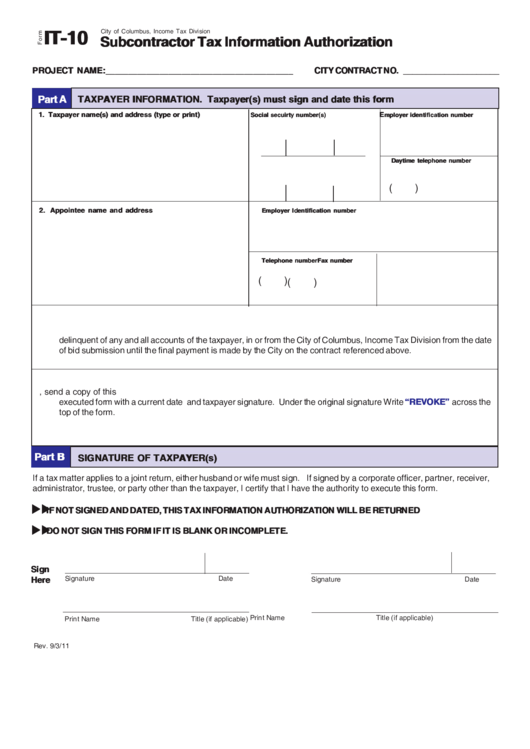

Form It-10 - Subcontractor Tax Information Authorization

ADVERTISEMENT

IT-10

City of Columbus, Income Tax Division

Subcontractor Tax Information Authorization

PROJECT NAME:__________________________________________

CITY CONTRACT NO. _____________________

Part A

TAXPAYER INFORMATION. Taxpayer(s) must sign and date this form

1. Taxpayer name(s) and address (type or print)

E

Social secuirty number(s)

mployer identification number

Daytime telephone number

(

)

2. Appointee name and address

Employer Identification number

Telephone number

Fax number

(

)

(

)

3.

The appointee is authorized to inspect and/or receive confidential tax information with regard to the status current/

delinquent of any and all accounts of the taxpayer, in or from the City of Columbus, Income Tax Division from the date

of bid submission until the final payment is made by the City on the contract referenced above.

4.

Retention/revocation of tax information authorization. If you want to revoke this authorization, send a copy of this

executed form with a current date and taxpayer signature. Under the original signature Write

“REVOKE”

across the

top of the form.

Part B

SIGNATURE OF TAXPAYER(s)

If a tax matter applies to a joint return, either husband or wife must sign. If signed by a corporate officer, partner, receiver,

administrator, trustee, or party other than the taxpayer, I certify that I have the authority to execute this form.

IF NOT SIGNED AND DATED, THIS TAX INFORMATION AUTHORIZATION WILL BE RETURNED

DO NOT SIGN THIS FORM IF IT IS BLANK OR INCOMPLETE.

Sign

Here

Signature

Date

Signature

Date

Print Name

Title (if applicable)

Print Name

Title (if applicable)

Rev. 9/3/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2