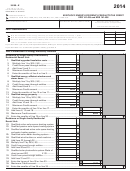

5695–K

Page 2

*1500030307*

41A720–S7 (10–15)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Part II–Installation of Energy Efficiency Products (continued)

Multifamily Residential Rental Unit or

Commercial Property:

37. Qualified active solar space–heating system 37

00

38. Qualified passive solar space–heating system 38

00

39. Qualified combined active solar space–heating

and water–heating system ............................... 39

00

40. Qualified solar water–heating system ......... 40

00

41. Qualified wind turbine or wind machine ..... 41

00

42. Add lines 37 through 41 ................................. 42

00

43. Multiply line 42 by 30% (.30) ............................ 43

00

44. Credit from pass–through entities .................... 44

00

45. Add lines 43 and 44 ........................................ 45

00

46. Qualified solar photovoltaic system–Watts of

direct current (DC) ____________ X $3 ............ 46

00

47. Credit from pass–through entities .................... 47

00

48. Add lines 46 and 47 ........................................ 48

00

49. Enter the larger of line 45 or line 48 ..................................................... 49

00

50. Maximum credit amount ....................................................................... 50

$1,000 00

51. Enter the smaller of line 49 or line 50 ......................................................................................... 51

00

Commercial Property:

52. Qualified energy–efficient interior lighting

system ............................................................ 52

00

53. Multiply line 52 by 30% (.30) ......................... 53

00

54. Credit from pass–through entities .................... 54

00

55. Add lines 53 and 54 ......................................... 55

00

56. Maximum credit amount ............................... 56

$500 00

57. Enter the smaller of line 55 or line 56 .................................................. 57

00

58. Qualified energy–efficient heating, cooling,

ventilation or hot water system ................... 58

00

59. Multiply line 58 by 30% (.30) ......................... 59

00

60. Credit from pass–through entities .................... 60

00

61. Add lines 59 and 60 ......................................... 61

00

62. Maximum credit amount ............................... 62

$500 00

63. Enter the smaller of line 61 or line 62 .................................................. 63

00

64. Add lines 57 and 63 ....................................................................................................................... 64

00

65. Add lines 21, 36, 51 and 64 .......................................................................................................... 65

00

66. Enter any unused Energy Efficiency Products Tax Credit from the 2014 Form 5695-K,

Part II, line 67, if applicable ........................................................................................................... 66

00

67. Add lines 65 and 66 ...................................................................................................................... 67

00

Enter the amounts from this Form 5695–K on the applicable tax return as follows:

Individual, estate or trust filing:

•

Form 740–Enter the amount from Line 67 on Form 740, Section A, Line 18.

•

Form 740–NP–Enter the amount from Line 67 on Form 740–NP , Section A, Line 18.

•

Form 741–Enter the amount from Line 67 on Form 741, Line 18.

Corporation or pass–through entity filing:

•

Form 720–Enter the amount from Line 67 on Schedule TCS, Line 16.

•

Form 720S–Enter the amounts from Lines 6, 12, 18, 36, 36, 51, 51, 57 and 63 on Form 720S, Schedule K, Lines 27, 28, 29, 30, 31,

32, 33, 34 and 35, respectively; and the amount from Line 67 on Schedule TCS, Line 16.

•

Form 725–Enter the amount from Line 67 on Schedule TCS, Line 16.

•

Form 765–Enter the amounts from Lines 6, 12, 18, 36, 36, 51, 51, 57 and 63 on Form 765, Schedule K, Lines 28, 29, 30, 31, 32, 33,

34, 35 and 36, respectively; and the amount from Line 67 on Schedule TCS, Line 16.

•

Form 765–GP–Enter the amounts from Lines 6, 12, 18, 36, 36, 51, 51, 57 and 63 on Form 765–GP , Schedule K, Lines 28, 29, 30,

31, 32, 33, 34, 35 and 36, respectively.

•

Note: For pass-through entities Lines 36 and 51 are reported twice because they are included on two separate lines of the

Schedule K and subsequently the Schedule K-1. For pass-through entities these credits are passed from Schedule K-1 to a

lower tiered entity’s Form 5695-K. The credit limitation for Line 36 of the higher tiered entity’s Form 5695-K will be entered on

Lines 29 and 32 of the lower tiered entity’s Form 5695-K, and the credit limitation for Line 51 of the higher tiered entity’s Form

5695-K will be entered on Lines 44 and 47 of the lower tiered entity’s Form 5695-K.

1

1 2

2 3

3 4

4