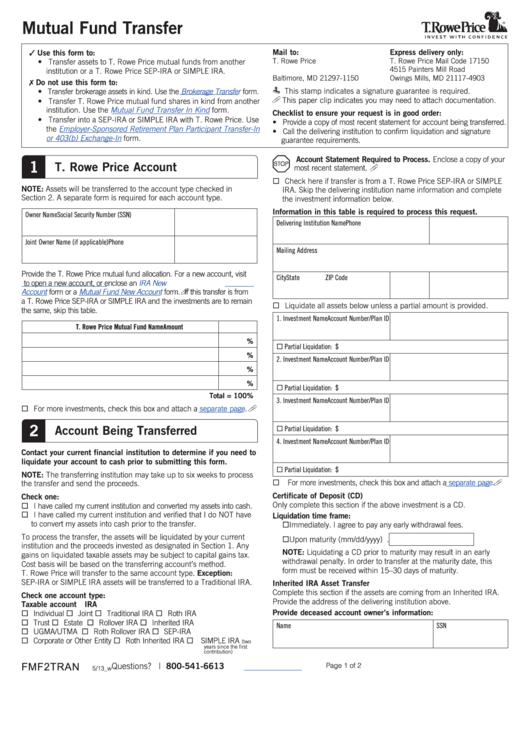

Mutual Fund Transfer

Mail to:

Express delivery only:

✓ Use this form to:

T. Rowe Price

T. Rowe Price Mail Code 17150

• Transfer assets to T. Rowe Price mutual funds from another

P.O. Box 17150

4515 Painters Mill Road

institution or a T. Rowe Price SEP-IRA or SIMPLE IRA.

Baltimore, MD 21297-1150

Owings Mills, MD 21117-4903

✗ Do not use this form to:

• Transfer brokerage assets in kind. Use the

Brokerage Transfer

form.

This stamp indicates a signature guarantee is required.

This paper clip indicates you may need to attach documentation.

• Transfer T. Rowe Price mutual fund shares in kind from another

institution. Use the

Mutual Fund Transfer In Kind

form.

Checklist to ensure your request is in good order:

• Transfer into a SEP-IRA or SIMPLE IRA with T. Rowe Price. Use

• Provide a copy of most recent statement for account being transferred.

the

Employer-Sponsored Retirement Plan Participant Transfer-In

• Call the delivering institution to confirm liquidation and signature

or 403(b) Exchange-In

form.

guarantee requirements.

Account Statement Required to Process. Enclose a copy of your

1

T. Rowe Price Account

most recent statement.

Check here if transfer is from a T. Rowe Price SEP-IRA or SIMPLE

NOTE: Assets will be transferred to the account type checked in

IRA. Skip the delivering institution name information and complete

Section 2. A separate form is required for each account type.

the investment information below.

Information in this table is required to process this request.

Owner Name

Social Security Number (SSN)

Delivering Institution Name

Phone

Joint Owner Name (if applicable)

Phone

Mailing Address

Provide the T. Rowe Price mutual fund allocation. For a new account, visit

City

State

ZIP Code

to open a new account, or enclose an

IRA New

Account

form or a

Mutual Fund New Account

form.

If this transfer is from

a T. Rowe Price SEP-IRA or SIMPLE IRA and the investments are to remain

Liquidate all assets below unless a partial amount is provided.

the same, skip this table.

1. Investment Name

Account Number/Plan ID

T. Rowe Price Mutual Fund Name

Amount

%

Partial Liquidation: $

%

2. Investment Name

Account Number/Plan ID

%

%

Partial Liquidation: $

Total = 100%

3. Investment Name

Account Number/Plan ID

For more investments, check this box and attach a

separate

page.

2

Account Being Transferred

Partial Liquidation: $

4. Investment Name

Account Number/Plan ID

Contact your current financial institution to determine if you need to

liquidate your account to cash prior to submitting this form.

Partial Liquidation: $

NOTE: The transferring institution may take up to six weeks to process

For more investments, check this box and attach a

separate

page.

the transfer and send the proceeds.

Certificate of Deposit (CD)

Check one:

Only complete this section if the above investment is a CD.

I have called my current institution and converted my assets into cash.

I have called my current institution and verified that I do NOT have

Liquidation time frame:

to convert my assets into cash prior to the transfer.

Immediately. I agree to pay any early withdrawal fees.

To process the transfer, the assets will be liquidated by your current

Upon maturity (mm/dd/yyyy)

.

institution and the proceeds invested as designated in Section 1. Any

NOTE: Liquidating a CD prior to maturity may result in an early

gains on liquidated taxable assets may be subject to capital gains tax.

withdrawal penalty. In order to transfer at the maturity date, this

Cost basis will be based on the transferring account’s method.

form must be received within 15–30 days of maturity.

T. Rowe Price will transfer to the same account type. Exception:

SEP-IRA or SIMPLE IRA assets will be transferred to a Traditional IRA.

Inherited IRA Asset Transfer

Complete this section if the assets are coming from an Inherited IRA.

Check one account type:

Provide the address of the delivering institution above.

Taxable account

IRA

Provide deceased account owner’s information:

Individual

Joint

Traditional IRA

Roth IRA

Trust

Estate Rollover IRA

Inherited IRA

Name

SSN

UGMA/UTMA

Roth Rollover IRA SEP-IRA

Corporate or Other Entity Roth Inherited IRA SIMPLE IRA

(two

years since the first

contribution)

FMF2TRAN

Questions?

| 800-541-6613

Page 1 of 2

5/13_w

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2