Withholding Tax Formula - 2016

ADVERTISEMENT

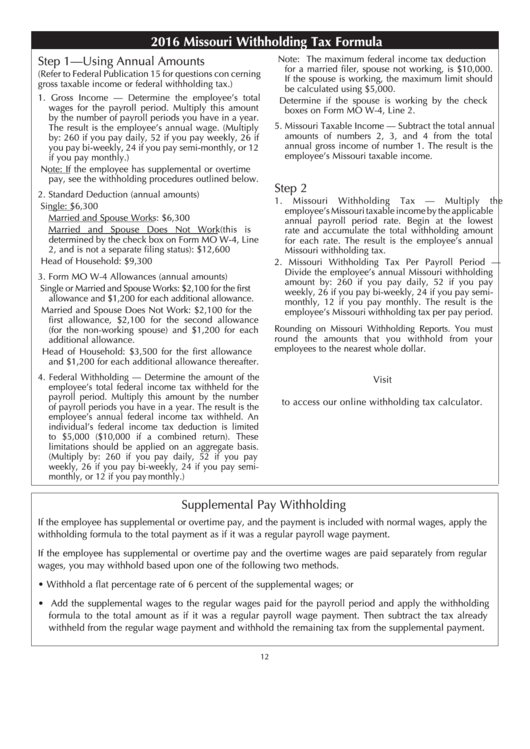

2016 Missouri Withholding Tax Formula

Step 1—Using Annual Amounts

Note: The maximum federal income tax deduction

for a married filer, spouse not working, is $10,000.

(Refer to Federal Publication 15 for questions con cerning

If the spouse is working, the maximum limit should

gross taxable income or federal withholding tax.)

be calculated using $5,000.

1. Gross Income — Determine the employee’s total

Determine if the spouse is working by the check

wages for the payroll period. Multiply this amount

boxes on Form MO W‑4, Line 2.

by the number of payroll periods you have in a year.

5. Missouri Taxable Income — Subtract the total annual

The result is the employee’s annual wage. (Multiply

amounts of numbers 2, 3, and 4 from the total

by: 260 if you pay daily, 52 if you pay weekly, 26 if

annual gross income of number 1. The result is the

you pay bi‑weekly, 24 if you pay semi‑monthly, or 12

employee’s Missouri taxable income.

if you pay monthly.)

Note: If the employee has supplemental or overtime

pay, see the withholding procedures outlined below.

Step 2

2. Standard Deduction (annual amounts)

1. Missouri

Withholding

Tax

—

Multiply

the

Single: $6,300

employee’s Missouri taxable income by the applicable

Married and Spouse Works: $6,300

annual payroll period rate. Begin at the lowest

Married and Spouse Does Not Work (this is

rate and accumulate the total withholding amount

determined by the check box on Form MO W‑4, Line

for each rate. The result is the employee’s annual

2, and is not a separate filing status): $12,600

Missouri withholding tax.

Head of Household: $9,300

2. Missouri Withholding Tax Per Payroll Period —

Divide the employee’s annual Missouri withholding

3. Form MO W‑4 Allowances (annual amounts)

amount by: 260 if you pay daily, 52 if you pay

Single or Married and Spouse Works: $2,100 for the first

weekly, 26 if you pay bi‑weekly, 24 if you pay semi‑

allowance and $1,200 for each additional allowance.

monthly, 12 if you pay monthly. The result is the

Married and Spouse Does Not Work: $2,100 for the

employee’s Missouri withholding tax per pay period.

first allowance, $2,100 for the second allowance

Rounding on Missouri Withholding Reports. You must

(for the non‑working spouse) and $1,200 for each

round the amounts that you withhold from your

additional allowance.

employees to the nearest whole dollar.

Head of Household: $3,500 for the first allowance

and $1,200 for each additional allowance thereafter.

4. Federal Withholding — Determine the amount of the

Visit

employee’s total federal income tax withheld for the

payroll period. Multiply this amount by the number

to access our online withholding tax calculator.

of payroll periods you have in a year. The result is the

employee’s annual federal income tax withheld. An

individual’s federal income tax deduction is limited

to $5,000 ($10,000 if a combined return). These

limitations should be applied on an aggregate basis.

(Multiply by: 260 if you pay daily, 52 if you pay

weekly, 26 if you pay bi‑weekly, 24 if you pay semi‑

monthly, or 12 if you pay monthly.)

Supplemental Pay Withholding

If the employee has supplemental or overtime pay, and the payment is included with normal wages, apply the

withholding formula to the total payment as if it was a regular payroll wage payment.

If the employee has supplemental or overtime pay and the overtime wages are paid separately from regular

wages, you may withhold based upon one of the following two methods.

• Withhold a flat percentage rate of 6 percent of the supplemental wages; or

• Add the supplemental wages to the regular wages paid for the payroll period and apply the withholding

formula to the total amount as if it was a regular payroll wage payment. Then subtract the tax already

withheld from the regular wage payment and withhold the remaining tax from the supplemental payment.

12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2