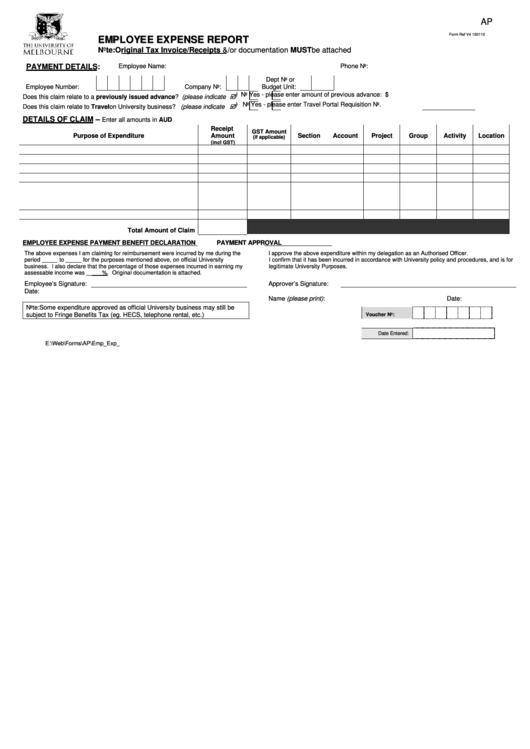

Form Ref V4 - Employee Expense Report

ADVERTISEMENT

AP

Form Ref V4 150110

E

M

P

L

O

Y

E

E

E

X

P

E

N

S

E

R

E

P

O

R

T

E

M

P

L

O

Y

E

E

E

X

P

E

N

S

E

R

E

P

O

R

T

Note: Original Tax Invoice/Receipts &/or documentation MUST be attached

Employee Name:

Phone No:

PAYMENT DETAILS:

Dept No or

Employee Number:

Company No:

Budget Unit:

Does this claim relate to a previously issued advance? (please indicate

)

No

Yes - please enter amount of previous advance: $

Does this claim relate to Travel on University business? (please indicate

)

No

Yes - please enter Travel Portal Requisition No.

DETAILS OF CLAIM –

Enter all amounts in AUD

Receipt

GST Amount

Purpose of Expenditure

Amount

Section

Account

Project

Group

Activity

Location

(if applicable)

(incl GST)

Total Amount of Claim

EMPLOYEE EXPENSE PAYMENT BENEFIT DECLARATION

PAYMENT APPROVAL

The above expenses I am claiming for reimbursement were incurred by me during the

I approve the above expenditure within my delegation as an Authorised Officer.

period

to

for the purposes mentioned above, on official University

I confirm that it has been incurred in accordance with University policy and procedures, and is for

business. I also declare that the percentage of those expenses incurred in earning my

legitimate University Purposes.

assessable income was __

%. Original documentation is attached.

Employee’s Signature:

Approver’s Signature:

Date:

Name (please print):

Date:

Note:

Some expenditure approved as official University business may still be

subject to Fringe Benefits Tax (eg. HECS, telephone rental, etc.)

Voucher No:

Date Entered:

E:\Web\Forms\AP\Emp_Exp_Report.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1