Schedule D - Capital Gains And Losses - 2016

ADVERTISEMENT

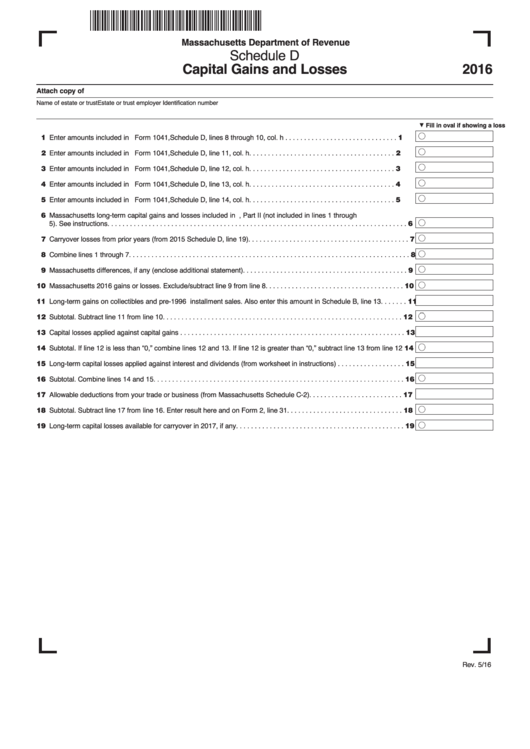

Massachusetts Department of Revenue

Schedule D

Capital Gains and Losses

2016

Attach copy of U.S. Schedule D.

Name of estate or trust

Estate or trust employer Identification number

Fill in oval if showing a loss

5

11 Enter amounts included in U.S. Form 1041, Schedule D, lines 8 through 10, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Enter amounts included in U.S. Form 1041, Schedule D, line 11, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13 Enter amounts included in U.S. Form 1041, Schedule D, line 12, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Enter amounts included in U.S. Form 1041, Schedule D, line 13, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Enter amounts included in U.S. Form 1041, Schedule D, line 14, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Massachusetts long-term capital gains and losses included in U.S. Form 4797, Part II (not included in lines 1 through

5). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Carryover losses from prior years (from 2015 Schedule D, line 19). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Combine lines 1 through 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Massachusetts differences, if any (enclose additional statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Massachusetts 2016 gains or losses. Exclude/subtract line 9 from line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Long-term gains on collectibles and pre-1996 installment sales. Also enter this amount in Schedule B, line 13 . . . . . . . 11

12 Subtotal. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Capital losses applied against capital gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtotal. If line 12 is less than “0,” combine lines 12 and 13. If line 12 is greater than “0,” subtract line 13 from line 12 14

15 Long-term capital losses applied against interest and dividends (from worksheet in instructions) . . . . . . . . . . . . . . . . . . 15

16 Subtotal. Combine lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Allowable deductions from your trade or business (from Massachusetts Schedule C-2) . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Subtotal. Subtract line 17 from line 16. Enter result here and on Form 2, line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Long-term capital losses available for carryover in 2017, if any. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Rev. 5/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1