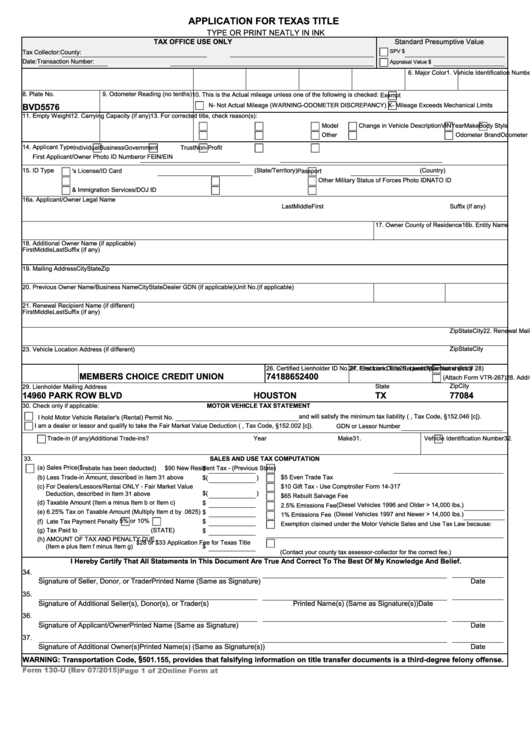

APPLICATION FOR TEXAS TITLE

TYPE OR PRINT NEATLY IN INK

TAX OFFICE USE ONLY

Standard Presumptive Value

SPV $

Tax Collector:

County:

Date:

Transaction Number:

Appraisal Value $

1. Vehicle Identification Number

2. Year

3. Make

4. Body Style

5. Model

6. Major Color

7. Minor Color

8. Plate No.

9. Odometer Reading (no tenths) 10. This is the Actual mileage unless one of the following is checked:

Exempt

BVD5576

N- Not Actual Mileage (WARNING-ODOMETER DISCREPANCY)

X- Mileage Exceeds Mechanical Limits

11. Empty Weight

12. Carrying Capacity (if any)

13. For corrected title, check reason(s):

Make

Body Style

Model

Change in Vehicle Description

VIN

Year

Add Lien

Remove Lien

Other

Odometer Reading

Odometer Brand

14. Applicant Type

Individual

Business

Government

Trust

Non-Profit

First Applicant/Owner Photo ID Number

or FEIN/EIN

15. ID Type

(State/Territory)

(Country)

U.S. Driver's License/ID Card

Passport

U.S. Military ID

NATO ID

Other Military Status of Forces Photo ID

U.S. Citizenship & Immigration Services/DOJ ID

U.S. Department of State ID

U.S. Department of Homeland Security ID

16a. Applicant/Owner Legal Name

First

Middle

Last

Suffix (if any)

16b. Entity Name

17. Owner County of Residence

18. Additional Owner Name (if applicable)

First

Middle

Last

Suffix (if any)

19. Mailing Address

City

State

Zip

20. Previous Owner Name/Business Name

City

State

Dealer GDN (if applicable) Unit No.(if applicable)

21. Renewal Recipient Name (if different)

First

Middle

Last

Suffix (if any)

22. Renewal Mailing Address (if different)

City

State

Zip

City

State

Zip

23. Vehicle Location Address (if different)

24. First Lien Date

25. Lienholder Name (first)

26. Certified Lienholder ID No.

27. Electronic Title Request?

(Cannot check # 28)

MEMBERS CHOICE CREDIT UNION

74188652400

28. Additional Lien(s)?

(Attach Form VTR-267)

City

State

Zip

29. Lienholder Mailing Address

14960 PARK ROW BLVD

HOUSTON

77084

TX

30. Check only if applicable:

MOTOR VEHICLE TAX STATEMENT

and will satisfy the minimum tax liability (V.A.T.S., Tax Code, §152.046 [c]).

I hold Motor Vehicle Retailer's (Rental) Permit No.

I am a dealer or lessor and qualify to take the Fair Market Value Deduction (V.A.T.S., Tax Code, §152.002 [c]).

GDN or Lessor Number

31.

Trade-in (if any)

Vehicle Identification Number

Year

Make

32.

Additional Trade-ins?

33.

SALES AND USE TAX COMPUTATION

(a) Sales Price($

rebate has been deducted)

$90 New Resident Tax - (Previous State)

$

(b) Less Trade-in Amount, described in Item 31 above

$5 Even Trade Tax

$(

)

(c) For Dealers/Lessors/Rental ONLY - Fair Market Value

$10 Gift Tax - Use Comptroller Form 14-317

Deduction, described in Item 31 above

$(

)

$65 Rebuilt Salvage Fee

(d) Taxable Amount (Item a minus Item b or Item c)

$

(Diesel Vehicles 1996 and Older > 14,000 lbs.)

2.5% Emissions Fee

(e) 6.25% Tax on Taxable Amount (Multiply Item d by .0625)

$

(Diesel Vehicles 1997 and Newer > 14,000 lbs.)

1% Emissions Fee

5% or

10%

(f) Late Tax Payment Penalty

$

Exemption claimed under the Motor Vehicle Sales and Use Tax Law because:

(g) Tax Paid to

(STATE)

$

(h) AMOUNT OF TAX AND PENALTY DUE

$28 or $33 Application Fee for Texas Title

$

(Item e plus Item f minus Item g)

(Contact your county tax assessor-collector for the correct fee.)

I Hereby Certify That All Statements In This Document Are True And Correct To The Best Of My Knowledge And Belief.

34.

Signature of Seller, Donor, or Trader

Printed Name (Same as Signature)

Date

35.

Signature of Additional Seller(s), Donor(s), or Trader(s)

Printed Name(s) (Same as Signature(s))

Date

36.

Signature of Applicant/Owner

Printed Name (Same as Signature)

Date

37.

Signature of Additional Owner(s)

Printed Name(s) (Same as Signature(s))

Date

WARNING: Transportation Code, § 501.155, provides that falsifying information on title transfer documents is a third-degree felony offense.

Form 130-U (Rev 07/2015)

Online Form at

Page 1 of 2

1

1 2

2