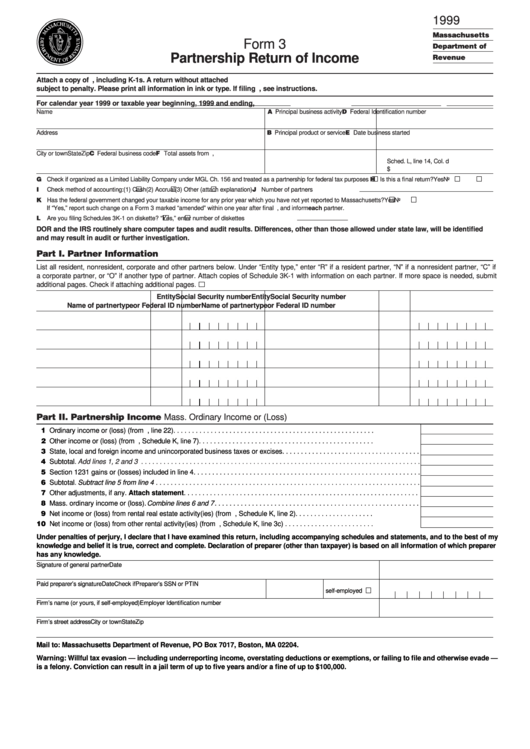

Form 3 Partnership Return Of Income

ADVERTISEMENT

1999

Massachusetts

Form 3

Department of

Partnership Return of Income

Revenue

Attach a copy of U.S. Form 1065 or Form 1065-B and all schedules, including K-1s. A return without attached U.S. information is incomplete and

subject to penalty. Please print all information in ink or type. If filing U.S. Form 1065-B, see instructions.

For calendar year 1999 or taxable year beginning

, 1999 and ending

,

Name

A Principal business activity

D Federal Identification number

Address

B Principal product or service

E Date business started

City or town

State

Zip

C Federal business code

F Total assets from U.S. Form 1065,

Sched. L, line 14, Col. d

$

G Check if organized as a Limited Liability Company under MGL Ch. 156 and treated as a partnership for federal tax purposes

H Is this a final return?

Yes

No

I

Check method of accounting: (1)

Cash (2)

Accrual (3)

Other (attach explanation)

J Number of partners

K Has the federal government changed your taxable income for any prior year which you have not yet reported to Massachusetts?

Yes

No

If “Yes,” report such change on a Form 3 marked “amended” within one year after final U.S. determination, and inform each partner.

L Are you filing Schedules 3K-1 on diskette?

Yes

No. If “Yes,” enter number of diskettes

DOR and the IRS routinely share computer tapes and audit results. Differences, other than those allowed under state law, will be identified

and may result in audit or further investigation.

Part I. Partner Information

List all resident, nonresident, corporate and other partners below. Under “Entity type,” enter “R” if a resident partner, “N” if a nonresident partner, “C” if

a corporate partner, or “O” if another type of partner. Attach copies of Schedule 3K-1 with information on each partner. If more space is needed, submit

additional pages. Check if attaching additional pages.

Entity

Social Security number

Entity

Social Security number

Name of partner

type

or Federal ID number

Name of partner

type

or Federal ID number

Part II. Partnership Income Mass. Ordinary Income or (Loss)

11 Ordinary income or (loss) (from U.S. Form 1065, line 22). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Other income or (loss) (from U.S. Form 1065, Schedule K, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 State, local and foreign income and unincorporated business taxes or excises. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 Subtotal.

Add lines 1, 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 Section 1231 gains or (losses) included in line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Subtotal. Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Other adjustments, if any. Attach statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Mass. ordinary income or (loss). Combine lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 Net income or (loss) from rental real estate activity(ies) (from U.S. Form 1065, Schedule K, line 2). . . . . . . . . . . . . . . . . . . . .

10 Net income or (loss) from other rental activity(ies) (from U.S. Form 1065, Schedule K, line 3c) . . . . . . . . . . . . . . . . . . . . . . . .

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer

has any knowledge.

Signature of general partner

Date

Paid preparer’s signature

Date

Check if

Preparer’s SSN or PTIN

self-employed

Firm’s name (or yours, if self-employed)

Employer Identification number

Firm’s street address

City or town

State

Zip

Mail to: Massachusetts Department of Revenue, PO Box 7017, Boston, MA 02204.

Warning: Willful tax evasion — including underreporting income, overstating deductions or exemptions, or failing to file and otherwise evade —

is a felony. Conviction can result in a jail term of up to five years and/or a fine of up to $100,000.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2