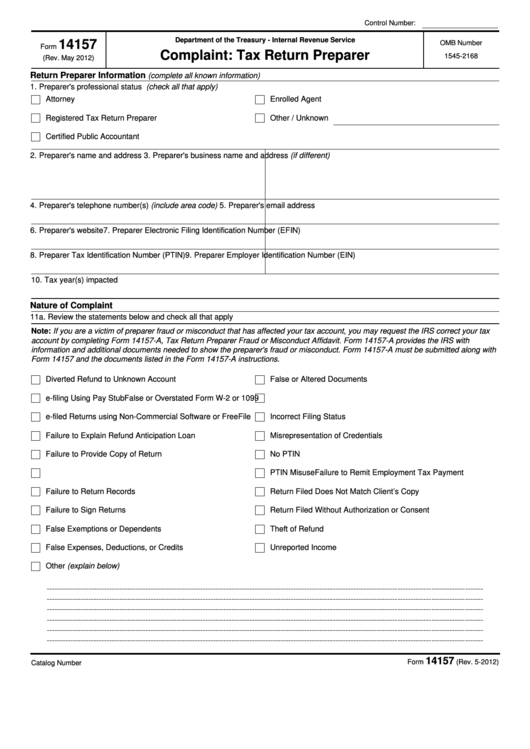

Control Number:

Department of the Treasury - Internal Revenue Service

14157

OMB Number

Form

Complaint: Tax Return Preparer

1545-2168

(Rev. May 2012)

Return Preparer Information

(complete all known information)

1. Preparer's professional status (check all that apply)

Attorney

Enrolled Agent

Registered Tax Return Preparer

Other / Unknown

Certified Public Accountant

2. Preparer's name and address

3. Preparer's business name and address (if different)

4. Preparer's telephone number(s) (include area code)

5. Preparer's email address

6. Preparer's website

7. Preparer Electronic Filing Identification Number (EFIN)

8. Preparer Tax Identification Number (PTIN)

9. Preparer Employer Identification Number (EIN)

10. Tax year(s) impacted

Nature of Complaint

11a. Review the statements below and check all that apply

Note: If you are a victim of preparer fraud or misconduct that has affected your tax account, you may request the IRS correct your tax

account by completing Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit. Form 14157-A provides the IRS with

information and additional documents needed to show the preparer's fraud or misconduct. Form 14157-A must be submitted along with

Form 14157 and the documents listed in the Form 14157-A instructions.

Diverted Refund to Unknown Account

False or Altered Documents

e-filing Using Pay Stub

False or Overstated Form W-2 or 1099

e-filed Returns using Non-Commercial Software or FreeFile

Incorrect Filing Status

Failure to Explain Refund Anticipation Loan

Misrepresentation of Credentials

Failure to Provide Copy of Return

No PTIN

Failure to Remit Employment Tax Payment

PTIN Misuse

Failure to Return Records

Return Filed Does Not Match Client’s Copy

Failure to Sign Returns

Return Filed Without Authorization or Consent

False Exemptions or Dependents

Theft of Refund

False Expenses, Deductions, or Credits

Unreported Income

Other (explain below)

14157

Form

(Rev. 5-2012)

Catalog Number 55242M

1

1 2

2 3

3 4

4