Form Nc-4 - 2003 Employee'S Withholding Allowance Certificate

ADVERTISEMENT

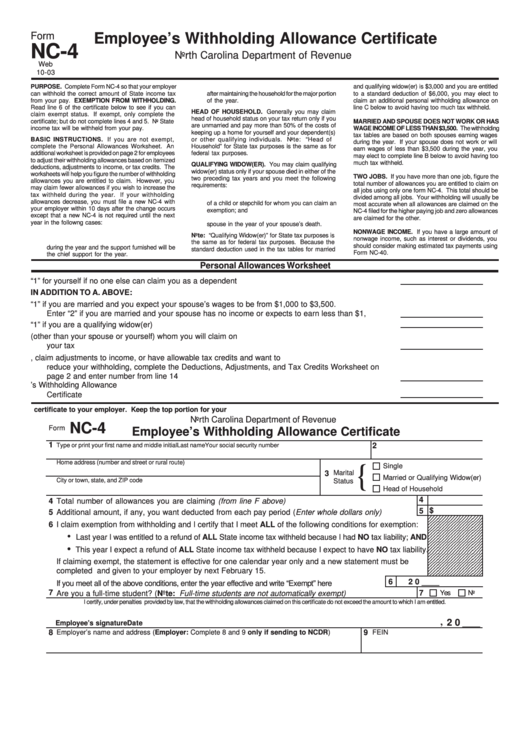

Form

Employee’s Withholding Allowance Certificate

NC-4

North Carolina Department of Revenue

Web

10-03

PURPOSE. Complete Form NC-4 so that your employer

3.

When an individual ceases to be head of household

and qualifying widow(er) is $3,000 and you are entitled

can withhold the correct amount of State income tax

after maintaining the household for the major portion

to a standard deduction of $6,000, you may elect to

from your pay. EXEMPTION FROM WITHHOLDING.

of the year.

claim an additional personal withholding allowance on

Read line 6 of the certificate below to see if you can

line C below to avoid having too much tax withheld.

HEAD OF HOUSEHOLD. Generally you may claim

claim exempt status. If exempt, only complete the

head of household status on your tax return only if you

certificate; but do not complete lines 4 and 5. No State

MARRIED AND SPOUSE DOES NOT WORK OR HAS

are unmarried and pay more than 50% of the costs of

income tax will be withheld from your pay.

WAGE INCOME OF LESS THAN $3,500. The withholding

keeping up a home for yourself and your dependent(s)

tax tables are based on both spouses earning wages

BASIC INSTRUCTIONS. If you are not exempt,

or other qualifying individuals. Note: “Head of

during the year. If your spouse does not work or will

complete the Personal Allowances Worksheet. An

Household” for State tax purposes is the same as for

earn wages of less than $3,500 during the year, you

additional worksheet is provided on page 2 for employees

federal tax purposes.

may elect to complete line B below to avoid having too

to adjust their withholding allowances based on itemized

much tax withheld.

QUALIFYING WIDOW(ER). You may claim qualifying

deductions, adjustments to income, or tax credits. The

widow(er) status only if your spouse died in either of the

worksheets will help you figure the number of withholding

TWO JOBS. If you have more than one job, figure the

two preceding tax years and you meet the following

allowances you are entitled to claim. However, you

total number of allowances you are entitled to claim on

requirements:

may claim fewer allowances if you wish to increase the

all jobs using only one form NC-4. This total should be

tax withheld during the year. If your withholding

1.

Your home is maintained as the main household

divided among all jobs. Your withholding will usually be

allowances decrease, you must file a new NC-4 with

of a child or stepchild for whom you can claim an

most accurate when all allowances are claimed on the

your employer within 10 days after the change occurs

exemption; and

NC-4 filed for the higher paying job and zero allowances

except that a new NC-4 is not required until the next

2.

You were entitled to file a joint return with your

are claimed for the other.

year in the followng cases:

spouse in the year of your spouse’s death.

NONWAGE INCOME. If you have a large amount of

1.

When a dependent dies during the year.

Note: “Qualifying Widow(er)” for State tax purposes is

nonwage income, such as interest or dividends, you

2.

When an individual ceases to be a dependent

the same as for federal tax purposes. Because the

should consider making estimated tax payments using

during the year and the support furnished will be

standard deduction used in the tax tables for married

Form NC-40.

the chief support for the year.

Personal Allowances Worksheet

A.

Enter “1” for yourself if no one else can claim you as a dependent .................................................... A.

IN ADDITION TO A. ABOVE:

B.

Enter “1” if you are married and you expect your spouse’s wages to be from $1,000 to $3,500.

Enter “2” if you are married and your spouse has no income or expects to earn less than $1,000 .... B.

C. Enter “1” if you are a qualifying widow(er). .......................................................................................... C.

D. Enter the number of dependents (other than your spouse or yourself) whom you will claim on

your tax return ...................................................................................................................................... D.

E.

If you plan to itemize, claim adjustments to income, or have allowable tax credits and want to

reduce your withholding, complete the Deductions, Adjustments, and Tax Credits Worksheet on

page 2 and enter number from line 14 ................................................................................................ E.

F.

Add lines A through E and enter total here and on line 4 of your Employee’s Withholding Allowance

Certificate ............................................................................................................................................. F.

............................................ Cut here and give this certificate to your employer. Keep the top portion for your records .........................................

North Carolina Department of Revenue

NC-4

Form

Employee’s Withholding Allowance Certificate

1

Type or print your first name and middle initial

Last name

2

Your social security number

Home address (number and street or rural route)

Single

{

3

Marital

Married or Qualifying Widow(er)

City or town, state, and ZIP code

Status

Head of Household

4

4

Total number of allowances you are claiming (from line F above) ...........................................................

$

5

5

Additional amount, if any, you want deducted from each pay period (Enter whole dollars only) ..............

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

6

I claim exemption from withholding and I certify that I meet ALL of the following conditions for exemption:

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

•

Last year I was entitled to a refund of ALL State income tax withheld because I had NO tax liability; AND

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

•

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

This year I expect a refund of ALL State income tax withheld because I expect to have NO tax liability.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

If claiming exempt, the statement is effective for one calendar year only and a new statement must be

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

completed and given to your employer by next February 15.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

6

2 0 ____

If you meet all of the above conditions, enter the year effective and write “Exempt” here ......................

7

Are you a full-time student? (Note: Full-time students are not automatically exempt) ...............................

7

Yes

No

I certify, under penalties provided by law, that the withholding allowances claimed on this certificate do not exceed the amount to which I am entitled.

,

2 0

Employee’s signature

Date

____

Employer’s name and address (Employer: Complete 8 and 9 only if sending to NCDR)

FEIN

8

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2