Tax Organizer For Corporations, S Corporations, Partnerships & Limited Liability Corporations (Or Partnerships)

ADVERTISEMENT

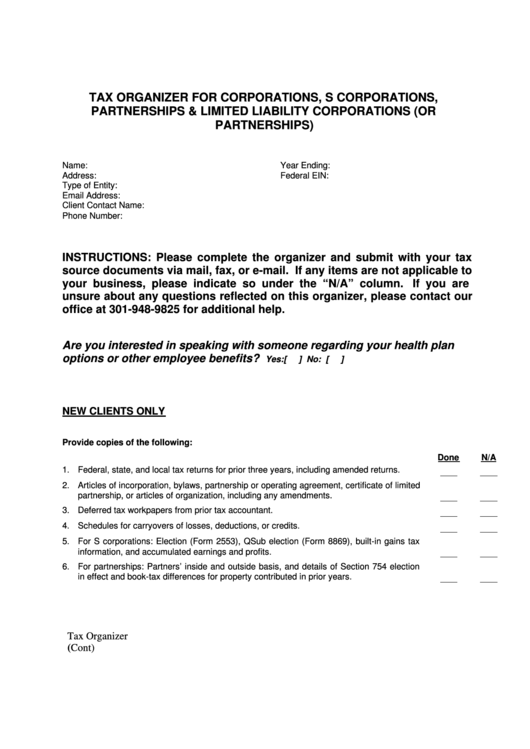

TAX ORGANIZER FOR CORPORATIONS, S CORPORATIONS,

PARTNERSHIPS & LIMITED LIABILITY CORPORATIONS (OR

PARTNERSHIPS)

Name:

Year Ending:

Address:

Federal EIN:

Type of Entity:

Email Address:

Client Contact Name:

Phone Number:

INSTRUCTIONS: Please complete the organizer and submit with your tax

source documents via mail, fax, or e-mail. If any items are not applicable to

your business, please indicate so under the “N/A” column.

If you are

unsure about any questions reflected on this organizer, please contact our

office at 301-948-9825 for additional help.

Are you interested in speaking with someone regarding your health plan

options or other employee benefits?

Yes: [

] No: [

]

NEW CLIENTS ONLY

Provide copies of the following:

Done

N/A

1. Federal, state, and local tax returns for prior three years, including amended returns.

2. Articles of incorporation, bylaws, partnership or operating agreement, certificate of limited

partnership, or articles of organization, including any amendments.

3. Deferred tax workpapers from prior tax accountant.

4. Schedules for carryovers of losses, deductions, or credits.

5. For S corporations: Election (Form 2553), QSub election (Form 8869), built-in gains tax

information, and accumulated earnings and profits.

6. For partnerships: Partners’ inside and outside basis, and details of Section 754 election

in effect and book-tax differences for property contributed in prior years.

Tax Organizer

(Cont)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4