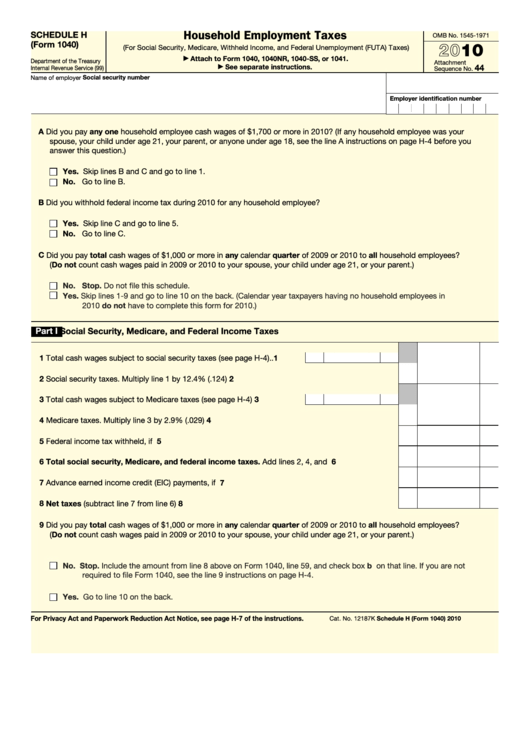

Household Employment Taxes

SCHEDULE H

OMB No. 1545-1971

(Form 1040)

2010

(For Social Security, Medicare, Withheld Income, and Federal Unemployment (FUTA) Taxes)

Attach to Form 1040, 1040NR, 1040-SS, or 1041.

▶

Department of the Treasury

Attachment

44

See separate instructions.

Internal Revenue Service (99)

▶

Sequence No.

Social security number

Name of employer

Employer identification number

A Did you pay any one household employee cash wages of $1,700 or more in 2010? (If any household employee was your

spouse, your child under age 21, your parent, or anyone under age 18, see the line A instructions on page H-4 before you

answer this question.)

Yes. Skip lines B and C and go to line 1.

No. Go to line B.

B Did you withhold federal income tax during 2010 for any household employee?

Yes. Skip line C and go to line 5.

No. Go to line C.

C Did you pay total cash wages of $1,000 or more in any calendar quarter of 2009 or 2010 to all household employees?

(Do not count cash wages paid in 2009 or 2010 to your spouse, your child under age 21, or your parent.)

No. Stop. Do not file this schedule.

Yes. Skip lines 1-9 and go to line 10 on the back. (Calendar year taxpayers having no household employees in

2010 do not have to complete this form for 2010.)

Part I

Social Security, Medicare, and Federal Income Taxes

1

1 Total cash wages subject to social security taxes (see page H-4) .

.

2 Social security taxes. Multiply line 1 by 12.4% (.124) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3 Total cash wages subject to Medicare taxes (see page H-4) .

.

.

.

3

4 Medicare taxes. Multiply line 3 by 2.9% (.029)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5 Federal income tax withheld, if any .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 Total social security, Medicare, and federal income taxes. Add lines 2, 4, and 5 .

6

.

.

.

.

7 Advance earned income credit (EIC) payments, if any .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8 Net taxes (subtract line 7 from line 6) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9 Did you pay total cash wages of $1,000 or more in any calendar quarter of 2009 or 2010 to all household employees?

(Do not count cash wages paid in 2009 or 2010 to your spouse, your child under age 21, or your parent.)

No. Stop. Include the amount from line 8 above on Form 1040, line 59, and check box b on that line. If you are not

required to file Form 1040, see the line 9 instructions on page H-4.

Yes. Go to line 10 on the back.

For Privacy Act and Paperwork Reduction Act Notice, see page H-7 of the instructions.

Cat. No. 12187K

Schedule H (Form 1040) 2010

1

1 2

2