Tax Organizer Template - 2015 Income Tax Return

ADVERTISEMENT

Tax Organizer

This Tax Organizer is designed to help you collect and report the information needed to prepare your 2015 income

tax return. The following worksheets will help in the preparation of your tax return by focusing attention on your

specific needs.

Enter your 2015 information in the designated areas on the worksheets. If you need to include additional

information, you may use the back of a worksheet or an additional page.

In addition, please provide a copy of the following information:

Copy of your 2014 federal and state tax return (if not already in our possession)

Form(s) W-2 and 1099-MISC (reporting income)

Form(s) 1099-G (reporting unemployment or state tax refund)

Form(s) 1099-R (reporting pension, IRA, or annuity income)

Form(s) 1099-C (reporting cancellation of debt. Complete insolvency worksheet(s))

Form(s) 1099-INT, 1099-DIV, 1099-OID (reporting interest and dividend income)

Form(s) 1098 (reporting interest paid, copies of real estate tax bills and other information relating to real

property holdings)

Form(s) SSA-1099 (reporting social security benefits)

Form 1095-A, 1095-B, 1095-C, 1099-HC (Proof of Health Insurance)

All other income sources, copy of any notices from the IRS, or any items you have questions about

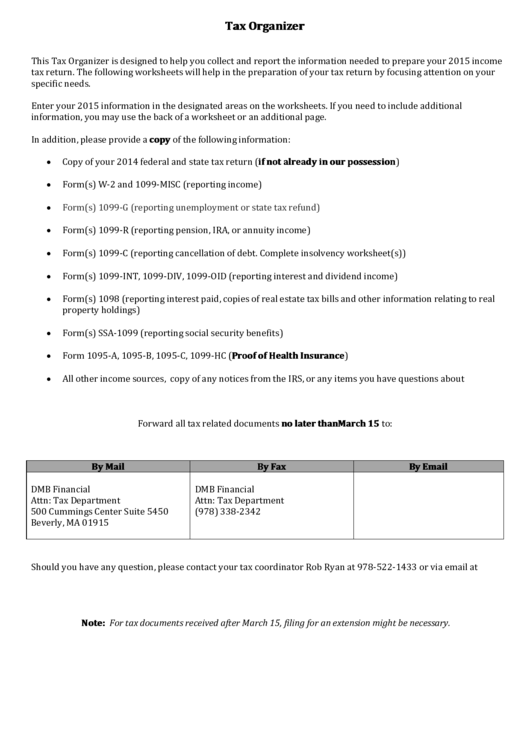

Forward all tax related documents no later than March 15 to:

By Mail

By Fax

By Email

DMB Financial

DMB Financial

Attn: Tax Department

Attn: Tax Department

500 Cummings Center Suite 5450

(978) 338-2342

Beverly, MA 01915

Should you have any question, please contact your tax coordinator Rob Ryan at 978-522-1433 or via email at

Note: For tax documents received after March 15, filing for an extension might be necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7