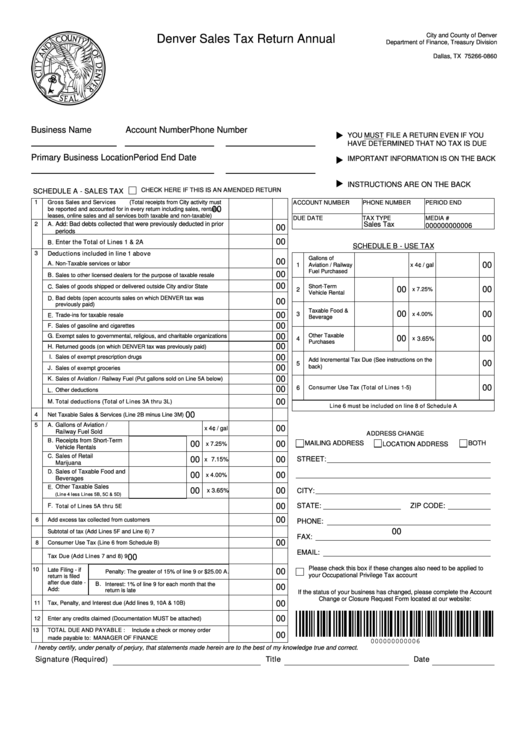

City and County of Denver

Denver Sales Tax Return Annual

Department of Finance, Treasury Division

P.O. Box 660860

Dallas, TX 75266-0860

Business Name

Account Number

Phone Number

u

YOU MUST FILE A RETURN EVEN IF YOU

HAVE DETERMINED THAT NO TAX IS DUE

Primary Business Location

Period End Date

u

IMPORTANT INFORMATION IS ON THE BACK

u

INSTRUCTIONS ARE ON THE BACK

CHECK HERE IF THIS IS AN AMENDED RETURN

SCHEDULE A - SALES TAX

1

Gross Sales and Services

(Total receipts from City activity must

ACCOUNT NUMBER

PHONE NUMBER

PERIOD END

00

be reported and accounted for in every return including sales, rentals,

leases, online sales and all services both taxable and non-taxable)

DUE DATE

TAX TYPE

MEDIA #

Add: Bad debts collected that were previously deducted in prior

20-Dec-9999

Sales Tax

4268195847

2

A.

000000000006

00

periods

00

B.

Enter the Total of Lines 1 & 2A

SCHEDULE B - USE TAX

3

Deductions included in line 1 above

Gallons of

00

A. Non-Taxable services or labor

00

1

Aviation / Railway

x 4¢ / gal

Fuel Purchased

00

B. Sales to other licensed dealers for the purpose of taxable resale

00

C. Sales of goods shipped or delivered outside City and/or State

Short-Term

00

00

2

x 7.25%

Vehicle Rental

D. Bad debts (open accounts sales on which DENVER tax was

00

previously paid)

Taxable Food &

00

00

00

3

x 4.00%

E. Trade-ins for taxable resale

Beverage

00

F. Sales of gasoline and cigarettes

00

Other Taxable

G.

Exempt sales to governmental, religious, and charitable organizations

00

00

4

x

3.65%

Purchases

00

H. Returned goods (on which DENVER tax was previously paid)

00

I. Sales of exempt prescription drugs

Add Incremental Tax Due (See instructions on the

00

5

back)

00

J. Sales of exempt groceries

00

K. Sales of Aviation / Railway Fuel (Put gallons sold on Line 5A below)

00

00

6

Consumer Use Tax (Total of Lines 1-5)

L. Other deductions

00

M. Total deductions (Total of Lines 3A thru 3L)

Line 6 must be included on line 8 of Schedule A

00

4

Net Taxable Sales & Services (Line 2B minus Line 3M)

5

A.

Gallons of Aviation /

00

x 4¢ / gal

Railway Fuel Sold

ADDRESS CHANGE

B.

Receipts from Short-Term

00

00

MAILING ADDRESS

BOTH

LOCATION ADDRESS

x 7.25%

Vehicle Rentals

C.

Sales of Retail

00

00

STREET:

7.15%

x

Marijuana

D.

Sales of Taxable Food and

00

00

x 4.00%

Beverages

Other Taxable Sales

E.

00

00

x 3.65%

CITY:

(Line 4 less Lines 5B, 5C & 5D)

00

STATE:

ZIP CODE:

F.

Total of Lines 5A thru 5E

00

6

Add excess tax collected from customers

PHONE:

00

7

Subtotal of tax (Add Lines 5F and Line 6)

FAX:

00

8

Consumer Use Tax (Line 6 from Schedule B)

EMAIL:

00

9

Tax Due (Add Lines 7 and 8)

Please check this box if these changes also need to be applied to

10

Late Filing - if

00

A.

Penalty: The greater of 15% of line 9 or $25.00

your Occupational Privilege Tax account

return is filed

after due date -

B. Interest: 1% of line 9 for each month that the

00

Add:

return is late

If the status of your business has changed, please complete the Account

Change or Closure Request Form located at our website:

00

11

Tax, Penalty, and Interest due (Add lines 9, 10A & 10B)

00

12

Enter any credits claimed (Documentation MUST be attached)

13

TOTAL DUE AND PAYABLE :

Include a check or money order

00

made payable to:

MANAGER OF FINANCE

000000000006

4268195847

I hereby certify, under penalty of perjury, that statements made herein are to the best of my knowledge true and correct.

Signature (Required)

Title

Date

1

1 2

2