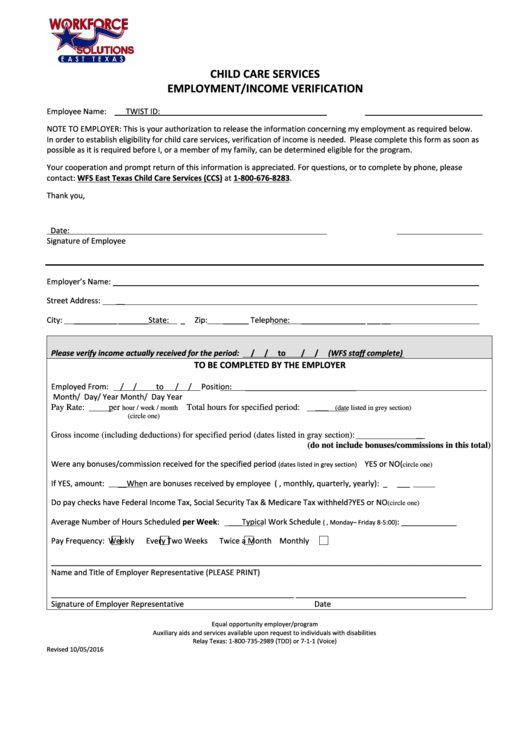

CHILD CARE SERVICES

EMPLOYMENT/INCOME VERIFICATION

Employee Name:

TWIST ID:

NOTE TO EMPLOYER: This is your authorization to release the information concerning my employment as required below.

In order to establish eligibility for child care services, verification of income is needed. Please complete this form as soon as

possible as it is required before I, or a member of my family, can be determined eligible for the program.

Your cooperation and prompt return of this information is appreciated. For questions, or to complete by phone, please

contact: WFS East Texas Child Care Services (CCS) at 1-800-676-8283.

Thank you,

Date:

Signature of Employee

Employer’s Name:

________________________________________________________________________________

Street Address:

__

City:

__________

_______ State:

_

Zip:

______ Telephone:

_______________ ___ __

Please verify income actually received for the period:

/

/

to

/

/

(WFS staff complete)

TO BE COMPLETED BY THE EMPLOYER

Employed From:

/

/

to

/

/

Position:

__________________________

Month/ Day/ Year

Month/ Day Year

Pay Rate:

per

Total hours for specified period:

___

hour / week / month

(date listed in grey section)

(circle one)

Gross income (including deductions) for specified period (dates listed in gray section):

__

(do not include bonuses/commissions in this total)

Were any bonuses/commission received for the specified period

YES or NO (

(dates listed in grey section)

circle one)

If YES, amount:

__ When are bonuses received by employee (i.e., monthly, quarterly, yearly): _

___

Do pay checks have Federal Income Tax, Social Security Tax & Medicare Tax withheld?

YES or NO

(circle one)

Average Number of Hours Scheduled per Week:

___ Typical Work Schedule

: _____________

(i.e., Monday – Friday 8-5:00)

Pay Frequency:

Weekly

Every Two Weeks

Twice a Month

Monthly

_____________________________________________________________________________________________________

Name and Title of Employer Representative (PLEASE PRINT)

_________________________________________________________

________________________________________

Signature of Employer Representative

Date

Equal opportunity employer/program

Auxiliary aids and services available upon request to individuals with disabilities

Relay Texas: 1-800-735-2989 (TDD) or 7-1-1 (Voice)

Revised 10/05/2016

1

1 2

2