Form 323-A - Reclaimer'S And Transporters Monthly Tax Report Of Oil Transported, Stored And Sold

ADVERTISEMENT

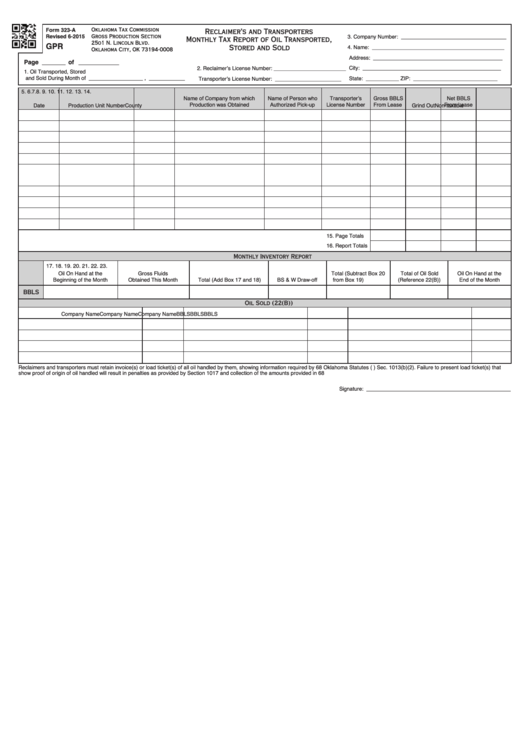

Form 323-A

Oklahoma Tax Commission

Reclaimer’s and Transporters

Revised 6-2015

Gross Production Section

3. Company Number: ___________________________________

Monthly Tax Report of Oil Transported,

GPR

25o1 N. Lincoln Blvd.

Stored and Sold

4. Name: ____________________________________________

Oklahoma City, OK 73194-0008

Address: ___________________________________________

Page _______ of ____________

City: ______________________________________________

2. Reclaimer’s License Number: ________________________

1. Oil Transported, Stored

and Sold During Month of __________________ , ____________

Transporter’s License Number: ______________________

State: ___________

ZIP: ____________________________

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

Name of Company from which

Name of Person who

Transporter’s

Gross BBLS

Net BBLS

Production was Obtained

Authorized Pick-up

License Number

From Lease

From Lease

Date

Production Unit Number

County

Grind Out

Non-taxable

15. Page Totals

16. Report Totals

Monthly Inventory Report

17.

18.

19.

20.

21.

22.

23.

Oil On Hand at the

Gross Fluids

Total (Subtract Box 20

Total of Oil Sold

Oil On Hand at the

Beginning of the Month

Obtained This Month

Total (Add Box 17 and 18)

BS & W Draw-off

from Box 19)

(Reference 22(B))

End of the Month

BBLS

Oil Sold (22(B))

Company Name

BBLS

Company Name

BBLS

Company Name

BBLS

Reclaimers and transporters must retain invoice(s) or load ticket(s) of all oil handled by them, showing information required by 68 Oklahoma Statutes (O.S.) Sec. 1013(b)(2). Failure to present load ticket(s) that

show proof of origin of oil handled will result in penalties as provided by Section 1017 and collection of the amounts provided in 68 O.S. Sec. 1003.

Signature: ________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2