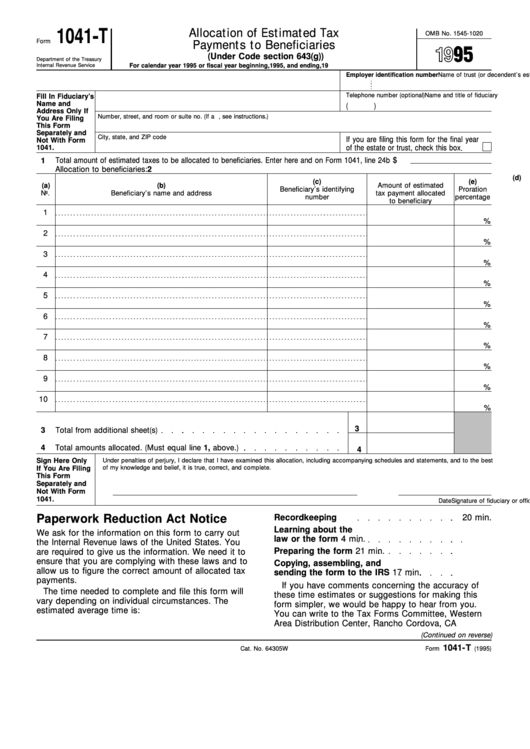

Form 1041-T - Allocation Of Estimated Tax Payments To Beneficiaries - 1995

ADVERTISEMENT

1041-T

Allocation of Estimated Tax

OMB No. 1545-1020

Form

Payments to Beneficiaries

(Under Code section 643(g))

Department of the Treasury

For calendar year 1995 or fiscal year beginning

,1995, and ending

,19

Internal Revenue Service

Name of trust (or decendent’s estate)

Employer identification number

Name and title of fiduciary

Telephone number (optional)

Fill In Fiduciary’s

Name and

(

)

Address Only If

Number, street, and room or suite no. (If a P.O. box, see instructions.)

You Are Filing

This Form

Separately and

City, state, and ZIP code

If you are filing this form for the final year

Not With Form

1041.

of the estate or trust, check this box

1

Total amount of estimated taxes to be allocated to beneficiaries. Enter here and on Form 1041, line 24b

$

2

Allocation to beneficiaries:

(d)

(c)

(e)

(a)

(b)

Amount of estimated

Beneficiary’s identifying

Proration

No.

Beneficiary’s name and address

tax payment allocated

number

percentage

to beneficiary

1

%

2

%

3

%

4

%

5

%

6

%

7

%

8

%

9

%

10

%

3

3

Total from additional sheet(s)

4

Total amounts allocated. (Must equal line 1, above.)

4

Sign Here Only

Under penalties of perjury, I declare that I have examined this allocation, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct, and complete.

If You Are Filing

This Form

Separately and

Not With Form

1041.

Signature of fiduciary or officer representing fiduciary

Date

Paperwork Reduction Act Notice

Recordkeeping

20 min.

Learning about the

We ask for the information on this form to carry out

law or the form

4 min.

the Internal Revenue laws of the United States. You

Preparing the form

21 min.

are required to give us the information. We need it to

ensure that you are complying with these laws and to

Copying, assembling, and

allow us to figure the correct amount of allocated tax

sending the form to the IRS

17 min.

payments.

If you have comments concerning the accuracy of

The time needed to complete and file this form will

these time estimates or suggestions for making this

vary depending on individual circumstances. The

form simpler, we would be happy to hear from you.

estimated average time is:

You can write to the Tax Forms Committee, Western

Area Distribution Center, Rancho Cordova, CA

(Continued on reverse)

1041-T

Cat. No. 64305W

Form

(1995)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2