05-391

PRINT FORM

CLEAR FIELDS

(Rev.2-17/5)

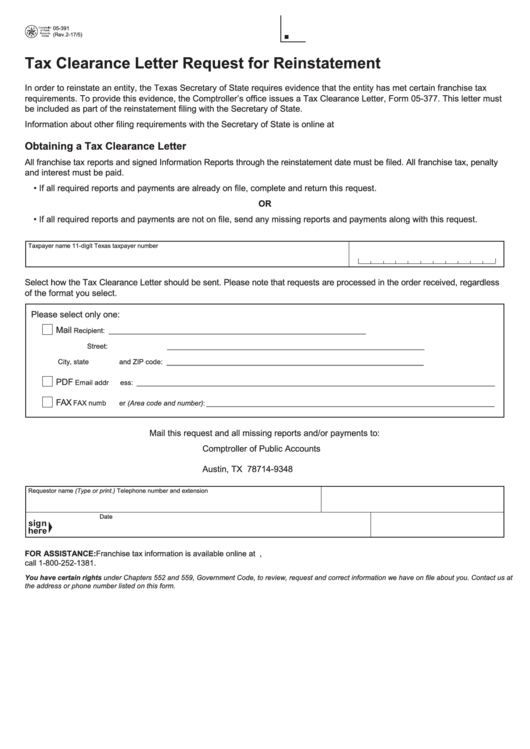

Tax Clearance Letter Request for Reinstatement

In order to reinstate an entity, the Texas Secretary of State requires evidence that the entity has met certain franchise tax

requirements. To provide this evidence, the Comptroller’s office issues a Tax Clearance Letter, Form 05-377. This letter must

be included as part of the reinstatement filing with the Secretary of State.

Information about other filing requirements with the Secretary of State is online at

Obtaining a Tax Clearance Letter

All franchise tax reports and signed Information Reports through the reinstatement date must be filed. All franchise tax, penalty

and interest must be paid.

• If all required reports and payments are already on file, complete and return this request.

OR

• If all required reports and payments are not on file, send any missing reports and payments along with this request.

Taxpayer name

11-digit Texas taxpayer number

Select how the Tax Clearance Letter should be sent. Please note that requests are processed in the order received, regardless

of the format you select.

Please select only one:

Mail

Recipient:

__________________________________________________________________

Street:

__________________________________________________________________

City, state

and ZIP code: __________________________________________________________________

PDF

Email addr

ess: ____________________________________________________________________________________________

FAX

FAX numb

er (Area code and number): __________________________________________________________________________

Mail this request and all missing reports and/or payments to:

Comptroller of Public Accounts

P.O. Box 149348

Austin, TX 78714-9348

Requestor name (Type or print.)

Telephone number and extension

Date

FOR ASSISTANCE: Franchise tax information is available online at For additional assistance,

call 1-800-252-1381.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you. Contact us at

the address or phone number listed on this form.

1

1