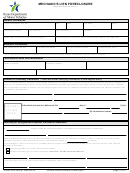

MECHANIC'S LIEN FORECLOSURE

Mechanic's Lien Foreclosure Procedures

GENERAL INFORMATION - A copy of the signed work order must be submitted. In addition, a determination must be made as to

where the vehicle was last registered. Ownership can only be obtained through a court order if a signed work order is unavailable or

no determination can be made as to where the vehicle was last registered.

1.

FORECLOSURE NOTICE - Not later than 30 days after the day on which charges accrue, the mechanic/garage must notify the

owner(s) and lienholder(s) of record by certified mail, return receipt requested, of the charges due and request payment. Notice by

newspaper publication may be permitted (see “Notification by Newspaper” below). Not later than 30 days after the day on which

charges accrue, the mechanic/garage must submit a copy of the notice (made to the owner(s) and lienholder(s)), a copy of the

signed work order, and a $25 administrative fee to the county tax assessor-collector's office in the county in which the repairs were

made. The mechanic must include in the notice the physical address where the repairs were made, the legal name of the mechanic/

garage, the taxpayer or employer identification number of the mechanic/garage, and a copy of the signed work order authorizing

repairs. NOTE: The notice must also be sent to the address that appears on the work order/document authorizing

possession if the addresses are different from the address on the motor vehicle record.

2. STORAGE NOTICE, IF APPLICABLE - If any amount of the charges include storage fees, a second notification is required. Refer

to Storage Lien Foreclosure, Form VTR-265-S, for additional notification requirements when storage fees are included. Form

VTR-265-S must be submitted if storage fees are included. Additionally, a release of lien (if applicable) is required; otherwise,

foreclosure must be through a court of competent jurisdiction.

3. PUBLIC SALE - If charges remain unpaid, the mechanic may sell the vehicle at public sale anytime on or after the 31st day after

notice is mailed to the owner(s)/lienholder(s) or published if such notice was made prior to September 1, 2015; otherwise, the

mechanic may sell at public sale anytime on or after the 31st day after a copy of the notice or publication was filed with the county

tax assessor-collector's office. The proceeds shall be applied to the payment of charges, and the balance shall be paid to the

person entitled to them.

4. APPLICATION FOR TITLE - The highest bidder at public sale must apply for title, unless the vehicle is purchased by a dealer with

a current General Distinguishing Number (GDN).

NOTIFICATION BY NEWSPAPER - In lieu of written notification, publication of the notice(s) in a newspaper of general circulation in

the county in which the vehicle is stored may be used only if ALL of the following apply:

(1) The mechanic/garage submits a written request by certified mail, return receipt requested, to the governmental entity with which

the motor vehicle is registered requesting information relating to the identity of the last known registered owner(s) and any

lienholder(s) of record.

(2) The mechanic/garage:

(a) is advised in writing by the governmental entity with which the motor vehicle is registered that the entity is unwilling or unable

to provide information on the last known registered owner or any lienholder of record, or

(b) does not receive a response from the governmental entity with which the motor vehicle is registered on or before the 21st

day after the date the holder of the lien submits a request under (1).

(3) The identity of the last known registered owner cannot be determined.

(4) The registration does not contain an address for the last known registered owner.

(5) The mechanic/garage cannot determine the identities and addresses of the lienholders of record.

NOTE: The mechanic/garage is not required to publish notice if a correctly addressed notice is sent with sufficient postage

and is returned as unclaimed, refused, the forwarding order has expired, or with a notation that the addressee is unknown or

has moved without leaving a forwarding address.

Evidence Required to Transfer Ownership

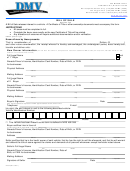

a. Form 130-U - Application for Texas Title.

b. Form VTR-265-M - Mechanic's Lien Foreclosure.

c. Verification of Title and Registration - If the vehicle is registered in Texas, verification of Texas title and registration is required.

If registered outside of Texas, verification of title and registration from the state of record, if available. If not available, the following

may be provided in lieu of title and registration verification from the state of record:

(1) If a mechanic/garage sends a request for title and registration verification to the state of record (by certified mail) and is

informed by letter that due to the Driver's Privacy Protection Act restrictions the state will forward the mechanic's notification to

the owner(s) for notification purposes, then the original letter(s) from the state of record and certified receipts for each

notification sent to that state will be acceptable, or

(2) If notification is made by newspaper publication, proof that a correctly addressed request for the name and address of the last

known registered owner(s) and lienholder(s) was sent to the state of record by certified mail with return receipt requested.

Proof consists of a copy of the request and certified receipts for the notification sent to the state of record.

d. Proof of Notifications

Notices by Certified Mail - Proof consists of the date stamped receipts for certified mail and return receipt, including any unopened

certified letter(s) returned as undeliverable, unclaimed, refused, or no forwarding address.

Notice by Newspaper Publication (only if applicable) - Proof consists of the certified request (as listed above for certified mail) sent

to the state of record requesting verification of owner(s) and lienholder(s) AND a legible photocopy of the newspaper publication

including the name and date of the publication.

Receipt from County Tax Assessor-Collector - Dated receipt showing $25 administrative fee was paid. This confirms filing with the

county tax assessor-collector's office.

e. Liability Insurance - A copy of current proof of liability insurance in the applicant's name.

f. Work Order - Attach a copy of the signed work order.

g. Out-of-State Vehicles - An Out-of-State Identification Certificate, Form VI-30, or a Texas Vehicle Inspection Report and a certified

weight certificate if the vehicle is a commercial vehicle.

Form VTR-265-M Rev 08/15

Online Form at

Page 2 of 2

1

1 2

2