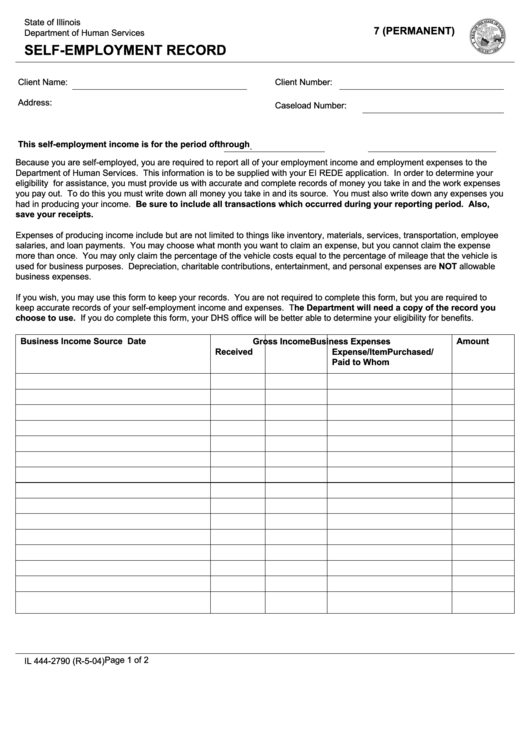

State of Illinois

7 (PERMANENT)

Department of Human Services

SELF-EMPLOYMENT RECORD

Client Name:

Client Number:

Address:

Caseload Number:

This self-employment income is for the period of

through

.

Because you are self-employed, you are required to report all of your employment income and employment expenses to the

Department of Human Services. This information is to be supplied with your EI REDE application. In order to determine your

eligibility for assistance, you must provide us with accurate and complete records of money you take in and the work expenses

you pay out. To do this you must write down all money you take in and its source. You must also write down any expenses you

had in producing your income. Be sure to include all transactions which occurred during your reporting period. Also,

save your receipts.

Expenses of producing income include but are not limited to things like inventory, materials, services, transportation, employee

salaries, and loan payments. You may choose what month you want to claim an expense, but you cannot claim the expense

more than once. You may only claim the percentage of the vehicle costs equal to the percentage of mileage that the vehicle is

used for business purposes. Depreciation, charitable contributions, entertainment, and personal expenses are NOT allowable

business expenses.

If you wish, you may use this form to keep your records. You are not required to complete this form, but you are required to

keep accurate records of your self-employment income and expenses. The Department will need a copy of the record you

choose to use. If you do complete this form, your DHS office will be better able to determine your eligibility for benefits.

Business Income Source

Date

Gross Income Business Expenses

Amount

Received

Expense/ItemPurchased/

Paid to Whom

Page 1 of 2

IL 444-2790 (R-5-04)

1

1 2

2