Form St-100-I, 12/15, Instructions For Form St-100

ADVERTISEMENT

ST-100-I (12/15)

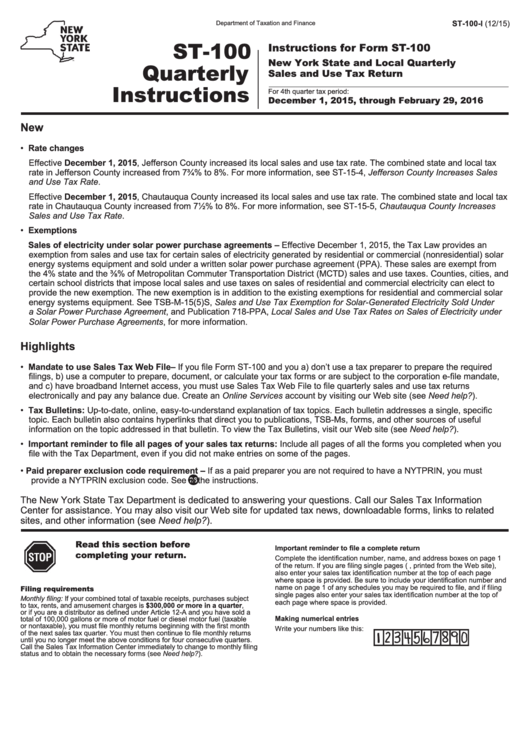

Department of Taxation and Finance

ST-100

Instructions for Form ST-100

New York State and Local Quarterly

Quarterly

Sales and Use Tax Return

Instructions

For 4th quarter tax period:

December 1, 2015, through February 29, 2016

New

• Rate changes

Effective December 1, 2015, Jefferson County increased its local sales and use tax rate. The combined state and local tax

rate in Jefferson County increased from 7¾% to 8%. For more information, see ST-15-4, Jefferson County Increases Sales

and Use Tax Rate.

Effective December 1, 2015, Chautauqua County increased its local sales and use tax rate. The combined state and local tax

rate in Chautauqua County increased from 7½% to 8%. For more information, see ST-15-5, Chautauqua County Increases

Sales and Use Tax Rate.

• Exemptions

Sales of electricity under solar power purchase agreements – Effective December 1, 2015, the Tax Law provides an

exemption from sales and use tax for certain sales of electricity generated by residential or commercial (nonresidential) solar

energy systems equipment and sold under a written solar power purchase agreement (PPA). These sales are exempt from

the 4% state and the ⅜% of Metropolitan Commuter Transportation District (MCTD) sales and use taxes. Counties, cities, and

certain school districts that impose local sales and use taxes on sales of residential and commercial electricity can elect to

provide the new exemption. The new exemption is in addition to the existing exemptions for residential and commercial solar

energy systems equipment. See TSB-M-15(5)S, Sales and Use Tax Exemption for Solar-Generated Electricity Sold Under

a Solar Power Purchase Agreement, and Publication 718-PPA, Local Sales and Use Tax Rates on Sales of Electricity under

Solar Power Purchase Agreements, for more information.

Highlights

• Mandate to use Sales Tax Web File – If you file Form ST-100 and you a) don’t use a tax preparer to prepare the required

filings, b) use a computer to prepare, document, or calculate your tax forms or are subject to the corporation e-file mandate,

and c) have broadband Internet access, you must use Sales Tax Web File to file quarterly sales and use tax returns

electronically and pay any balance due. Create an Online Services account by visiting our Web site (see Need help?).

• Tax Bulletins: Up-to-date, online, easy-to-understand explanation of tax topics. Each bulletin addresses a single, specific

topic. Each bulletin also contains hyperlinks that direct you to publications, TSB-Ms, forms, and other sources of useful

information on the topic addressed in that bulletin. To view the Tax Bulletins, visit our Web site (see Need help?).

• Important reminder to file all pages of your sales tax returns: Include all pages of all the forms you completed when you

file with the Tax Department, even if you did not make entries on some of the pages.

• Paid preparer exclusion code requirement – If as a paid preparer you are not required to have a NYTPRIN, you must

provide a NYTPRIN exclusion code. See

in the instructions.

The New York State Tax Department is dedicated to answering your questions. Call our Sales Tax Information

Center for assistance. You may also visit our Web site for updated tax news, downloadable forms, links to related

sites, and other information (see Need help?).

Read this section before

Important reminder to file a complete return

completing your return.

Complete the identification number, name, and address boxes on page 1

of the return. If you are filing single pages (e.g., printed from the Web site),

also enter your sales tax identification number at the top of each page

where space is provided. Be sure to include your identification number and

name on page 1 of any schedules you may be required to file, and if filing

Filing requirements

single pages also enter your sales tax identification number at the top of

Monthly filing: If your combined total of taxable receipts, purchases subject

each page where space is provided.

to tax, rents, and amusement charges is $300,000 or more in a quarter,

or if you are a distributor as defined under Article 12-A and you have sold a

Making numerical entries

total of 100,000 gallons or more of motor fuel or diesel motor fuel (taxable

or nontaxable), you must file monthly returns beginning with the first month

Write your numbers like this:

of the next sales tax quarter. You must then continue to file monthly returns

until you no longer meet the above conditions for four consecutive quarters.

Call the Sales Tax Information Center immediately to change to monthly filing

status and to obtain the necessary forms (see Need help?).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4