Amended Annual Withholding Reconciliation Nc-3x

ADVERTISEMENT

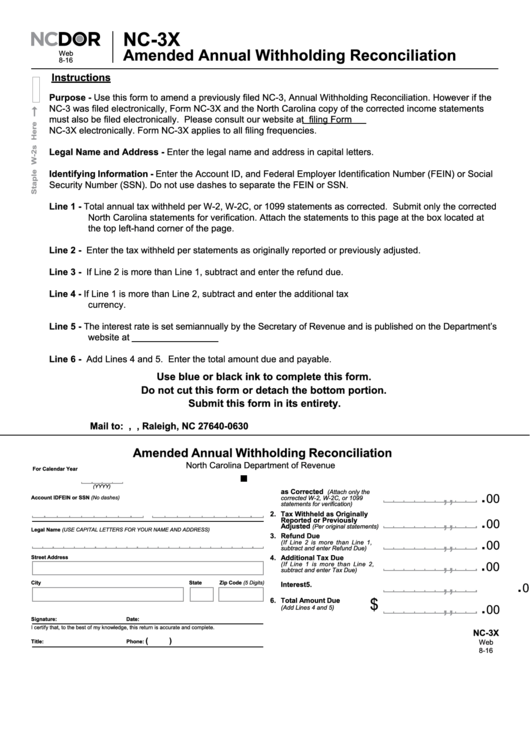

NC-3X

Amended Annual Withholding Reconciliation

Web

8-16

Instructions

Purpose - Use this form to amend a previously filed NC-3, Annual Withholding Reconciliation. However if the

NC-3 was filed electronically, Form NC-3X and the North Carolina copy of the corrected income statements

must also be filed electronically. Please consult our website at for information on filing Form

NC-3X electronically. Form NC-3X applies to all filing frequencies.

Legal Name and Address - Enter the legal name and address in capital letters.

Identifying Information - Enter the Account ID, and Federal Employer Identification Number (FEIN) or Social

Security Number (SSN). Do not use dashes to separate the FEIN or SSN.

Line 1 - Total annual tax withheld per W-2, W-2C, or 1099 statements as corrected. Submit only the corrected

North Carolina statements for verification. Attach the statements to this page at the box located at

the top left-hand corner of the page.

Line 2 - Enter the tax withheld per statements as originally reported or previously adjusted.

Line 3 - If Line 2 is more than Line 1, subtract and enter the refund due.

Line 4 - If Line 1 is more than Line 2, subtract and enter the additional tax due. Make check payable in U.S.

currency.

Line 5 - The interest rate is set semiannually by the Secretary of Revenue and is published on the Department’s

website at

Line 6 - Add Lines 4 and 5. Enter the total amount due and payable.

Use blue or black ink to complete this form.

Do not cut this form or detach the bottom portion.

Submit this form in its entirety.

Mail to: N.C. Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0630

Amended Annual Withholding Reconciliation

North Carolina Department of Revenue

For Calendar Year

1. Total Annual Tax Withheld

,

,

.

(YYYY)

as Corrected

(Attach only the

00

corrected W-2, W-2C, or 1099

Account ID

FEIN or SSN (No dashes)

statements for verification)

,

,

.

2.

Tax Withheld as Originally

Reported or Previously

00

Adjusted

(Per original statements)

Legal Name (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

,

,

.

3.

Refund Due

00

(If Line 2 is more than Line 1,

subtract and enter Refund Due)

,

,

.

4.

Additional Tax Due

Street Address

00

(If Line 1 is more than Line 2,

subtract and enter Tax Due)

,

,

.

City

State

Zip Code (5 Digits)

5.

Interest

00

,

,

.

$

6.

Total Amount Due

00

(Add Lines 4 and 5)

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

NC-3X

(

)

Title:

Phone:

Web

8-16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1