Certificate Of Exemption

ADVERTISEMENT

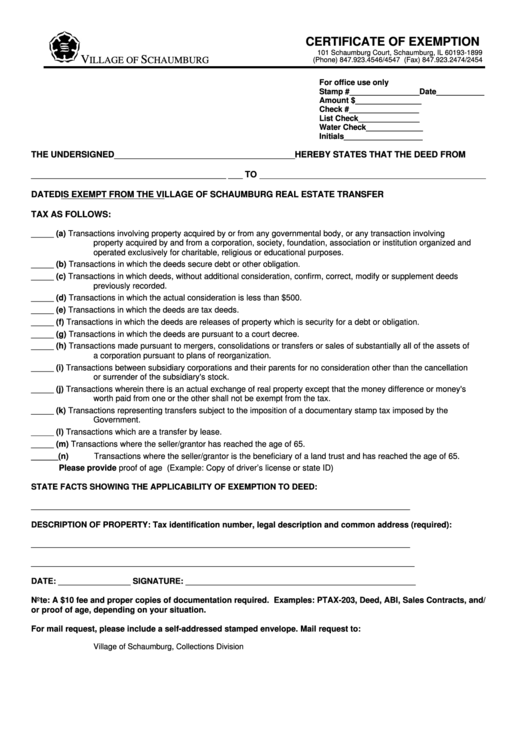

CERTIFICATE OF EXEMPTION

101 Schaumburg Court, Schaumburg, IL 60193-1899

V

S

ILLAGE OF

CHAUMBURG

(Phone) 847.923.4546/4547 (Fax) 847.923.2474/2454

For office use only

Stamp #________________Date___________

Amount $_______________

Check #________________

List Check______________

Water Check_____________

Initials__________________

THE UNDERSIGNED______________________________________HEREBY STATES THAT THE DEED FROM

_________________________________________ ___ TO

DATED

IS EXEMPT FROM THE VILLAGE OF SCHAUMBURG REAL ESTATE TRANSFER

TAX AS FOLLOWS:

_____ (a)

Transactions involving property acquired by or from any governmental body, or any transaction involving

property acquired by and from a corporation, society, foundation, association or institution organized and

operated exclusively for charitable, religious or educational purposes.

_____ (b)

Transactions in which the deeds secure debt or other obligation.

_____ (c)

Transactions in which deeds, without additional consideration, confirm, correct, modify or supplement deeds

previously recorded.

_____ (d)

Transactions in which the actual consideration is less than $500.

_____ (e)

Transactions in which the deeds are tax deeds.

_____ (f)

Transactions in which the deeds are releases of property which is security for a debt or obligation.

_____ (g)

Transactions in which the deeds are pursuant to a court decree.

_____ (h)

Transactions made pursuant to mergers, consolidations or transfers or sales of substantially all of the assets of

a corporation pursuant to plans of reorganization.

_____ (i)

Transactions between subsidiary corporations and their parents for no consideration other than the cancellation

or surrender of the subsidiary's stock.

_____ (j)

Transactions wherein there is an actual exchange of real property except that the money difference or money's

worth paid from one or the other shall not be exempt from the tax.

_____ (k)

Transactions representing transfers subject to the imposition of a documentary stamp tax imposed by the U.S.

Government.

_____ (l)

Transactions which are a transfer by lease.

_____ (m)

Transactions where the seller/grantor has reached the age of 65.

______(n)

Transactions where the seller/grantor is the beneficiary of a land trust and has reached the age of 65.

Please provide proof of age (Example: Copy of driver’s license or state ID)

STATE FACTS SHOWING THE APPLICABILITY OF EXEMPTION TO DEED:

____________________________________________________________________________________

DESCRIPTION OF PROPERTY: Tax identification number, legal description and common address (required):

____________________________________________________________________________________

_____________________________________________________________________________________

DATE: ________________ SIGNATURE: ___________________________________________________

Note: A $10 fee and proper copies of documentation required. Examples: PTAX-203, Deed, ABI, Sales Contracts, and/

or proof of age, depending on your situation.

For mail request, please include a self-addressed stamped envelope. Mail request to:

Village of Schaumburg, Collections Division

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2