Client Questionnaire

ADVERTISEMENT

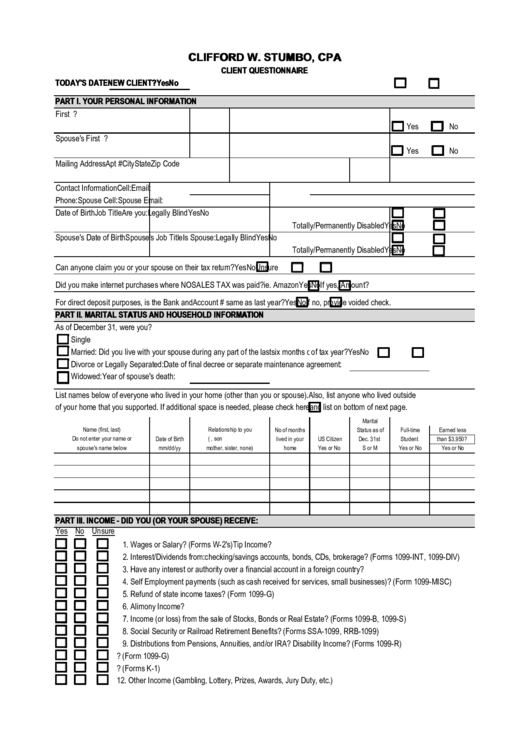

CLIFFORD W. STUMBO, CPA

CLIENT QUESTIONNAIRE

TODAY'S DATE

NEW CLIENT?

Yes

No

PART I. YOUR PERSONAL INFORMATION

First Name

M.I.

Last Name

Are you a US Citizen?

Yes

No

Spouse's First Name

M.I.

Last Name

Is Spouse a US Citizen?

Yes

No

Mailing Address

Apt #

City

State

Zip Code

Contact Information

Cell:

Email:

Phone:

Spouse Cell:

Spouse Email:

Date of Birth

Job Title

Are you:

Legally Blind

Yes

No

Totally/Permanently Disabled

Yes

No

Spouse's Date of Birth

Spouse's Job Title

Is Spouse:

Legally Blind

Yes

No

Totally/Permanently Disabled

Yes

No

Can anyone claim you or your spouse on their tax return?

Yes

No

Unsure

Did you make internet purchases where NO SALES TAX was paid? ie. Amazon

Yes

No If yes, Amount?

For direct deposit purposes, is the Bank and Account # same as last year?

Yes

No If no, provide voided check.

PART II. MARITAL STATUS AND HOUSEHOLD INFORMATION

As of December 31, were you?

Single

Married: Did you live with your spouse during any part of the last six months of 2012?

of tax year?

Yes

Yes

No

No

Divorce or Legally Separated: Date of final decree or separate maintenance agreement:

Widowed: Year of spouse's death:

List names below of everyone who lived in your home (other than you or spouse). Also, list anyone who lived outside

of your home that you supported. If additional space is needed, please check here

and list on bottom of next page.

Marital

Name (first, last)

Relationship to you

No of months

Status as of

Full-time

Earned less

Do not enter your name or

Date of Birth

(e.g. daughtter, son

lived in your

US Citizen

Dec. 31st

Student

than $3,950?

spouse's name below

mm/dd/yy

mother, sister, none)

home

Yes or No

S or M

Yes or No

Yes or No

PART III. INCOME - DID YOU (OR YOUR SPOUSE) RECEIVE:

Yes No Unsure

1. Wages or Salary? (Forms W-2's) Tip Income?

2. Interest/Dividends from: checking/savings accounts, bonds, CDs, brokerage? (Forms 1099-INT, 1099-DIV)

3. Have any interest or authority over a financial account in a foreign country?

4. Self Employment payments (such as cash received for services, small businesses)? (Form 1099-MISC)

5. Refund of state income taxes? (Form 1099-G)

6. Alimony Income?

7. Income (or loss) from the sale of Stocks, Bonds or Real Estate? (Forms 1099-B, 1099-S)

8. Social Security or Railroad Retirement Benefits? (Forms SSA-1099, RRB-1099)

9. Distributions from Pensions, Annuities, and/or IRA? Disability Income? (Forms 1099-R)

10. Unemployment Compensation? (Form 1099-G)

11. Income from S-Corporations or Partnerships? (Forms K-1)

12. Other Income (Gambling, Lottery, Prizes, Awards, Jury Duty, etc.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2 3

3 4

4