Vsw Data Collection Form

ADVERTISEMENT

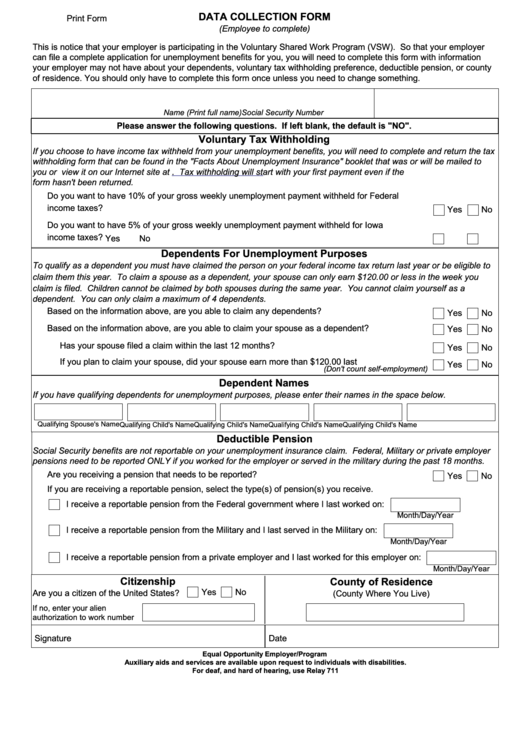

DATA COLLECTION FORM

Print Form

(Employee to complete)

This is notice that your employer is participating in the Voluntary Shared Work Program (VSW). So that your employer

can file a complete application for unemployment benefits for you, you will need to complete this form with information

your employer may not have about your dependents, voluntary tax withholding preference, deductible pension, or county

of residence. You should only have to complete this form once unless you need to change something.

Name (Print full name)

Social Security Number

Please answer the following questions. If left blank, the default is "NO".

Voluntary Tax Withholding

If you choose to have income tax withheld from your unemployment benefits, you will need to complete and return the tax

withholding form that can be found in the "Facts About Unemployment Insurance" booklet that was or will be mailed to

you or view it on our Internet site at Tax withholding will start with your first payment even if the

form hasn't been returned.

Do you want to have 10% of your gross weekly unemployment payment withheld for Federal

income taxes?........................................................................................................................................

Yes

No

Do you want to have 5% of your gross weekly unemployment payment withheld for Iowa

income taxes?........................................................................................................................................

Yes

No

Dependents For Unemployment Purposes

To qualify as a dependent you must have claimed the person on your federal income tax return last year or be eligible to

claim them this year. To claim a spouse as a dependent, your spouse can only earn $120.00 or less in the week you

claim is filed. Children cannot be claimed by both spouses during the same year. You cannot claim yourself as a

dependent. You can only claim a maximum of 4 dependents.

Based on the information above, are you able to claim any dependents?............................................

Yes

No

Based on the information above, are you able to claim your spouse as a dependent?........................

Yes

No

Has your spouse filed a claim within the last 12 months?................................................................

Yes

No

If you plan to claim your spouse, did your spouse earn more than $120.00 last week....................

Yes

No

(Don't count self-employment)

Dependent Names

If you have qualifying dependents for unemployment purposes, please enter their names in the space below.

Qualifying Spouse's Name

Qualifying Child's Name

Qualifying Child's Name

Qualifying Child's Name

Qualifying Child's Name

Deductible Pension

Social Security benefits are not reportable on your unemployment insurance claim. Federal, Military or private employer

pensions need to be reported ONLY if you worked for the employer or served in the military during the past 18 months.

Are you receiving a pension that needs to be reported?.......................................................................

Yes

No

If you are receiving a reportable pension, select the type(s) of pension(s) you receive.

I receive a reportable pension from the Federal government where I last worked on:

Month/Day/Year

I receive a reportable pension from the Military and I last served in the Military on:

Month/Day/Year

I receive a reportable pension from a private employer and I last worked for this employer on:

Month/Day/Year

Citizenship

County of Residence

Yes

No

Are you a citizen of the United States?

(County Where You Live)

If no, enter your alien

authorization to work number

Signature

Date

Equal Opportunity Employer/Program

Auxiliary aids and services are available upon request to individuals with disabilities.

For deaf, and hard of hearing, use Relay 711

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1