Real Property Tax Exemption Application

ADVERTISEMENT

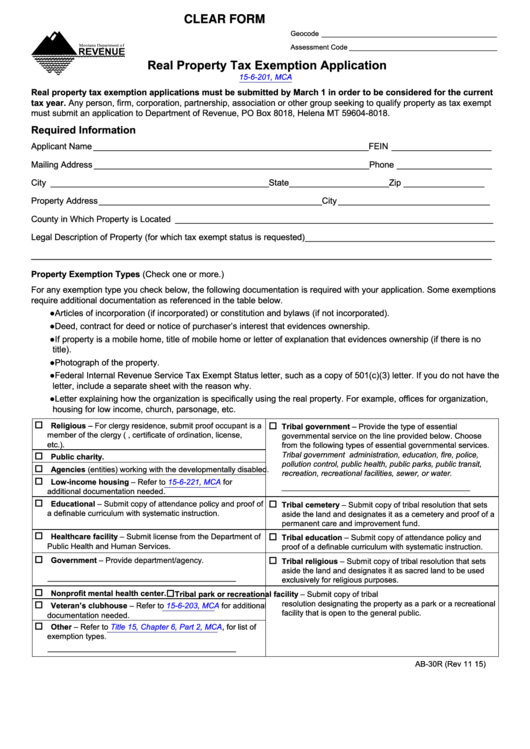

CLEAR FORM

Geocode _____________________________________________

Assessment Code ______________________________________

Real Property Tax Exemption Application

15-6-201, MCA

Real property tax exemption applications must be submitted by March 1 in order to be considered for the current

tax year. Any person, firm, corporation, partnership, association or other group seeking to qualify property as tax exempt

must submit an application to Department of Revenue, PO Box 8018, Helena MT 59604-8018.

Required Information

Applicant Name __________________________________________________________ FEIN _____________________

Mailing Address __________________________________________________________ Phone ____________________

City ______________________________________________ State _____________________ Zip _________________

Property Address _______________________________________________ City ________________________________

County in Which Property is Located ___________________________________________________________________

Legal Description of Property (for which tax exempt status is requested) ________________________________________

_________________________________________________________________________________________________

Property Exemption Types (Check one or more.)

For any exemption type you check below, the following documentation is required with your application. Some exemptions

require additional documentation as referenced in the table below.

● Articles of incorporation (if incorporated) or constitution and bylaws (if not incorporated).

● Deed, contract for deed or notice of purchaser’s interest that evidences ownership.

● If property is a mobile home, title of mobile home or letter of explanation that evidences ownership (if there is no

title).

● Photograph of the property.

● Federal Internal Revenue Service Tax Exempt Status letter, such as a copy of 501(c)(3) letter. If you do not have the

letter, include a separate sheet with the reason why.

● Letter explaining how the organization is specifically using the real property. For example, offices for organization,

housing for low income, church, parsonage, etc.

Religious – For clergy residence, submit proof occupant is a

Tribal government – Provide the type of essential

member of the clergy (e.g., certificate of ordination, license,

governmental service on the line provided below. Choose

etc.).

from the following types of essential governmental services.

Tribal government administration, education, fire, police,

Public charity.

pollution control, public health, public parks, public transit,

Agencies (entities) working with the developmentally disabled.

recreation, recreational facilities, sewer, or water.

Low-income housing – Refer to

15-6-221, MCA

for

___________________________________________

additional documentation needed.

Educational – Submit copy of attendance policy and proof of

Tribal cemetery – Submit copy of tribal resolution that sets

a definable curriculum with systematic instruction.

aside the land and designates it as a cemetery and proof of a

permanent care and improvement fund.

Healthcare facility – Submit license from the Department of

Tribal education – Submit copy of attendance policy and

Public Health and Human Services.

proof of a definable curriculum with systematic instruction.

Government – Provide department/agency.

Tribal religious – Submit copy of tribal resolution that sets

aside the land and designates it as sacred land to be used

___________________________________________

exclusively for religious purposes.

Nonprofit mental health center.

Tribal park or recreational facility – Submit copy of tribal

resolution designating the property as a park or a recreational

Veteran’s clubhouse – Refer to

15-6-203, MCA

for additional

facility that is open to the general public.

documentation needed.

,

Other – Refer to

Title 15, Chapter 6, Part 2, MCA

for list of

exemption types.

___________________________________________

AB-30R (Rev 11 15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2