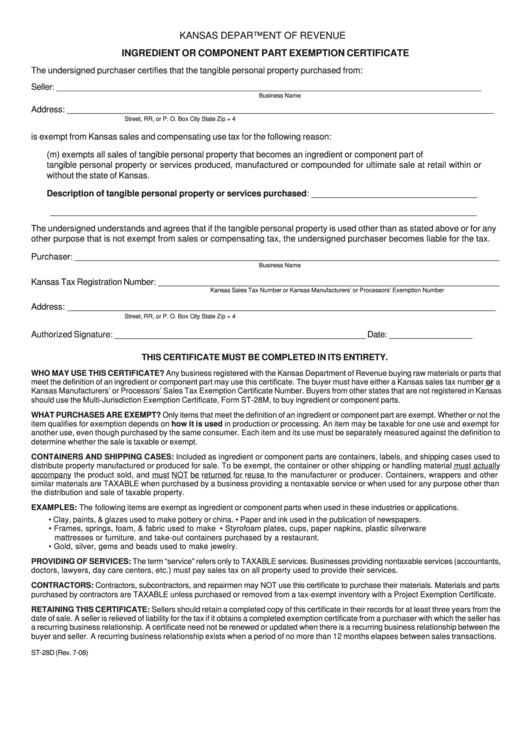

KANSAS DEPARTMENT OF REVENUE

INGREDIENT OR COMPONENT PART EXEMPTION CERTIFICATE

The undersigned purchaser certifies that the tangible personal property purchased from:

Seller

:

_________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P. O. Box

City

State

Zip + 4

is exempt from Kansas sales and compensating use tax for the following reason:

K.S.A. 79-3606(m) exempts all sales of tangible personal property that becomes an ingredient or component part of

tangible personal property or services produced, manufactured or compounded for ultimate sale at retail within or

without the state of Kansas.

Description of tangible personal property or services purchased: ___________________________________

__________________________________________________________________________________________

The undersigned understands and agrees that if the tangible personal property is used other than as stated above or for any

other purpose that is not exempt from sales or compensating tax, the undersigned purchaser becomes liable for the tax.

Purchaser

: _________________________________________________________________________________________________

Business Name

Kansas Tax Registration Number

: ______________________________________________________________________________

Kansas Sales Tax Number or Kansas Manufacturers’ or Processors’ Exemption Number

Address:

__________________________________________________________________________________________________

Street, RR, or P. O. Box

City

State

Zip + 4

Authorized Signature: _____________________________________________________

Date

: ___________________

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS CERTIFICATE? Any business registered with the Kansas Department of Revenue buying raw materials or parts that

meet the definition of an ingredient or component part may use this certificate. The buyer must have either a Kansas sales tax number or a

Kansas Manufacturers’ or Processors’ Sales Tax Exemption Certificate Number. Buyers from other states that are not registered in Kansas

should use the Multi-Jurisdiction Exemption Certificate, Form ST-28M, to buy ingredient or component parts.

WHAT PURCHASES ARE EXEMPT? Only items that meet the definition of an ingredient or component part are exempt. Whether or not the

item qualifies for exemption depends on how it is used in production or processing. An item may be taxable for one use and exempt for

another use, even though purchased by the same consumer. Each item and its use must be separately measured against the definition to

determine whether the sale is taxable or exempt.

CONTAINERS AND SHIPPING CASES: Included as ingredient or component parts are containers, labels, and shipping cases used to

distribute property manufactured or produced for sale. To be exempt, the container or other shipping or handling material must actually

accompany the product sold, and must NOT be returned for reuse to the manufacturer or producer. Containers, wrappers and other

similar materials are TAXABLE when purchased by a business providing a nontaxable service or when used for any purpose other than

the distribution and sale of taxable property.

EXAMPLES: The following items are exempt as ingredient or component parts when used in these industries or applications.

• Clay, paints, & glazes used to make pottery or china.

• Paper and ink used in the publication of newspapers.

• Frames, springs, foam, & fabric used to make

• Styrofoam plates, cups, paper napkins, plastic silverware

mattresses or furniture.

and take-out containers purchased by a restaurant.

• Gold, silver, gems and beads used to make jewelry.

PROVIDING OF SERVICES: The term “service” refers only to TAXABLE services. Businesses providing nontaxable services (accountants,

doctors, lawyers, day care centers, etc.) must pay sales tax on all property used to provide their services.

CONTRACTORS: Contractors, subcontractors, and repairmen may NOT use this certificate to purchase their materials. Materials and parts

purchased by contractors are TAXABLE unless purchased or removed from a tax-exempt inventory with a Project Exemption Certificate.

RETAINING THIS CERTIFICATE: Sellers should retain a completed copy of this certificate in their records for at least three years from the

date of sale. A seller is relieved of liability for the tax if it obtains a completed exemption certificate from a purchaser with which the seller has

a recurring business relationship. A certificate need not be renewed or updated when there is a recurring business relationship between the

buyer and seller. A recurring business relationship exists when a period of no more than 12 months elapses between sales transactions.

ST-28D (Rev. 7-08)

1

1