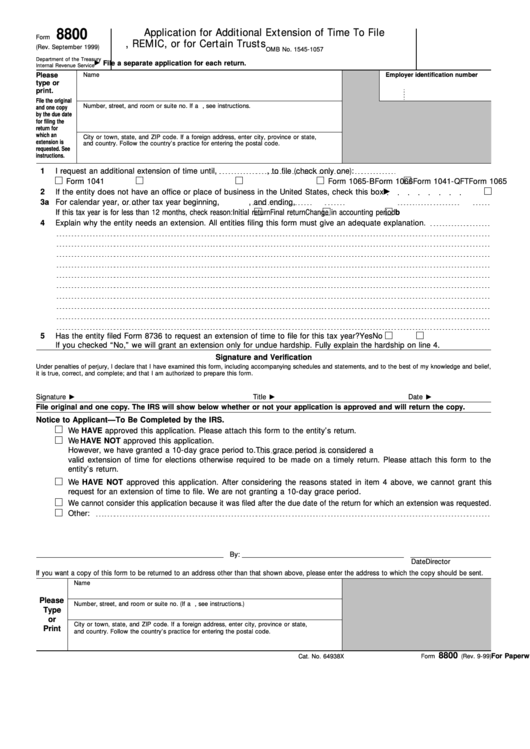

Form 8800 (Rev. September 1999) - Application For Additional Extension Of Time To File U.s. Return For A Partnership, Remic, Or For Certain Trusts

ADVERTISEMENT

8800

Application for Additional Extension of Time To File

Form

U.S. Return for a Partnership, REMIC, or for Certain Trusts

(Rev. September 1999)

OMB No. 1545-1057

Department of the Treasury

File a separate application for each return.

Internal Revenue Service

Please

Name

Employer identification number

type or

print.

File the original

Number, street, and room or suite no. If a P.O. box, see instructions.

and one copy

by the due date

for filing the

return for

which an

City or town, state, and ZIP code. If a foreign address, enter city, province or state,

extension is

and country. Follow the country’s practice for entering the postal code.

requested. See

instructions.

1

I request an additional extension of time until

,

, to file (check only one):

Form 1041

Form 1041-QFT

Form 1065

Form 1065-B

Form 1066

2

If the entity does not have an office or place of business in the United States, check this box

3a For calendar year

, or other tax year beginning

,

, and ending

,

b

If this tax year is for less than 12 months, check reason:

Initial return

Final return

Change in accounting period

4

Explain why the entity needs an extension. All entities filing this form must give an adequate explanation.

5

Has the entity filed Form 8736 to request an extension of time to file for this tax year?

Yes

No

If you checked “No,” we will grant an extension only for undue hardship. Fully explain the hardship on line 4.

Signature and Verification

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete; and that I am authorized to prepare this form.

Signature

Title

Date

File original and one copy. The IRS will show below whether or not your application is approved and will return the copy.

Notice to Applicant—To Be Completed by the IRS.

We HAVE approved this application. Please attach this form to the entity’s return.

We HAVE NOT approved this application.

However, we have granted a 10-day grace period to

. This grace period is considered a

valid extension of time for elections otherwise required to be made on a timely return. Please attach this form to the

entity’s return.

We HAVE NOT approved this application. After considering the reasons stated in item 4 above, we cannot grant this

request for an extension of time to file. We are not granting a 10-day grace period.

We cannot consider this application because it was filed after the due date of the return for which an extension was requested.

Other:

By:

Director

Date

If you want a copy of this form to be returned to an address other than that shown above, please enter the address to which the copy should be sent.

Name

Please

Number, street, and room or suite no. (If a P.O. box, see instructions.)

Type

or

City or town, state, and ZIP code. If a foreign address, enter city, province or state,

Print

and country. Follow the country’s practice for entering the postal code.

8800

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 64938X

Form

(Rev. 9-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2