Form Sdat-Rp - Petition For Review Of Real Property

ADVERTISEMENT

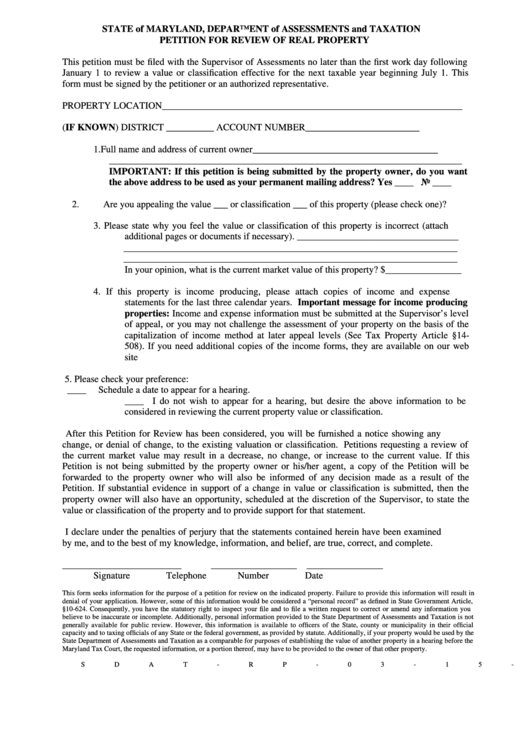

STATE of MARYLAND, DEPARTMENT of ASSESSMENTS and TAXATION

PETITION FOR REVIEW OF REAL PROPERTY

This petition must be filed with the Supervisor of Assessments no later than the first work day following

January 1 to review a value or classification effective for the next taxable year beginning July 1. This

form must be signed by the petitioner or an authorized representative.

PROPERTY LOCATION_______________________________________________________________

(IF KNOWN) DISTRICT __________ ACCOUNT NUMBER________________________

1.

Full name and address of current owner_______________________________________

__________________________________________________________________________

IMPORTANT: If this petition is being submitted by the property owner, do you want

the above address to be used as your permanent mailing address? Yes ____ No ____

2.

Are you appealing the value ___ or classification ___ of this property (please check one)?

3.

Please state why you feel the value or classification of this property is incorrect (attach

additional pages or documents if necessary). __________________________________

______________________________________________________________________

______________________________________________________________________

In your opinion, what is the current market value of this property? $________________

4.

If this property is income producing, please attach copies of income and expense

statements for the last three calendar years. Important message for income producing

properties: Income and expense information must be submitted at the Supervisor’s level

of appeal, or you may not challenge the assessment of your property on the basis of the

capitalization of income method at later appeal levels (See Tax Property Article §14-

508). If you need additional copies of the income forms, they are available on our web

site

5.

Please check your preference:

____

Schedule a date to appear for a hearing.

____

I do not wish to appear for a hearing, but desire the above information to be

considered in reviewing the current property value or classification.

After this Petition for Review has been considered, you will be furnished a notice showing any

change, or denial of change, to the existing valuation or classification. Petitions requesting a review of

the current market value may result in a decrease, no change, or increase to the current value. If this

Petition is not being submitted by the property owner or his/her agent, a copy of the Petition will be

forwarded to the property owner who will also be informed of any decision made as a result of the

Petition. If substantial evidence in support of a change in value or classification is submitted, then the

property owner will also have an opportunity, scheduled at the discretion of the Supervisor, to state the

value or classification of the property and to provide support for that statement.

I declare under the penalties of perjury that the statements contained herein have been examined

by me, and to the best of my knowledge, information, and belief, are true, correct, and complete.

_________________________

__________________

________________

Signature

Telephone Number

Date

This form seeks information for the purpose of a petition for review on the indicated property. Failure to provide this information will result in

denial of your application. However, some of this information would be considered a “personal record” as defined in State Government Article,

§10-624. Consequently, you have the statutory right to inspect your file and to file a written request to correct or amend any information you

believe to be inaccurate or incomplete. Additionally, personal information provided to the State Department of Assessments and Taxation is not

generally available for public review. However, this information is available to officers of the State, county or municipality in their official

capacity and to taxing officials of any State or the federal government, as provided by statute. Additionally, if your property would be used by the

State Department of Assessments and Taxation as a comparable for purposes of establishing the value of another property in a hearing before the

Maryland Tax Court, the requested information, or a portion thereof, may have to be provided to the owner of that other property.

SDAT-RP-03-15-10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3