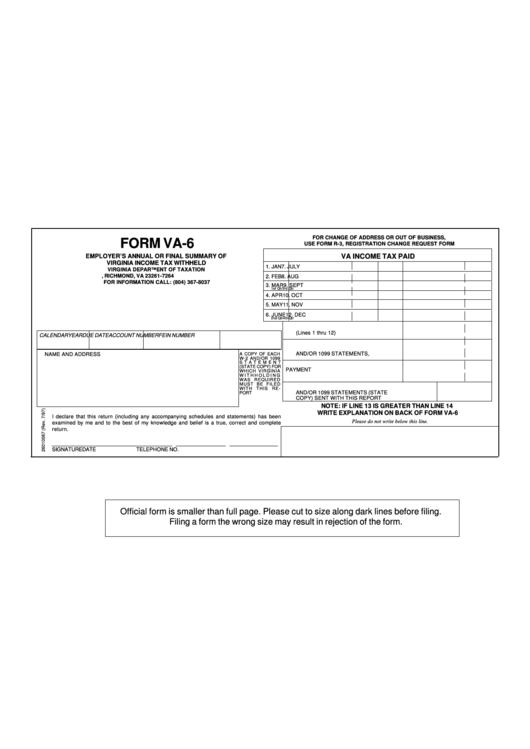

Form Va-6 Employer'S Annual Or Final Summary Of Virginia Income Tax Withheld

ADVERTISEMENT

FOR CHANGE OF ADDRESS OR OUT OF BUSINESS,

FORM VA-6

USE FORM R-3, REGISTRATION CHANGE REQUEST FORM

VA INCOME TAX PAID

EMPLOYER’S ANNUAL OR FINAL SUMMARY OF

VIRGINIA INCOME TAX WITHHELD

1. JAN

7. JULY

VIRGINIA DEPAR TMENT OF TAXATION

P.O. BOX 27264, RICHMOND, VA 23261-7264

2. FEB

8. AUG

FOR INFORMATION CALL: (804) 367-8037

3. MAR

9. SEPT

1st Qtr

3rd Qtr

4. APR

10. OCT

5. MAY

11. NOV

6. JUNE

12. DEC

2nd Qtr

4th Qtr

13. TOTAL PAYMENTS

(Lines 1 thru 12)

CALENDAR YEAR

DUE DATE

ACCOUNT NUMBER

FEIN NUMBER

14. TOTAL VA TAX WITHHELD ON W-2

AND/OR 1099 STATEMENTS, i.e. 1099R

A COPY OF EACH

NAME AND ADDRESS

W-2 AND/OR 1099

S T A T E M E N T

(STATE COPY) FOR

15. ADDITIONAL PAYMENT

WHICH VIRGINIA

W I T H H O L D I N G

WAS REQUIRED

MUST BE FILED

16. ENTER THE TOTAL NUMBER OF W-2

WITH THIS RE-

AND/OR 1099 STATEMENTS (STATE

PORT

COPY) SENT WITH THIS REPORT

NOTE: IF LINE 13 IS GREATER THAN LINE 14

WRITE EXPLANATION ON BACK OF FORM VA-6

I declare that this return (including any accompanying schedules and statements) has been

Please do not write below this line.

examined by me and to the best of my knowledge and belief is a true, correct and complete

return.

SIGNATURE

DATE

TELEPHONE NO.

Official form is smaller than full page. Please cut to size along dark lines before filing.

Filing a form the wrong size may result in rejection of the form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1