Income Certification Form

ADVERTISEMENT

State of New York

Gertz Plaza

Division of Housing and Community Renewal

92-31 Union Hall Street

Office of Rent Administration

Jamaica, NY 11433

(718) 739-6400

Web Site:

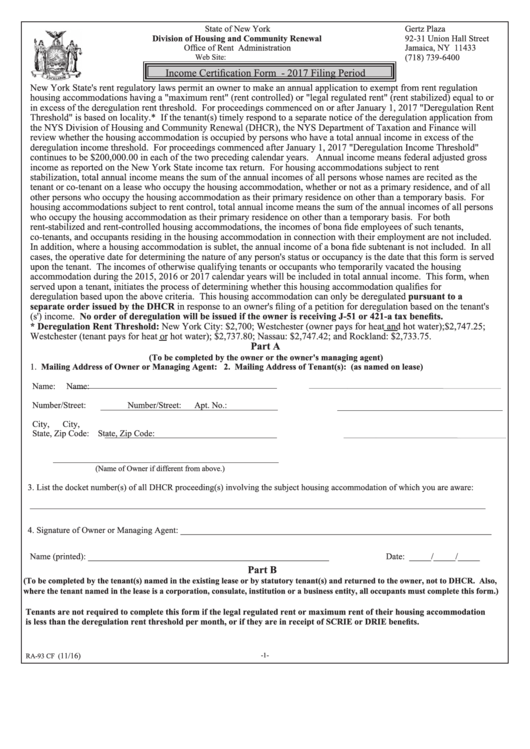

Income Certification Form - 2017 Filing Period

New York State's rent regulatory laws permit an owner to make an annual application to exempt from rent regulation

housing accommodations having a "maximum rent" (rent controlled) or "legal regulated rent" (rent stabilized) equal to or

in excess of the deregulation rent threshold. For proceedings commenced on or after January 1, 2017 "Deregulation Rent

Threshold" is based on locality.* If the tenant(s) timely respond to a separate notice of the deregulation application from

the NYS Division of Housing and Community Renewal (DHCR), the NYS Department of Taxation and Finance will

review whether the housing accommodation is occupied by persons who have a total annual income in excess of the

deregulation income threshold. For proceedings commenced after January 1, 2017 "Deregulation Income Threshold"

continues to be $200,000.00 in each of the two preceding calendar years. Annual income means federal adjusted gross

income as reported on the New York State income tax return. For housing accommodations subject to rent

stabilization, total annual income means the sum of the annual incomes of all persons whose names are recited as the

tenant or co-tenant on a lease who occupy the housing accommodation, whether or not as a primary residence, and of all

other persons who occupy the housing accommodation as their primary residence on other than a temporary basis. For

housing accommodations subject to rent control, total annual income means the sum of the annual incomes of all persons

who occupy the housing accommodation as their primary residence on other than a temporary basis. For both

rent-stabilized and rent-controlled housing accommodations, the incomes of bona fide employees of such tenants,

co-tenants, and occupants residing in the housing accommodation in connection with their employment are not included.

In addition, where a housing accommodation is sublet, the annual income of a bona fide subtenant is not included. In all

cases, the operative date for determining the nature of any person's status or occupancy is the date that this form is served

upon the tenant. The incomes of otherwise qualifying tenants or occupants who temporarily vacated the housing

accommodation during the 2015, 2016 or 2017 calendar years will be included in total annual income. This form, when

served upon a tenant, initiates the process of determining whether this housing accommodation qualifies for

deregulation based upon the above criteria. This housing accommodation can only be deregulated pursuant to a

separate order issued by the DHCR in response to an owner's filing of a petition for deregulation based on the tenant's

(s') income. No order of deregulation will be issued if the owner is receiving J-51 or 421-a tax benefits.

* Deregulation Rent Threshold: New York City: $2,700; Westchester (owner pays for heat and hot water);$2,747.25;

Westchester (tenant pays for heat or hot water); $2,737.80; Nassau: $2,747.42; and Rockland: $2,733.75.

Part A

(To be completed by the owner or the owner's managing agent)

1. Mailing Address of Owner or Managing Agent:

2. Mailing Address of Tenant(s): (as named on lease)

Name:

Name:

Number/Street:

Number/Street:

Apt. No.:

City,

City,

State, Zip Code:

State, Zip Code:

(Name of Owner if different from above.)

3. List the docket number(s) of all DHCR proceeding(s) involving the subject housing accommodation of which you are aware:

________________________________________________________________________________________________________

4. Signature of Owner or Managing Agent: _______________________________________________________________________

Name (printed): _______________________________________________________

Date: _____/_____/_____

Part B

(To be completed by the tenant(s) named in the existing lease or by statutory tenant(s) and returned to the owner, not to DHCR. Also,

where the tenant named in the lease is a corporation, consulate, institution or a business entity, all occupants must complete this form.)

Tenants are not required to complete this form if the legal regulated rent or maximum rent of their housing accommodation

is less than the deregulation rent threshold per month, or if they are in receipt of SCRIE or DRIE benefits.

11/16)

-1-

RA-93 CF (

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4