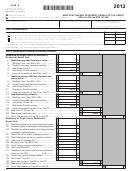

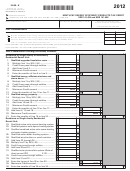

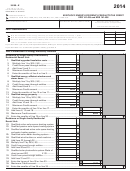

5695–K

Page 3

INSTRUCTIONS FOR FORM 5695–K

41A720–S7 (10–15)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Purpose of Form—This form is used by a taxpayer to claim a tax

electric heat pump water heater; (b) An electric heat pump; (c) A

credit for installation of energy efficiency products for residential

closed loop geothermal heat pump; (d) An open loop geothermal

and commercial property as provided by KRS 141.436. The

heat pump; (e) A direct expansion (DX) geothermal heat pump; (f)

nonrefundable credit shall apply against tax imposed under KRS

A central air conditioner; (g) A natural gas, propane, or oil furnace

141.020 or 141.040, and KRS 141.0401 for taxable years beginning

or hot water heater; (h) A hot water boiler including outdoor wood–

after December 31, 2008, and before January 1, 2016. An unused

fired boiler units; or (i) An advanced main air circulating fan.

tax credit may be carried forward one year.

Line 14—Enter the amount on Line 13 multiplied by 30 percent (.30).

PART I – QUALIFICATIONS

Line 15—Enter the total of the amounts from Form 720S, Schedule

The tax credit provided by KRS 141.436 shall apply in the tax year in

K–1, Line 29 and from Form 765 or Form 765–GP, Schedule K–1,

which the installation is complete. If the installation was completed

Line 30.

before January 1, 2015, or after December 31, 2015, you do not

qualify for this credit. If you have taken the ENERGY STAR home

Line 16—Enter the total of Lines 14 and 15.

or the ENERGY STAR manufactured home tax credit provided by

KRS 141.437, you do not qualify for this credit.

Line 18—Enter the smaller of Line 16 or Line 17.

A taxpayer and spouse may each file Form 5695-K, Kentucky Energy

Line 19—Enter the total of Lines 6, 12, and 18.

Efficiency Tax Credit, regardless of their filing status, and each of

them may claim up to the maximum credit subject to the limitation

Line 21—Enter the smaller of Line 19 or Line 20.

provided for each type of energy efficiency product. However, the

cost of qualified energy efficiency products shall not be claimed

Taxpayer’s Residence or Single–family Residential Rental Unit:

more than once.

Line 22—Enter the installed cost of a qualified active solar

PART II – INSTALLATION OF ENERGY EFFICIENCY PRODUCTS

space–heating system. KRS 141.435(1) provides that “active solar

space–heating system” means a system that: (a) Consists of solar

Taxpayer’s Residence or Single–family or Multifamily Residential

energy collectors that collect and absorb solar radiation combined

with electric fans or pumps to transfer and distribute that solar

Rental Unit:

heat; (b) May include an energy storage space–heating system to

Line 1—Enter the installed cost of qualified upgraded insulation.

provide heat when the sun is not shining; and (c) Is installed by a

KRS 141.435(15) provides that “upgraded insulation” means

certified installer.

insulation with the following R–value ratings: (a) Attic insulation

rated R–38 or higher; (b) Exterior wall, crawl space, and basement

Line 23—Enter the installed cost of a qualified passive solar space–

exterior wall insulation rated R–13 or higher; and (c) Floor insulation

heating system. KRS 141.435(11) provides that “passive solar

rated R–19 or higher.

space–heating system” means a system that: (a) Takes advantage

of the warmth of the sun through the use of design features such

Line 2—Enter the amount on Line 1 multiplied by 30 percent (.30).

as large south–facing windows and materials in the floors or walls

that absorb warmth during the day and release that warmth at

Line 3—Enter the total of the amounts from Form 720S, Schedule

night; (b) Includes one or more of the following designs: (i) Direct

K–1, Line 27 and from Form 765 or Form 765–GP, Schedule K–1,

gain which stores and slowly releases heat energy collected from

Line 28.

the sun shining directly into the building and warming materials

such as tile or concrete; (ii) Indirect gain which uses materials that

Line 4—Enter the total of Lines 2 and 3.

are located between the sun and the living space such as a wall to

hold, store, and release heat; or (iii) Isolated gain which collects

Line 6—Enter the smaller of Line 4 or Line 5.

warmer air from an area that is remote from the living space,

such as a sunroom attached to a house, and the warmer air flows

Line 7—Enter the installed cost of qualified energy–efficient

naturally to the rest of the house; and (c) Meets the guidelines and

technical requirements for passive solar design.

windows and storm doors. KRS 141.435(8) provides that “energy–

efficient windows and storm doors” means windows and storm

doors that are: (a) ENERGY STAR–labeled; and (b) Certified by the

Line 24—Enter the installed cost of a qualified combined active solar

National Fenestration Rating Council as meeting the North–Central

space–heating and water–heating system. KRS 141.435(3) provides

U.S. climate zone performance standards for U–factor (nonsolar

that a “combined active solar space–heating and water–heating

heat conductance), solar heat gain coefficient, air leakage, visible–

system” means a system that meets the requirements of both

light transmittance, and condensation resistance.

an active solar space–heating system and a solar water–heating

system and is installed by a certified installer.

Line 8—Enter the amount on Line 7 multiplied by 30 percent (.30).

Line 25—Enter the installed cost of a qualified solar water–heating

Line 9—Enter the total of the amounts from Form 720S, Schedule

system. KRS 141.435(14) provides that a “solar water–heating

K–1, Line 28 and from Form 765 or Form 765–GP, Schedule K–1,

system” means a system that: (a) Uses solar–thermal energy to

Line 29.

heat water; (b) Is an indirect pressurized glycol system that uses

propylene glycol or an indirect drainback system that uses distilled

Line 10—Enter the total of Lines 8 and 9.

water or propylene glycol; (c) Uses OG–100 solar thermal collectors

that are certified by the Solar Rating and Certification Corporation

Line 12—Enter the smaller of Line 10 or Line 11.

and covered by a manufacturer’s warranty of not less than five

years; (d) Is installed by a certified installer; and (e) Is warranted

Line 13—Enter the installed cost of qualified energy property.

by the certified installer for a period of not less than two years.

KRS 141.435(12) provides that “qualified energy property” means

the following property that meets the performance, quality, and

Line 26—Enter the installed cost of a qualified wind turbine or

certification standards of and that would have been eligible for

wind machine. KRS 141.435(16) provides that a “wind turbine” or

the federal tax credit for residential energy property expenditures

“wind machine” means a turbine or machine used for generating

under 26 U.S.C. § 25C, as it existed on December 31, 2007: (a) An

electricity that: (a) Is certified as meeting the U.S. Wind Industry

1

1 2

2 3

3 4

4