Ia 1040 Instructions - 2016

ADVERTISEMENT

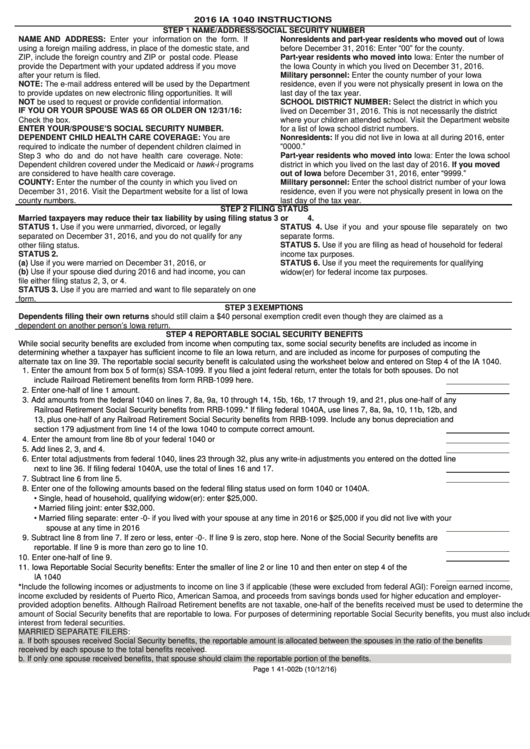

2016 IA 1040 INSTRUCTIONS

STEP 1 NAME/ADDRESS/SOCIAL SECURITY NUMBER

NAME AND ADDRESS: Enter your information on the form. If

Nonresidents and part-year residents who moved out of Iowa

using a foreign mailing address, in place of the domestic state, and

before December 31, 2016: Enter

ZIP, include the foreign country and ZIP or postal code. Please

Part-year residents who moved into Iowa: Enter the number of

provide the Department with your updated address if you move

the Iowa County in which you lived on December 31, 2016.

Military personnel: Enter the county number of your Iowa

after your return is filed.

NOTE: The e-mail address entered will be used by the Department

residence, even if you were not physically present in Iowa on the

to provide updates on new electronic filing opportunities. It will

last day of the tax year.

NOT be used to request or provide confidential information.

SCHOOL DISTRICT NUMBER: Select the district in which you

IF YOU OR YOUR SPOUSE WAS 65 OR OLDER ON 12/31/16:

lived on December 31, 2016. This is not necessarily the district

Check the box.

where your children attended school. Visit the Department website

ENTER YOUR/

S SOCIAL SECURITY NUMBER.

for a list of Iowa school district numbers.

DEPENDENT CHILD HEALTH CARE COVERAGE: You are

Nonresidents: If you did not live in Iowa at all during 2016, enter

required to indicate the number of dependent children claimed in

Step 3 who do and do not have health care coverage. Note:

Part-year residents who moved into Iowa: Enter the Iowa school

Dependent children covered under the Medicaid or hawk-i programs

district in which you lived on the last day of 2016. If you moved

out of Iowa before December 31, 2016

are considered to have health care coverage.

COUNTY: Enter the number of the county in which you lived on

Military personnel: Enter the school district number of your Iowa

December 31, 2016. Visit the Department website for a list of Iowa

residence, even if you were not physically present in Iowa on the

county numbers.

last day of the tax year.

STEP 2 FILING STATUS

Married taxpayers may reduce their tax liability by using filing status 3 or 4.

STATUS 1. Use if you were unmarried, divorced, or legally

STATUS 4. Use if you and your spouse file separately on two

separated on December 31, 2016, and you do not qualify for any

separate forms.

STATUS 5. Use if you are filing as head of household for federal

other filing status.

STATUS 2.

income tax purposes.

(a) Use if you were married on December 31, 2016, or

STATUS 6. Use if you meet the requirements for qualifying

(b) Use if your spouse died during 2016 and had income, you can

widow(er)

for

federal

income

tax

purposes.

file either filing status 2, 3, or 4.

STATUS 3. Use if you are married and want to file separately on one

form.

STEP 3 EXEMPTIONS

Dependents filing their own returns should s t i l l claim a $40 personal exemption credit even though they are claimed as a

dependent on

s Iowa return.

STEP 4 REPORTABLE SOCIAL SECURITY BENEFITS

While social security benefits are excluded from income when computing tax, some social security benefits are included as income in

determining whether a taxpayer has sufficient income to file an Iowa return, and are included as income for purposes of computing the

alternate tax on line 39. The reportable social security benefit is calculated using the worksheet below and entered on Step 4 of the IA 1040.

1. Enter the amount from box 5 of form(s) SSA-1099. If you filed a joint federal return, enter the totals for both spouses. Do not

include Railroad Retirement benefits from form RRB-1099 here. .................................................................................... 1.

2. Enter one-half of line 1 amount. ....................................................................................................................................... 2.

3. Add amounts from the federal 1040 on lines 7, 8a, 9a, 10 through 14, 15b, 16b, 17 through 19, and 21, plus one-half of any

Railroad Retirement Social Security benefits from RRB-1099.* If filing federal 1040A, use lines 7, 8a, 9a, 10, 11b, 12b, and

13, plus one-half of any Railroad Retirement Social Security benefits from RRB-1099. Include any bonus depreciation and

section 179 adjustment from line 14 of the Iowa 1040 to compute correct amount. ......................................................... 3.

4. Enter the amount from line 8b of your federal 1040 or 1040A.......................................................................................... 4.

5. Add lines 2, 3, and 4. ....................................................................................................................................................... 5.

6. Enter total adjustments from federal 1040, lines 23 through 32, plus any write-in adjustments you entered on the dotted line

next to line 36. If filing federal 1040A, use the total of lines 16 and 17. .......................................................................... 6.

7. Subtract line 6 from line 5. ............................................................................................................................................... 7.

8. Enter one of the following amounts based on the federal filing status used on form 1040 or 1040A.

Single, head of household, qualifying widow(er): enter $25,000.

Married filing joint: enter $32,000.

Married filing separate: enter -0- if you lived with your spouse at any time in 2016 or $25,000 if you did not live with your

spouse at any time in 2016 ......................................................................................................................................... 8.

9. Subtract line 8 from line 7. If zero or less, enter -0-. If line 9 is zero, stop here. None of the Social Security benefits are

reportable. If line 9 is more than zero go to line 10. ......................................................................................................... 9.

10. Enter one-half of line 9. .................................................................................................................................................. 10.

11. Iowa Reportable Social Security benefits: Enter the smaller of line 2 or line 10 and then enter on step 4 of the

IA 1040 .......................................................................................................................................................................... 11.

*Include the following incomes or adjustments to income on line 3 if applicable (these were excluded from federal AGI): Foreign earned income,

income excluded by residents of Puerto Rico, American Samoa, and proceeds from savings bonds used for higher education and employer-

provided adoption benefits. Although Railroad Retirement benefits are not taxable, one-half of the benefits received must be used to determine the

amount of Social Security benefits that are reportable to Iowa. For purposes of determining reportable Social Security benefits, you must also include

interest from federal securities.

MARRIED SEPARATE FILERS:

a. If both spouses received Social Security benefits, the reportable amount is allocated between the spouses in the ratio of the benefits

received by each spouse to the total benefits received.

b.

If

only

one

spouse

received

benefits,

that

spouse

should

claim

the

reportable

portion

of

the

benefits.

Page 1

41-002b (10/12/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1