Employment Verification

ADVERTISEMENT

Family Services

2536 Countryside Blvd., Suite 500

Clearwater, FL 33763

(727) 400-4411

Fax: (727) 400-4486

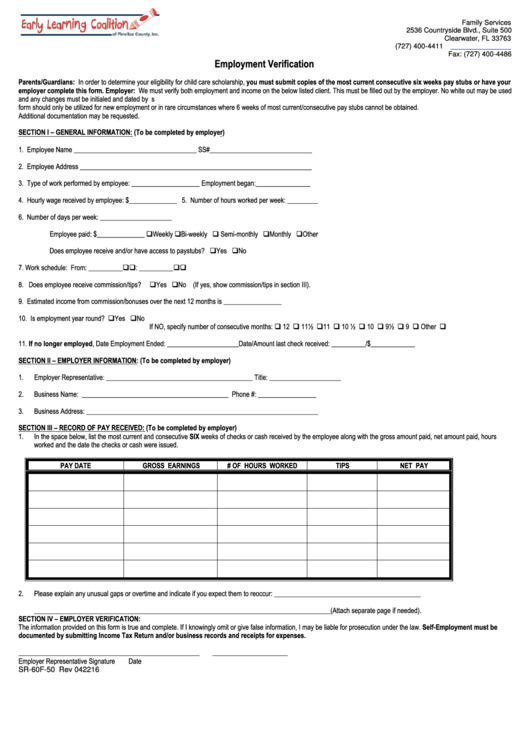

Employment Verification

Parents/Guardians: In order to determine your eligibility for child care scholarship, you must submit copies of the most current consecutive six weeks pay stubs or have your

employer complete this form. Employer: We must verify both employment and income on the below listed client. This must be filled out by the employer. No white out may be used

and any changes must be initialed and dated by employer. Please understand that the ELC will contact and/or visit your employer to verify the information presented on this form. This

form should only be utilized for new employment or in rare circumstances where 6 weeks of most current/consecutive pay stubs cannot be obtained.

Additional documentation may be requested.

SECTION I – GENERAL INFORMATION: (To be completed by employer)

1. Employee Name ____________________________________ SS#______________________________

2. Employee Address ____________________________________________________________________

3. Type of work performed by employee: ____________________ Employment began:________________

4. Hourly wage received by employee: $______________ 5. Number of hours worked per week: _________

6. Number of days per week: _____________________

Employee paid: $______________ Weekly Bi-weekly Semi-monthly Monthly Other

Does employee receive and/or have access to paystubs? Yes No

7. Work schedule: From: __________ A.M. P.M.

To: __________ A.M. P.M.

8. Does employee receive commission/tips?

Yes No (If yes, show commission/tips in section III).

9. Estimated income from commission/bonuses over the next 12 months is _________________

10. Is employment year round? Yes No

If NO, specify number of consecutive months: 12 11½ 11 10 ½ 10 9½ 9 Other

11. If no longer employed, Date Employment Ended: _____________________Date/Amount last check received: __________/$_____________

SECTION II – EMPLOYER INFORMATION: (To be completed by employer)

1.

Employer Representative: ___________________________________________ Title: _____________________

2.

Business Name: ___________________________________________ Phone #: _________________

3.

Business Address: ____________________________________________________________________

SECTION III – RECORD OF PAY RECEIVED: (To be completed by employer)

1.

In the space below, list the most current and consecutive SIX weeks of checks or cash received by the employee along with the gross amount paid, net amount paid, hours

worked and the date the checks or cash were issued.

PAY DATE

GROSS EARNINGS

# OF HOURS WORKED

TIPS

NET PAY

2.

Please explain any unusual gaps or overtime and indicate if you expect them to reoccur: ___________________________________________

_______________________________________________________________________________________(Attach separate page if needed).

SECTION IV – EMPLOYER VERIFICATION:

The information provided on this form is true and complete. If I knowingly omit or give false information, I may be liable for prosecution under the law. Self-Employment must be

documented by submitting Income Tax Return and/or business records and receipts for expenses.

________________________________________________

____________________

Employer Representative Signature

Date

SR-60F-50 Rev 042216

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1