Instructions For Form 588 Draft - Nonresident Withholding Waiver Request - 2017

ADVERTISEMENT

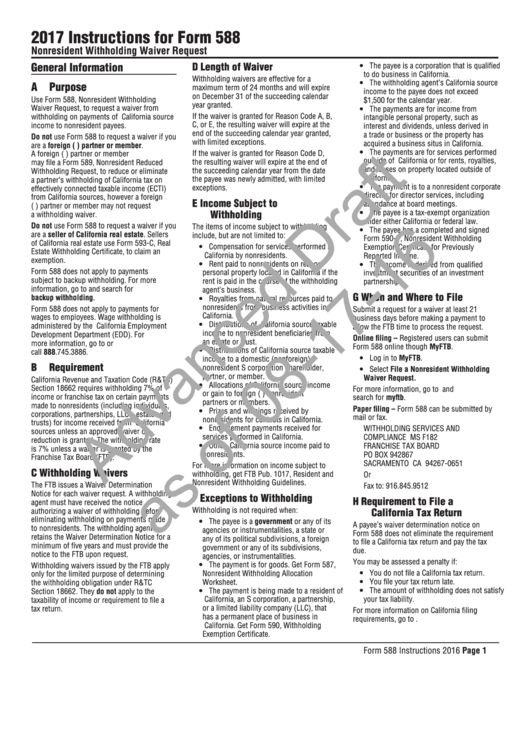

2017 Instructions for Form 588

Nonresident Withholding Waiver Request

General Information

D

Length of Waiver

y The payee is a corporation that is qualified

to do business in California.

Withholding waivers are effective for a

y The withholding agent’s California source

A

Purpose

maximum term of 24 months and will expire

income to the payee does not exceed

on December 31 of the succeeding calendar

Use Form 588, Nonresident Withholding

$1,500 for the calendar year.

year granted.

Waiver Request, to request a waiver from

y The payments are for income from

If the waiver is granted for Reason Code A, B,

withholding on payments of California source

intangible personal property, such as

C, or E, the resulting waiver will expire at the

income to nonresident payees.

interest and dividends, unless derived in

end of the succeeding calendar year granted,

a trade or business or the property has

Do not use Form 588 to request a waiver if you

with limited exceptions.

acquired a business situs in California.

are a foreign (non-U.S.) partner or member.

y The payments are for services performed

If the waiver is granted for Reason Code D,

A foreign (non-U.S.) partner or member

outside of California or for rents, royalties,

the resulting waiver will expire at the end of

may file a Form 589, Nonresident Reduced

and leases on property located outside of

the succeeding calendar year from the date

Withholding Request, to reduce or eliminate

California.

the payee was newly admitted, with limited

a partner’s withholding of California tax on

y The payment is to a nonresident corporate

exceptions.

effectively connected taxable income (ECTI)

director for director services, including

from California sources, however a foreign

E

Income Subject to

attendance at board meetings.

(non-U.S.) partner or member may not request

Withholding

y The payee is a tax-exempt organization

a withholding waiver.

under either California or federal law.

Do not use Form 588 to request a waiver if you

The items of income subject to withholding

y The payee has a completed and signed

are a seller of California real estate. Sellers

include, but are not limited to:

Form 590-P, Nonresident Withholding

of California real estate use Form 593-C, Real

y Compensation for services performed in

Exemption Certificate for Previously

Estate Withholding Certificate, to claim an

California by nonresidents.

Reported Income.

exemption.

y Rent paid to nonresidents on real or

y The income is derived from qualified

Form 588 does not apply to payments

personal property located in California if the

investment securities of an investment

subject to backup withholding. For more

rent is paid in the course of the withholding

partnership.

information, go to ftb.ca.gov and search for

agent’s business.

G

When and Where to File

backup withholding.

y Royalties from natural resources paid to

nonresidents from business activities in

Form 588 does not apply to payments for

Submit a request for a waiver at least 21

California.

wages to employees. Wage withholding is

business days before making a payment to

y Distributions of California source taxable

administered by the California Employment

allow the FTB time to process the request.

income to nonresident beneficiaries from

Development Department (EDD). For

Online filing – Registered users can submit

an estate or trust.

more information, go to edd.ca.gov or

Form 588 online though MyFTB.

y Distributions of California source taxable

call 888.745.3886.

y Log in to MyFTB.

income to a domestic (nonforeign)

B

Requirement

nonresident S corporation shareholder,

y Select File a Nonresident Withholding

partner, or member.

Waiver Request.

California Revenue and Taxation Code (R&TC)

y Allocations of California source income

Section 18662 requires withholding 7% of

For more information, go to ftb.ca.gov and

or gain to foreign (non-U.S.) nonresident

income or franchise tax on certain payments

search for myftb.

partners or members.

made to nonresidents (including individuals,

Paper filing – Form 588 can be submitted by

y Prizes and winnings received by

corporations, partnerships, LLCs, estates and

mail or fax.

nonresidents for contests in California.

trusts) for income received from California

y Endorsement payments received for

WITHHOLDING SERVICES AND

sources unless an approved waiver or

services performed in California.

COMPLIANCE MS F182

reduction is granted. The withholding rate

y Other California source income paid to

FRANCHISE TAX BOARD

is 7% unless a waiver is granted by the

nonresidents.

PO BOX 942867

Franchise Tax Board (FTB).

SACRAMENTO CA 94267-0651

For more information on income subject to

C

Withholding Waivers

withholding, get FTB Pub. 1017, Resident and

Or

Nonresident Withholding Guidelines.

The FTB issues a Waiver Determination

Fax to: 916.845.9512

Notice for each waiver request. A withholding

F

Exceptions to Withholding

H

Requirement to File a

agent must have received the notice

Withholding is not required when:

authorizing a waiver of withholding before

California Tax Return

eliminating withholding on payments made

y The payee is a government or any of its

A payee’s waiver determination notice on

to nonresidents. The withholding agent

agencies or instrumentalities, a state or

Form 588 does not eliminate the requirement

retains the Waiver Determination Notice for a

any of its political subdivisions, a foreign

to file a California tax return and pay the tax

minimum of five years and must provide the

government or any of its subdivisions,

due.

notice to the FTB upon request.

agencies, or instrumentalities.

You may be assessed a penalty if:

y The payment is for goods. Get Form 587,

Withholding waivers issued by the FTB apply

y You do not file a California tax return.

Nonresident Withholding Allocation

only for the limited purpose of determining

y You file your tax return late.

Worksheet.

the withholding obligation under R&TC

y The payment is being made to a resident of

y The amount of withholding does not satisfy

Section 18662. They do not apply to the

your tax liability.

California, an S corporation, a partnership,

taxability of income or requirement to file a

or a limited liability company (LLC), that

tax return.

For more information on California filing

has a permanent place of business in

requirements, go to ftb.ca.gov.

California. Get Form 590, Withholding

Exemption Certificate.

Form 588 Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2