Engagement Letter For Business Bookkeeping And Tax Prepartion

ADVERTISEMENT

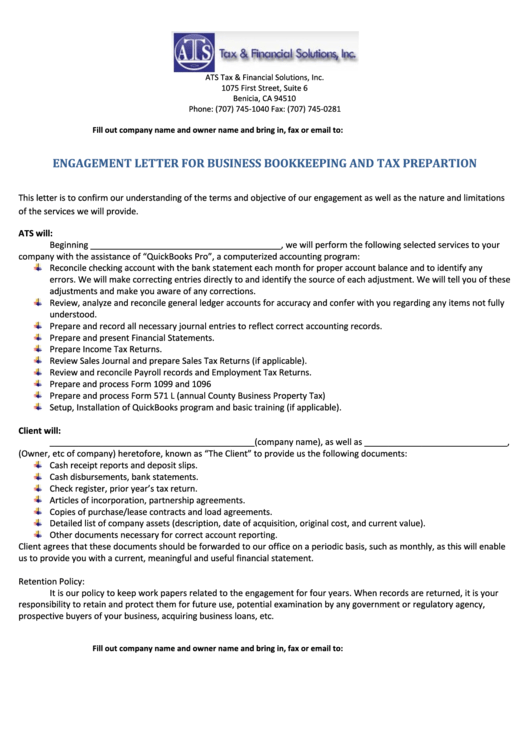

ATS Tax & Financial Solutions, Inc.

1075 First Street, Suite 6

Benicia, CA 94510

Phone: (707) 745-1040 Fax: (707) 745-0281

Fill out company name and owner name and bring in, fax or email to:

ENGAGEMENT LETTER FOR BUSINESS BOOKKEEPING AND TAX PREPARTION

This letter is to confirm our understanding of the terms and objective of our engagement as well as the nature and limitations

of the services we will provide.

ATS will:

Beginning ________________________________________, we will perform the following selected services to your

company with the assistance of “QuickBooks Pro”, a computerized accounting program:

Reconcile checking account with the bank statement each month for proper account balance and to identify any

errors. We will make correcting entries directly to and identify the source of each adjustment. We will tell you of these

adjustments and make you aware of any corrections.

Review, analyze and reconcile general ledger accounts for accuracy and confer with you regarding any items not fully

understood.

Prepare and record all necessary journal entries to reflect correct accounting records.

Prepare and present Financial Statements.

Prepare Income Tax Returns.

Review Sales Journal and prepare Sales Tax Returns (if applicable).

Review and reconcile Payroll records and Employment Tax Returns.

Prepare and process Form 1099 and 1096

Prepare and process Form 571 L (annual County Business Property Tax)

Setup, Installation of QuickBooks program and basic training (if applicable).

Client will:

___________________________________________(company name), as well as ______________________________,

(Owner, etc of company) heretofore, known as “The Client” to provide us the following documents:

Cash receipt reports and deposit slips.

Cash disbursements, bank statements.

Check register, prior year’s tax return.

Articles of incorporation, partnership agreements.

Copies of purchase/lease contracts and load agreements.

Detailed list of company assets (description, date of acquisition, original cost, and current value).

Other documents necessary for correct account reporting.

Client agrees that these documents should be forwarded to our office on a periodic basis, such as monthly, as this will enable

us to provide you with a current, meaningful and useful financial statement.

Retention Policy:

It is our policy to keep work papers related to the engagement for four years. When records are returned, it is your

responsibility to retain and protect them for future use, potential examination by any government or regulatory agency,

prospective buyers of your business, acquiring business loans, etc.

Fill out company name and owner name and bring in, fax or email to:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2