Form 9 Quarterly Gift Disclosure

Download a blank fillable Form 9 Quarterly Gift Disclosure in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 9 Quarterly Gift Disclosure with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

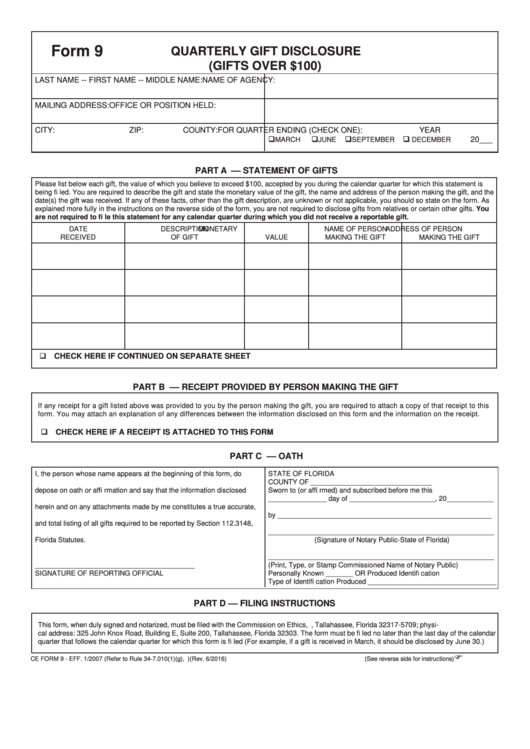

Form 9

QUARTERLY GIFT DISCLOSURE

(GIFTS OVER $100)

LAST NAME -- FIRST NAME -- MIDDLE NAME:

NAME OF AGENCY:

MAILING ADDRESS:

OFFICE OR POSITION HELD:

CITY:

ZIP:

COUNTY:

FOR QUARTER ENDING (CHECK ONE):

YEAR

20___

MARCH

JUNE

SEPTEMBER

DECEMBER

PART A –– STATEMENT OF GIFTS

Please list below each gift, the value of which you believe to exceed $100, accepted by you during the calendar quarter for which this statement is

being fi led. You are required to describe the gift and state the monetary value of the gift, the name and address of the person making the gift, and the

date(s) the gift was received. If any of these facts, other than the gift description, are unknown or not applicable, you should so state on the form. As

explained more fully in the instructions on the reverse side of the form, you are not required to disclose gifts from relatives or certain other gifts. You

are not required to fi le this statement for any calendar quarter during which you did not receive a reportable gift.

DATE

DESCRIPTION

MONETARY

NAME OF PERSON

ADDRESS OF PERSON

RECEIVED

OF GIFT

VALUE

MAKING THE GIFT

MAKING THE GIFT

CHECK HERE IF CONTINUED ON SEPARATE SHEET

PART B –– RECEIPT PROVIDED BY PERSON MAKING THE GIFT

If any receipt for a gift listed above was provided to you by the person making the gift, you are required to attach a copy of that receipt to this

form. You may attach an explanation of any differences between the information disclosed on this form and the information on the receipt.

CHECK HERE IF A RECEIPT IS ATTACHED TO THIS FORM

PART C –– OATH

I, the person whose name appears at the beginning of this form, do

STATE OF FLORIDA

COUNTY OF _______________________________

depose on oath or affi rmation and say that the information disclosed

Sworn to (or affi rmed) and subscribed before me this

_______________ day of ______________________, 20____________

herein and on any attachments made by me constitutes a true accurate,

by _______________________________________________________

and total listing of all gifts required to be reported by Section 112.3148,

__________________________________________________________

Florida Statutes.

(Signature of Notary Public-State of Florida)

__________________________________________________________

_________________________________________

(Print, Type, or Stamp Commissioned Name of Notary Public)

SIGNATURE OF REPORTING OFFICIAL

Personally Known _______ OR Produced Identifi cation

Type of Identifi cation Produced _________________________________

PART D –– FILING INSTRUCTIONS

This form, when duly signed and notarized, must be fi led with the Commission on Ethics, P.O. Drawer 15709, Tallahassee, Florida 32317-5709; physi-

cal address: 325 John Knox Road, Building E, Suite 200, Tallahassee, Florida 32303. The form must be fi led no later than the last day of the calendar

quarter that follows the calendar quarter for which this form is fi led (For example, if a gift is received in March, it should be disclosed by June 30.)

CE FORM 9 - EFF. 1/2007 (Refer to Rule 34-7.010(1)(g), F.A.C.)(Rev. 6/2016)

(See reverse side for instructions)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2