Do not write in this area.

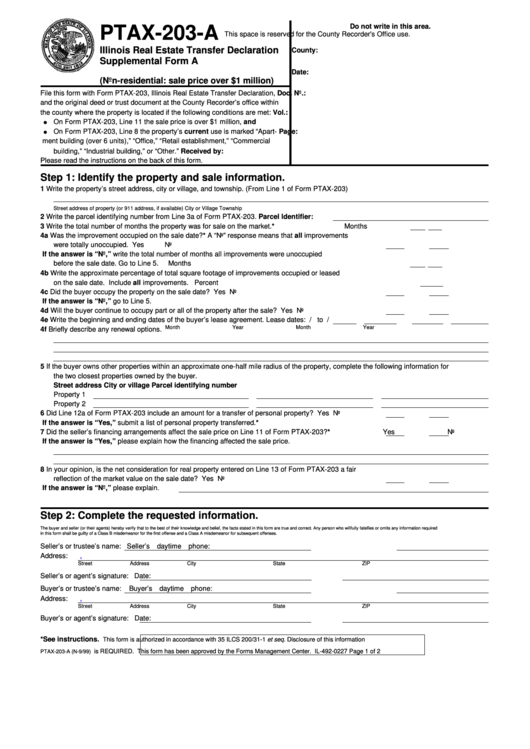

PTAX-203-A

This space is reserved for the County Recorder's Office use.

Illinois Real Estate Transfer Declaration

County:

Supplemental Form A

Date:

(Non-residential: sale price over $1 million)

File this form with Form PTAX-203, Illinois Real Estate Transfer Declaration,

Doc. No.:

and the original deed or trust document at the County Recorder’s office within

the county where the property is located if the following conditions are met:

Vol.:

On Form PTAX-203, Line 11 the sale price is over $1 million, and

On Form PTAX-203, Line 8 the property’s current use is marked “Apart-

Page:

ment building (over 6 units),” “Office,” “Retail establishment,” “Commercial

building,” “Industrial building,” or “Other.”

Received by:

Please read the instructions on the back of this form.

Step 1: Identify the property and sale information.

1

Write the property’s street address, city or village, and township. (From Line 1 of Form PTAX-203)

Street address of property (or 911 address, if available)

City or Village

Township

2

Write the parcel identifying number from Line 3a of Form PTAX-203.

Parcel Identifier:

3

Write the total number of months the property was for sale on the market.*

Months

4a Was the improvement occupied on the sale date?* A “No” response means that all improvements

were totally unoccupied.

Yes

No

If the answer is “No,” write the total number of months all improvements were unoccupied

before the sale date. Go to Line 5.

Months

4b Write the approximate percentage of total square footage of improvements occupied or leased

on the sale date. Include all improvements.

Percent

4c Did the buyer occupy the property on the sale date?

Yes

No

If the answer is “No,” go to Line 5.

4d Will the buyer continue to occupy part or all of the property after the sale?

Yes

No

4e Write the beginning and ending dates of the buyer’s lease agreement.

Lease dates:

/

to

/

Month

Year

Month

Year

4f Briefly describe any renewal options.

5

If the buyer owns other properties within an approximate one-half mile radius of the property, complete the following information for

the two closest properties owned by the buyer.

Street address

City or village

Parcel identifying number

Property 1

Property 2

6

Did Line 12a of Form PTAX-203 include an amount for a transfer of personal property?

Yes

No

If the answer is “Yes,” submit a list of personal property transferred.*

7

Did the seller’s financing arrangements affect the sale price on Line 11 of Form PTAX-203?*

Yes

No

If the answer is “Yes,” please explain how the financing affected the sale price.

8

In your opinion, is the net consideration for real property entered on Line 13 of Form PTAX-203 a fair

reflection of the market value on the sale date?

Yes

No

If the answer is “No,” please explain.

Step 2: Complete the requested information.

The buyer and seller (or their agents) hereby verify that to the best of their knowledge and belief, the facts stated in this form are true and correct. Any person who willfully falsifies or omits any information required

in this form shall be guilty of a Class B misdemeanor for the first offense and a Class A misdemeanor for subsequent offenses.

Seller’s or trustee’s name:

Seller’s daytime phone:

Address:

,

Street Address

City

State

ZIP

Seller’s or agent’s signature:

Date:

Buyer’s or trustee’s name:

Buyer’s daytime phone:

Address:

,

Street Address

City

State

ZIP

Buyer’s or agent’s signature:

Date:

*See instructions.

This form is authorized in accordance with 35 ILCS 200/31-1 et seq. Disclosure of this information

is REQUIRED. This form has been approved by the Forms Management Center. IL-492-0227

Page 1 of 2

PTAX-203-A (N-9/99)

1

1 2

2