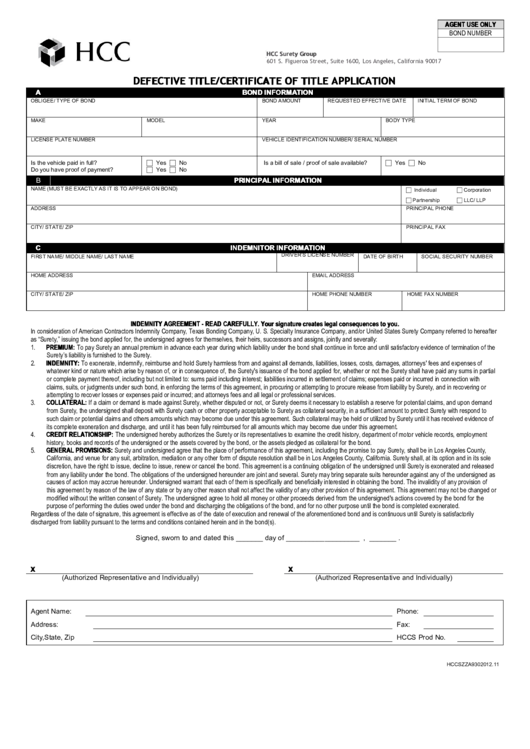

AGENT USE ONLY

BOND NUMBER

HCC Surety Group

601 S. Figueroa Street, Suite 1600, Los Angeles, California 90017

DEFECTIVE TITLE/CERTIFICATE OF TITLE APPLICATION

A

BOND INFORMATION

OBLIGEE/ TYPE OF BOND

BOND AMOUNT

REQUESTED EFFECTIVE DATE

INITIAL TERM OF BOND

MAKE

MODEL

YEAR

BODY TYPE

LICENSE PLATE NUMBER

VEHICLE IDENTIFICATION NUMBER/ SERIAL NUMBER

Yes No

Yes No

Is the vehicle paid in full?

Is a bill of sale / proof of sale available?

Yes No

Do you have proof of payment?

PRINCIPAL INFORMATION

B

NAME (MUST BE EXACTLY AS IT IS TO APPEAR ON BOND)

Individual

Corporation

Partnership

LLC/ LLP

ADDRESS

PRINCIPAL PHONE

CITY/ STATE/ ZIP

PRINCIPAL FAX

C

INDEMNITOR INFORMATION

DRIVER’S LICENSE NUMBER

FIRST NAME/ MIDDLE NAME/ LAST NAME

DATE OF BIRTH

SOCIAL SECURITY NUMBER

HOME ADDRESS

EMAIL ADDRESS

CITY/ STATE/ ZIP

HOME PHONE NUMBER

HOME FAX NUMBER

INDEMNITY AGREEMENT - READ CAREFULLY. Your signature creates legal consequences to you.

In consideration of American Contractors Indemnity Company, Texas Bonding Company, U. S. Specialty Insurance Company, and/or United States Surety Company referred to hereafter

as “Surety,” issuing the bond applied for, the undersigned agrees for themselves, their heirs, successors and assigns, jointly and severally:

1.

PREMIUM: To pay Surety an annual premium in advance each year during which liability under the bond shall continue in force and until satisfactory evidence of termination of the

Surety’s liability is furnished to the Surety.

2.

INDEMNITY: To exonerate, indemnify, reimburse and hold Surety harmless from and against all demands, liabilities, losses, costs, damages, attorneys' fees and expenses of

whatever kind or nature which arise by reason of, or in consequence of, the Surety's issuance of the bond applied for, whether or not the Surety shall have paid any sums in partial

or complete payment thereof, including but not limited to: sums paid including interest; liabilities incurred in settlement of claims; expenses paid or incurred in connection with

claims, suits, or judgments under such bond, in enforcing the terms of this agreement, in procuring or attempting to procure release from liability by Surety, and in recovering or

attempting to recover losses or expenses paid or incurred; and attorneys fees and all legal or professional services.

3.

COLLATERAL: If a claim or demand is made against Surety, whether disputed or not, or Surety deems it necessary to establish a reserve for potential claims, and upon demand

from Surety, the undersigned shall deposit with Surety cash or other property acceptable to Surety as collateral security, in a sufficient amount to protect Surety with respond to

such claim or potential claims and others amounts which may become due under this agreement. Such collateral may be held or utilized by Surety until it has received evidence of

its complete exoneration and discharge, and until it has been fully reimbursed for all amounts which may become due under this agreement.

4.

CREDIT RELATIONSHIP: The undersigned hereby authorizes the Surety or its representatives to examine the credit history, department of motor vehicle records, employment

history, books and records of the undersigned or the assets covered by the bond, or the assets pledged as collateral for the bond.

5.

GENERAL PROVISIONS: Surety and undersigned agree that the place of performance of this agreement, including the promise to pay Surety, shall be in Los Angeles County,

California, and venue for any suit, arbitration, mediation or any other form of dispute resolution shall be in Los Angeles County, California. Surety shall, at its option and in its sole

discretion, have the right to issue, decline to issue, renew or cancel the bond. This agreement is a continuing obligation of the undersigned until Surety is exonerated and released

from any liability under the bond. The obligations of the undersigned hereunder are joint and several. Surety may bring separate suits hereunder against any of the undersigned as

causes of action may accrue hereunder. Undersigned warrant that each of them is specifically and beneficially interested in obtaining the bond. The invalidity of any provision of

this agreement by reason of the law of any state or by any other reason shall not affect the validity of any other provision of this agreement. This agreement may not be changed or

modified without the written consent of Surety. The undersigned agree to hold all money or other proceeds derived from the undersigned's actions covered by the bond for the

purpose of performing the duties owed under the bond and discharging the obligations of the bond, and for no other purpose until the bond is completed exonerated.

Regardless of the date of signature, this agreement is effective as of the date of execution and renewal of the aforementioned bond and is continuous until Surety is satisfactorily

discharged from liability pursuant to the terms and conditions contained herein and in the bond(s).

rev2011.03

Signed, sworn to and dated this _______ day of ___________________ , _______ .

X

X

(Authorized Representative and Individually)

(Authorized Representative and Individually)

Agent Name:

Phone:

Address:

Fax:

City,State, Zip

HCCS Prod No.

HCCSZZA9302012.11

1

1