Clear form

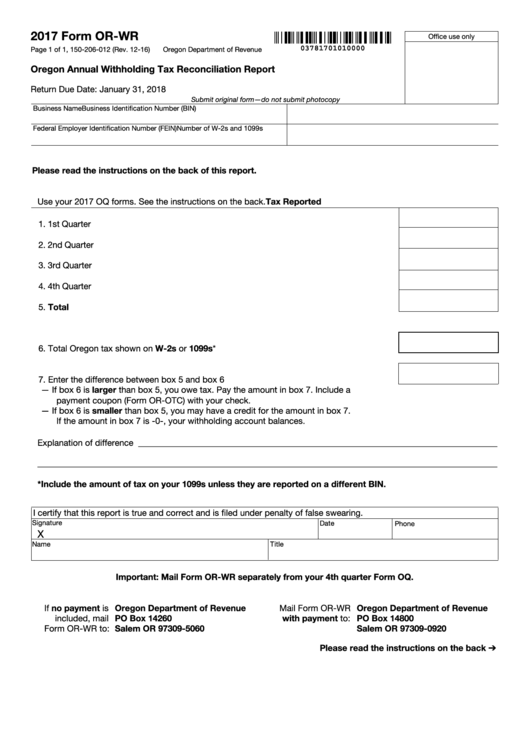

2017 Form OR-WR

Office use only

03781701010000

Page 1 of 1, 150-206-012 (Rev. 12-16)

Oregon Department of Revenue

Oregon Annual Withholding Tax Reconciliation Report

Return Due Date: January 31, 2018

Submit original form—do not submit photocopy

Business Name

Business Identification Number (BIN)

Federal Employer Identification Number (FEIN)

Number of W-2s and 1099s

Please read the instructions on the back of this report.

Use your 2017 OQ forms. See the instructions on the back.

Tax Reported

1. 1st Quarter .......................................................................................................................... 1.

2. 2nd Quarter ........................................................................................................................ 2.

3. 3rd Quarter ......................................................................................................................... 3.

4. 4th Quarter ......................................................................................................................... 4.

5. Total .................................................................................................................................. 5.

6. Total Oregon tax shown on W-2s or 1099s* ..................................................................... 6.

7. Enter the difference between box 5 and box 6 .................................................................. 7.

— If box 6 is larger than box 5, you owe tax. Pay the amount in box 7. Include a

payment coupon (Form OR-OTC) with your check.

— If box 6 is smaller than box 5, you may have a credit for the amount in box 7.

If the amount in box 7 is -0-, your withholding account balances.

Explanation of difference __________________________________________________________________________________

_________________________________________________________________________________________________________

*Include the amount of tax on your 1099s unless they are reported on a different BIN.

I certify that this report is true and correct and is filed under penalty of false swearing.

Signature

Date

Phone

X

Name

Title

Important: Mail Form OR-WR separately from your 4th quarter Form OQ.

If no payment is

Oregon Department of Revenue

Mail Form OR-WR

Oregon Department of Revenue

PO Box 14260

with payment to:

PO Box 14800

included, mail

Form OR-WR to:

Salem OR 97309-5060

Salem OR 97309-0920

Please read the instructions on the back ➔

1

1 2

2