Indiana Department of Revenue

MF-600

Petroleum Severance

State Form 11874

(R5 / 9-12)

Tax Return

For the month of _____________, 20______

Name

Mailing Address

License Number

City

State

Zip Code

Federal Identifi cation Number

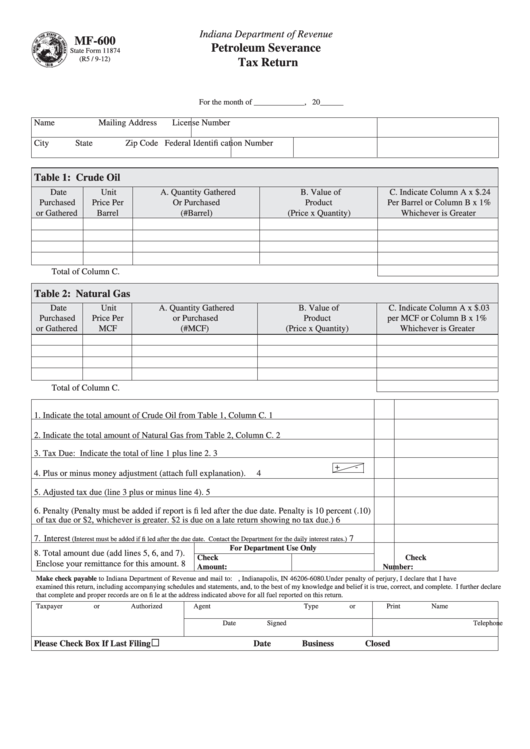

Table 1: Crude Oil

Date

Unit

A. Quantity Gathered

B. Value of

C. Indicate Column A x $.24

Purchased

Price Per

Or Purchased

Product

Per Barrel or Column B x 1%

or Gathered

Barrel

(#Barrel)

(Price x Quantity)

Whichever is Greater

Total of Column C.

Table 2: Natural Gas

Date

Unit

A. Quantity Gathered

B. Value of

C. Indicate Column A x $.03

Purchased

Price Per

or Purchased

Product

per MCF or Column B x 1%

or Gathered

MCF

(#MCF)

(Price x Quantity)

Whichever is Greater

Total of Column C.

1. Indicate the total amount of Crude Oil from Table 1, Column C.

1

2. Indicate the total amount of Natural Gas from Table 2, Column C.

2

3. Tax Due: Indicate the total of line 1 plus line 2.

3

+

-

4. Plus or minus money adjustment (attach full explanation).

4

5. Adjusted tax due (line 3 plus or minus line 4).

5

6. Penalty (Penalty must be added if report is fi led after the due date. Penalty is 10 percent (.10)

of tax due or $2, whichever is greater. $2 is due on a late return showing no tax due.)

6

7. Interest

7

(Interest must be added if fi led after the due date. Contact the Department for the daily interest rates.)

For Department Use Only

8. Total amount due (add lines 5, 6, and 7).

Check

Check

Enclose your remittance for this amount.

8

Amount:

Number:

Make check payable to Indiana Department of Revenue and mail to: P.O. Box 6080, Indianapolis, IN 46206-6080. Under penalty of perjury, I declare that I have

examined this return, including accompanying schedules and statements, and, to the best of my knowledge and belief it is true, correct, and complete. I further declare

that complete and proper records are on fi le at the address indicated above for all fuel reported on this return.

Taxpayer or Authorized Agent

Type or Print Name

Title

Date Signed

Telephone Number

□

Please Check Box If Last Filing

Date Business Closed

1

1 2

2