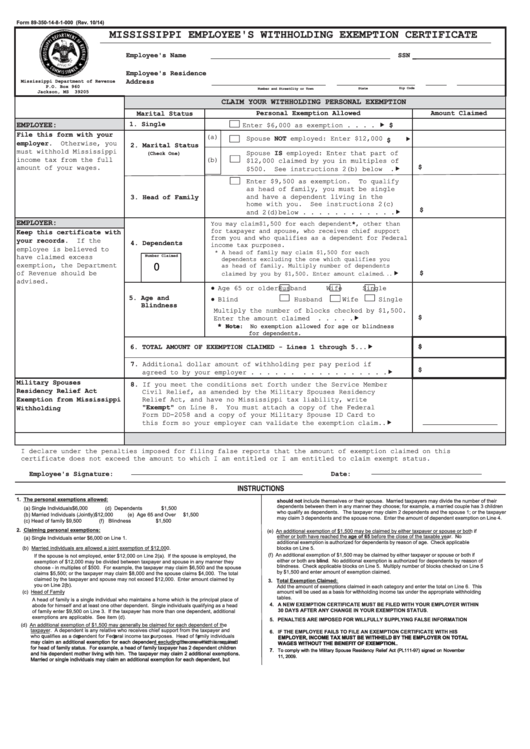

)RUP ����������8������ �5HY� ������

0,66,66,33, (03/2<((

6 :,7++2/',1* (;(037,21 &(57,),&$7(

(PSOR\HH

V 1DPH

661

(PSOR\HH

V 5HVLGHQFH

$GGUHVV

0LVVLVVLSSL 'HSDUWPHQW RI 5HYHQXH

3�2� %R[ ���

=LS &RGH

1XPEHU DQG 6WUHHW

&LW\ RU 7RZQ

6WDWH

-DFNVRQ� 06

�����

&/$,0 <285 :,7++2/',1* 3(5621$/ (;(037,21

3HUVRQDO ([HPSWLRQ $OORZHG

$PRXQW &ODLPHG

0DULWDO 6WDWXV

�� 6LQJOH

(03/2<((�

Enter $6,000 as exemption . . . . f

)LOH WKLV IRUP ZLWK \RXU

Spouse 127 employed: Enter $12,000

(a)

f

HPSOR\HU.

�� 0DULWDO 6WDWXV

Otherwise, you

Spouse ,6 employed: Enter that part of

must withhold Mississippi

�&KHFN 2QH�

income tax from the full

(b)

$12,000 claimed by you in multiples of

amount of your wages.

$500.

See instructions 2(b) below

.f

Enter $9,500 as exemption.

To qualify

as head of family, you must be single

�� +HDG RI )DPLO\

and have a dependent living in the

home with you.

See instructions 2(c)

and 2(d)below . . . . . . . . . . . .f

(03/2<(5�

You may claim $1,500 for each dependent

, other than

.HHS WKLV FHUWLILFDWH ZLWK

for taxpayer and spouse, who receives chief support

from you and who qualifies as a dependent for Federal

\RXU UHFRUGV.

If the

�� 'HSHQGHQWV

income tax purposes.

employee is believed to

* A head of family may claim $1,500 for each

1XPEHU &ODLPHG

have claimed excess

dependents excluding the one which qualifies you

exemption, the Department

0

as head of family. Multiply number of dependents

f

claimed by you by $1,500. Enter amount claimed . . .

of Revenue should be

1

advised.

Age 65 or older

Husband

Wife

Single

�� $JH DQG

Blind

Husband

Wife

Single

%OLQGQHVV

Multiply the number of blocks checked by $1,500.

Enter the amount claimed

. . . . .f

1RWH:

1RWH:

No exemption allowed for age or blindness

No exemption allowed for age or blindness

for dependents.

for dependents.

�� 727$/ $02817 2) (;(037,21 &/$,0(' � /LQHV � WKURXJK ����f

�� Additional dollar amount of withholding per pay period if

agreed to by your employer . . . . . .

. . . . . . . . . . .f

0LOLWDU\ 6SRXVHV

�� If you meet the conditions set forth under the Service Member

5HVLGHQF\ 5HOLHI $FW

Civil Relief, as amended by the Military Spouses Residency

([HPSWLRQ IURP 0LVVLVVLSSL

Relief Act, and have no Mississippi tax liability, write

([HPSW

:LWKKROGLQJ

on Line 8.

You must attach a copy of the Federal

Form DD-2058 and a copy of your Military Spouse ID Card to

this form so your employer can validate the exemption claim..f

I declare under the penalties imposed for filing false reports that the amount of exemption claimed on this

certificate does not exceed the amount to which I am entitled or I am entitled to claim exempt status.

(PSOR\HH

V 6LJQDWXUH�

'DWH�

INSTRUCTIONS

�� 7KH SHUVRQDO H[HPSWLRQV DOORZHG�

VKRXOG QRW include themselves or their spouse. Married taxpayers may divide the number of their

dependents between them in any manner they choose; for example, a married couple has 3 children

(a) Single Individuals

$6,000

(d) Dependents

$1,500

who qualify as dependents. The taxpayer may claim 2 dependents and the spouse 1; or the taxpayer

(b) Married Individuals (Jointly)

$12,000

(e) Age 65 and Over

$1,500

may claim 3 dependents and the spouse none. Enter the amount of dependent exemption on Line 4.

(c) Head of family

$9,500

(f) Blindness

$1,500

�� &ODLPLQJ SHUVRQDO H[HPSWLRQV�

(e) An additional exemption of $1,500 may be claimed by either taxpayer or spouse or both if

either or both have reached the DJH RI �� before the close of the taxable year. No

(a) Single Individuals enter $6,000 on Line 1.

additional exemption is authorized for dependents by reason of age. Check applicable

blocks on Line 5.

(b) Married individuals are allowed a joint exemption of $12,000.

(f) An additional exemption of $1,500 may be claimed by either taxpayer or spouse or both if

If the spouse is not employed, enter $12,000 on Line 2(a). If the spouse is employed, the

either or both are EOLQG. No additional exemption is authorized for dependents by reason of

exemption of $12,000 may be divided between taxpayer and spouse in any manner they

blindness. Check applicable blocks on Line 5. Multiply number of blocks checked on Line 5

choose - in multiples of $500. For example, the taxpayer may claim $6,500 and the spouse

by $1,500 and enter amount of exemption claimed.

claims $5,500; or the taxpayer may claim $8,000 and the spouse claims $4,000. The total

claimed by the taxpayer and spouse may not exceed $12,000. Enter amount claimed by

�� 7RWDO ([HPSWLRQ &ODLPHG�

you on Line 2(b).

Add the amount of exemptions claimed in each category and enter the total on Line 6. This

(c) Head of Family

amount will be used as a basis for withholding income tax under the appropriate withholding

tables.

A head of family is a single individual who maintains a home which is the principal place of

�� $ 1(: (;(037,21 &(57,),&$7( 0867 %( ),/(' :,7+ <285 (03/2<(5 :,7+,1

abode for himself and at least one other dependent. Single individuals qualifying as a head

�� '$<6 $)7(5 $1< &+$1*( ,1 <285 (;(037,21 67$786.

of family enter $9,500 on Line 3. If the taxpayer has more than one dependent, additional

exemptions are applicable. See item (d).

�� 3(1$/7,(6 $5( ,0326(' )25 :,//)8//< 6833/<,1* )$/6( ,1)250$7,21

(d) An additional exemption of $1,500 may generally be claimed for each dependent of the

taxpayer. A dependent is any relative who receives chief support from the taxpayer and

�� ,) 7+( (03/2<(( )$,/6 72 ),/( $1 (;(037,21 &(57,),&$7( :,7+ +,6

who qualifies as a dependent for Federal income tax purposes. Head of family individuals

q

p

p p

y

(03/2<(5� ,1&20( 7$; 0867 %( :,7++(/' %< 7+( (03/2<(5 21 727$/

(03/2<(5� ,1&20( 7$; 0867 %( :,7++(/' %< 7+( (03/2<(5 21 727$/

may claim an additional exemption for each dependent excluding the one which is required

may claim an additional exemption for each dependent excluding the one which is required

:$*(6 :,7+287 7+( %(1(),7 2) (;(037,21�.

:$*(6 :,7+287 7+( %(1(),7 2) (;(037,21�.

for head of family status. For example, a head of family taxpayer has 2 dependent children

for head of family status. For example, a head of family taxpayer has 2 dependent children

�

�

. To comply with the Military Spouse Residency Relief Act (PL111-97) signed on November

. To comply with the Military Spouse Residency Relief Act (PL111-97) signed on November

and his dependent mother living with him. The taxpayer may claim 2 additional exemptions.

and his dependent mother living with him. The taxpayer may claim 2 additional exemptions.

11, 2009.

11, 2009.

Married or single individuals may claim an additional exemption for each dependent, but

Married or single individuals may claim an additional exemption for each dependent, but

1

1