School District Income Tax Withholding Instructions With Form It 4 - Employee'S Withholding Exemption Certificate

ADVERTISEMENT

Rev. 11/14

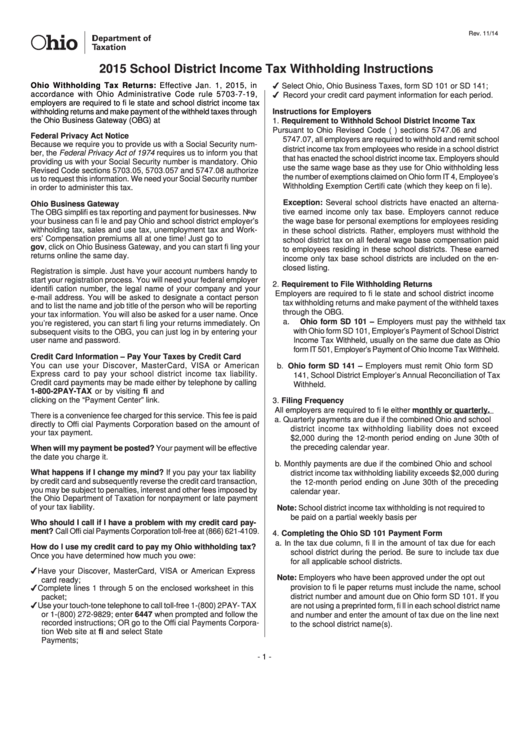

2015 School District Income Tax Withholding Instructions

Ohio Withholding Tax Returns: Effective Jan. 1, 2015, in

Select Ohio, Ohio Business Taxes, form SD 101 or SD 141;

accordance with Ohio Administrative Code rule 5703-7-19,

Record your credit card payment information for each period.

employers are required to fi le state and school district income tax

withholding returns and make payment of the withheld taxes through

Instructions for Employers

the Ohio Business Gateway (OBG) at business.ohio.gov.

1. Requirement to Withhold School District Income Tax

Pursuant to Ohio Revised Code (R.C.) sections 5747.06 and

Federal Privacy Act Notice

5747.07, all employers are required to withhold and remit school

Because we require you to provide us with a Social Security num-

district income tax from employees who reside in a school district

ber, the Federal Privacy Act of 1974 requires us to inform you that

that has enacted the school district income tax. Employers should

providing us with your Social Security number is mandatory. Ohio

use the same wage base as they use for Ohio withholding less

Revised Code sections 5703.05, 5703.057 and 5747.08 authorize

the number of exemptions claimed on Ohio form IT 4, Employee’s

us to request this information. We need your Social Security number

Withholding Exemption Certifi cate (which they keep on fi le).

in order to administer this tax.

Exception: Several school districts have enacted an alterna-

Ohio Business Gateway

tive earned income only tax base. Employers cannot reduce

The OBG simplifi es tax reporting and payment for businesses. Now

your business can fi le and pay Ohio and school district employer’s

the wage base for personal exemptions for employees residing

withholding tax, sales and use tax, unemployment tax and Work-

in these school districts. Rather, employers must withhold the

ers’ Compensation premiums all at one time! Just go to tax.ohio.

school district tax on all federal wage base compensation paid

gov, click on Ohio Business Gateway, and you can start fi ling your

to employees residing in these school districts. These earned

returns online the same day.

income only tax base school districts are included on the en-

closed listing.

Registration is simple. Just have your account numbers handy to

start your registration process. You will need your federal employer

2. Requirement to File Withholding Returns

identifi cation number, the legal name of your company and your

Employers are required to fi le state and school district income

e-mail address. You will be asked to designate a contact person

tax withholding returns and make payment of the withheld taxes

and to list the name and job title of the person who will be reporting

through the OBG.

your tax information. You will also be asked for a user name. Once

a. Ohio form SD 101 – Employers must pay the withheld tax

you’re registered, you can start fi ling your returns immediately. On

with Ohio form SD 101, Employer’s Payment of School District

subsequent visits to the OBG, you can just log in by entering your

Income Tax Withheld, usually on the same due date as Ohio

user name and password.

form IT 501, Employer’s Payment of Ohio Income Tax Withheld.

Credit Card Information – Pay Your Taxes by Credit Card

You can use your Discover, MasterCard, VISA or American

b. Ohio form SD 141 – Employers must remit Ohio form SD

Express card to pay your school district income tax liability.

141, School District Employer’s Annual Reconciliation of Tax

Credit card payments may be made either by telephone by calling

Withheld.

1-800-2PAY-TAX or by visiting and

clicking on the “Payment Center” link.

3. Filing Frequency

All employers are required to fi le either monthly or quarterly.

There is a convenience fee charged for this service. This fee is paid

a. Quarterly payments are due if the combined Ohio and school

directly to Offi cial Payments Corporation based on the amount of

district income tax withholding liability does not exceed

your tax payment.

$2,000 during the 12-month period ending on June 30th of

the preceding calendar year.

When will my payment be posted? Your payment will be effective

the date you charge it.

b. Monthly payments are due if the combined Ohio and school

What happens if I change my mind? If you pay your tax liability

district income tax withholding liability exceeds $2,000 during

by credit card and subsequently reverse the credit card transaction,

the 12-month period ending on June 30th of the preceding

you may be subject to penalties, interest and other fees imposed by

calendar year.

the Ohio Department of Taxation for nonpayment or late payment

of your tax liability.

Note: School district income tax withholding is not required to

be paid on a partial weekly basis per R.C. section 5747.07.

Who should I call if I have a problem with my credit card pay-

ment? Call Offi cial Payments Corporation toll-free at (866) 621-4109.

4. Completing the Ohio SD 101 Payment Form

a. In the tax due column, fi ll in the amount of tax due for each

How do I use my credit card to pay my Ohio withholding tax?

school district during the period. Be sure to include tax due

Once you have determined how much you owe:

for all applicable school districts.

Have your Discover, MasterCard, VISA or American Express

Note: Employers who have been approved under the opt out

card ready;

provision to fi le paper returns must include the name, school

Complete lines 1 through 5 on the enclosed worksheet in this

district number and amount due on Ohio form SD 101. If you

packet;

Use your touch-tone telephone to call toll-free 1-(800) 2PAY- TAX

are not using a preprinted form, fi ll in each school district name

or 1-(800) 272-9829; enter 6447 when prompted and follow the

and number and enter the amount of tax due on the line next

recorded instructions; OR go to the Offi cial Payments Corpora-

to the school district name(s).

tion Web site at and select State

Payments;

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4