Form Ds-1 Instructions - General Information - 2012

ADVERTISEMENT

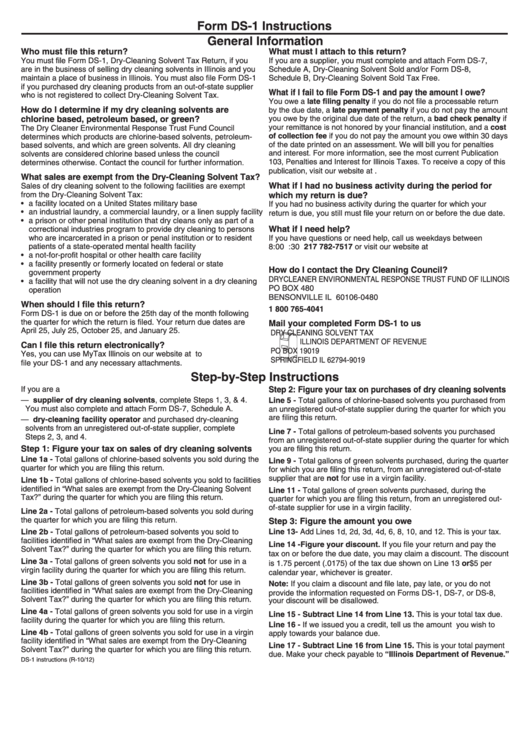

Form DS-1 Instructions

General Information

Who must file this return?

What must I attach to this return?

You must file Form DS-1, Dry-Cleaning Solvent Tax Return, if you

If you are a supplier, you must complete and attach Form DS-7,

are in the business of selling dry cleaning solvents in Illinois and you

Schedule A, Dry-Cleaning Solvent Sold and/or Form DS-8,

maintain a place of business in Illinois. You must also file Form DS-1

Schedule B, Dry-Cleaning Solvent Sold Tax Free.

if you purchased dry cleaning products from an out-of-state supplier

What if I fail to file Form DS-1 and pay the amount I owe?

who is not registered to collect Dry-Cleaning Solvent Tax.

You owe a late filing penalty if you do not file a processable return

How do I determine if my dry cleaning solvents are

by the due date, a late payment penalty if you do not pay the amount

chlorine based, petroleum based, or green?

you owe by the original due date of the return, a bad check penalty if

your remittance is not honored by your financial institution, and a cost

The Dry Cleaner Environmental Response Trust Fund Council

of collection fee if you do not pay the amount you owe within 30 days

determines which products are chlorine-based solvents, petroleum-

of the date printed on an assessment. We will bill you for penalties

based solvents, and which are green solvents. All dry cleaning

and interest. For more information, see the most current Publication

solvents are considered chlorine based unless the council

103, Penalties and Interest for Illinois Taxes. To receive a copy of this

determines otherwise. Contact the council for further information.

publication, visit our website at tax.illinois.gov.

What sales are exempt from the Dry-Cleaning Solvent Tax?

What if I had no business activity during the period for

Sales of dry cleaning solvent to the following facilities are exempt

which my return is due?

from the Dry-Cleaning Solvent Tax:

• a facility located on a United States military base

If you had no business activity during the quarter for which your

• an industrial laundry, a commercial laundry, or a linen supply facility

return is due, you still must file your return on or before the due date.

• a prison or other penal institution that dry cleans only as part of a

What if I need help?

correctional industries program to provide dry cleaning to persons

who are incarcerated in a prison or penal institution or to resident

If you have questions or need help, call us weekdays between

patients of a state-operated mental health facility

8:00 a.m. and 4:30 p.m. at 217 782-7517 or visit our website at

• a not-for-profit hospital or other health care facility

tax.illinois.gov.

• a facility presently or formerly located on federal or state

How do I contact the Dry Cleaning Council?

government property

DRYCLEANER ENVIRONMENTAL RESPONSE TRUST FUND OF ILLINOIS

• a facility that will not use the dry cleaning solvent in a dry cleaning

PO BOX 480

operation

BENSONVILLE IL 60106-0480

When should I file this return?

1 800 765-4041

Form DS-1 is due on or before the 25th day of the month following

the quarter for which the return is filed. Your return due dates are

Mail your completed Form DS-1 to us

April 25, July 25, October 25, and January 25.

DRY CLEANING SOLVENT TAX

ILLINOIS DEPARTMENT OF REVENUE

Can I file this return electronically?

PO BOX 19019

Yes, you can use MyTax Illinois on our website at tax.illinois.gov to

SPRINGFIELD IL 62794-9019

file your DS-1 and any necessary attachments.

Step-by-Step Instructions

If you are a

Step 2: Figure your tax on purchases of dry cleaning solvents

— supplier of dry cleaning solvents, complete Steps 1, 3, & 4.

Line 5 - Total gallons of chlorine-based solvents you purchased from

You must also complete and attach Form DS-7, Schedule A.

an unregistered out-of-state supplier during the quarter for which you

are filing this return.

— dry-cleaning facility operator and purchased dry-cleaning

solvents from an unregistered out-of-state supplier, complete

Line 7 - Total gallons of petroleum-based solvents you purchased

Steps 2, 3, and 4.

from an unregistered out-of-state supplier during the quarter for which

Step 1: Figure your tax on sales of dry cleaning solvents

you are filing this return.

L ine 1a - Total gallons of chlorine-based solvents you sold during the

Line 9 - Total gallons of green solvents purchased, during the quarter

quarter for which you are filing this return.

for which you are filing this return, from an unregistered out-of-state

supplier that are not for use in a virgin facility.

Line 1b - Total gallons of chlorine-based solvents you sold to facilities

identified in “What sales are exempt from the Dry-Cleaning Solvent

Line 11 - Total gallons of green solvents purchased, during the

Tax?” during the quarter for which you are filing this return.

quarter for which you are filing this return, from an unregistered out-

of-state supplier for use in a virgin facility.

Line 2a - Total gallons of petroleum-based solvents you sold during

the quarter for which you are filing this return.

Step 3: Figure the amount you owe

Line 2b - Total gallons of petroleum-based solvents you sold to

Line 13- Add Lines 1d, 2d, 3d, 4d, 6, 8, 10, and 12. This is your tax.

facilities identified in “What sales are exempt from the Dry-Cleaning

Line 14 - Figure your discount. If you file your return and pay the

Solvent Tax?” during the quarter for which you are filing this return.

tax on or before the due date, you may claim a discount. The discount

Line 3a - Total gallons of green solvents you sold not for use in a

is 1.75 percent (.0175) of the tax due shown on Line 13 or $5 per

virgin facility during the quarter for which you are filing this return.

calendar year, whichever is greater.

Line 3b - Total gallons of green solvents you sold not for use in

Note: If you claim a discount and file late, pay late, or you do not

facilities identified in “What sales are exempt from the Dry-Cleaning

provide the information requested on Forms DS-1, DS-7, or DS-8,

Solvent Tax?” during the quarter for which you are filing this return.

your discount will be disallowed.

Line 4a - Total gallons of green solvents you sold for use in a virgin

Line 15 - Subtract Line 14 from Line 13. This is your total tax due.

facility during the quarter for which you are filing this return.

Line 16 - If we issued you a credit, tell us the amount you wish to

Line 4b - Total gallons of green solvents you sold for use in a virgin

apply towards your balance due.

facility identified in “What sales are exempt from the Dry-Cleaning

Line 17 - Subtract Line 16 from Line 15. This is your total payment

Solvent Tax?” during the quarter for which you are filing this return.

due. Make your check payable to “Illinois Department of Revenue.”

DS-1 instructions (R-10/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1