Form W4 - Employee Withholding Allowance Certificate - Pennsylvania State University

ADVERTISEMENT

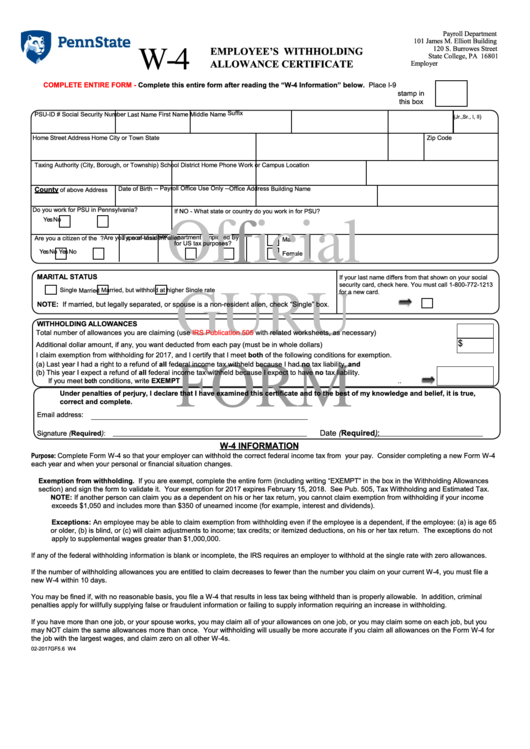

Payroll Department

101 James M. Elliott Building

W-4

120 S. Burrowes Street

EMPLOYEE’S WITHHOLDING

State College, PA 16801

ALLOWANCE CERTIFICATE

Employer I.D. No. 24-6000376

COMPLETE ENTIRE FORM -

Complete this entire form after reading the “W-4 Information” below.

Place I-9

stamp in

this box

Suffix

PSU-ID #

Social Security Number

First Name

Middle Name

Last Name

(Jr.,Sr., I, II)

Home Street Address

Home City or Town

State

Zip Code

Taxing Authority (City, Borough, or Township)

School District

Home Phone

Work or Campus Location

County

-- Payroll Office Use Only --

Date of Birth

Office Address

Building Name

of above Address

Do you work for PSU in Pennsylvania?

If NO - What state or country do you work in for PSU?

Yes

No

Of

icial

f

Sex

Department Employed By

Type of Visa

Are you a non-resident alien

Are you a citizen of the U.S.?

Male

for US tax purposes?

Yes

No

Yes

No

Female

GURU

MARITAL STATUS

If your last name differs from that shown on your social

security card, check here. You must call 1-800-772-1213

Single

Married, but withhold at higher Single rate

Married

for a new card.

NOTE: If married, but legally separated, or spouse is a non-resident alien, check “Single” box.

WITHHOLDING ALLOWANCES

Total number of allowances you are claiming (use

IRS Publication 505

with related worksheets, as necessary)

$

Additional dollar amount, if any, you want deducted from each pay (must be in whole dollars)

FORM

I claim exemption from withholding for 2017, and I certify that I meet both of the following conditions for exemption.

(a) Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and

(b) This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.

If you meet both conditions, write EXEMPT here..........................................................................................................

..

..........

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true,

correct and complete.

Email address:

Date (Required):

Signature (Required):

W-4 INFORMATION

Purpose: Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4

each year and when your personal or financial situation changes.

Exemption from withholding. If you are exempt, complete the entire form (including writing “EXEMPT” in the box in the Withholding Allowances

section) and sign the form to validate it. Your exemption for 2017 expires February 15, 2018. See Pub. 505, Tax Withholding and Estimated Tax.

NOTE: If another person can claim you as a dependent on his or her tax return, you cannot claim exemption from withholding if your income

exceeds $1,050 and includes more than $350 of unearned income (for example, interest and dividends).

Exceptions: An employee may be able to claim exemption from withholding even if the employee is a dependent, if the employee: (a) is age 65

or older, (b) is blind, or (c) will claim adjustments to income; tax credits; or itemized deductions, on his or her tax return. The exceptions do not

apply to supplemental wages greater than $1,000,000.

If any of the federal withholding information is blank or incomplete, the IRS requires an employer to withhold at the single rate with zero allowances.

If the number of withholding allowances you are entitled to claim decreases to fewer than the number you claim on your current W-4, you must file a

new W-4 within 10 days.

You may be fined if, with no reasonable basis, you file a W-4 that results in less tax being withheld than is properly allowable. In addition, criminal

penalties apply for willfully supplying false or fraudulent information or failing to supply information requiring an increase in withholding.

If you have more than one job, or your spouse works, you may claim all of your allowances on one job, or you may claim some on each job, but you

may NOT claim the same allowances more than once. Your withholding will usually be more accurate if you claim all allowances on the Form W-4 for

the job with the largest wages, and claim zero on all other W-4s.

02-2017

GF5.6 W4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1