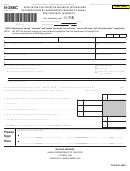

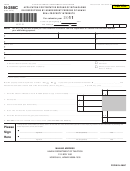

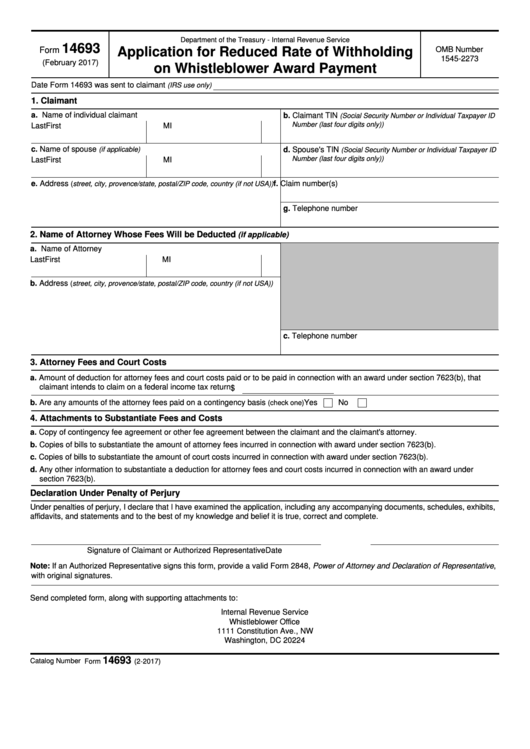

Department of the Treasury - Internal Revenue Service

14693

Application for Reduced Rate of Withholding

OMB Number

Form

1545-2273

(February 2017)

on Whistleblower Award Payment

Date Form 14693 was sent to claimant

(IRS use only)

1. Claimant

a. Name of individual claimant

b. Claimant TIN

(Social Security Number or Individual Taxpayer ID

Number (last four digits only))

Last

First

MI

c. Name of spouse

(if applicable)

d. Spouse's TIN

(Social Security Number or Individual Taxpayer ID

Number (last four digits only))

Last

First

MI

e. Address

f. Claim number(s)

(street, city, provence/state, postal/ZIP code, country (if not USA))

g. Telephone number

2. Name of Attorney Whose Fees Will be Deducted

(if applicable)

a. Name of Attorney

Last

First

MI

b. Address

(street, city, provence/state, postal/ZIP code, country (if not USA))

c. Telephone number

3. Attorney Fees and Court Costs

a. Amount of deduction for attorney fees and court costs paid or to be paid in connection with an award under section 7623(b), that

claimant intends to claim on a federal income tax return $

b. Are any amounts of the attorney fees paid on a contingency basis

Yes

No

(check one)

4. Attachments to Substantiate Fees and Costs

a. Copy of contingency fee agreement or other fee agreement between the claimant and the claimant's attorney.

b. Copies of bills to substantiate the amount of attorney fees incurred in connection with award under section 7623(b).

c. Copies of bills to substantiate the amount of court costs incurred in connection with award under section 7623(b).

d. Any other information to substantiate a deduction for attorney fees and court costs incurred in connection with an award under

section 7623(b).

Declaration Under Penalty of Perjury

Under penalties of perjury, I declare that I have examined the application, including any accompanying documents, schedules, exhibits,

affidavits, and statements and to the best of my knowledge and belief it is true, correct and complete.

Signature of Claimant or Authorized Representative

Date

Note: If an Authorized Representative signs this form, provide a valid Form 2848, Power of Attorney and Declaration of Representative,

with original signatures.

Send completed form, along with supporting attachments to:

Internal Revenue Service

Whistleblower Office

1111 Constitution Ave., NW

Washington, DC 20224

14693

Catalog Number 67566P

Form

(2-2017)

1

1 2

2